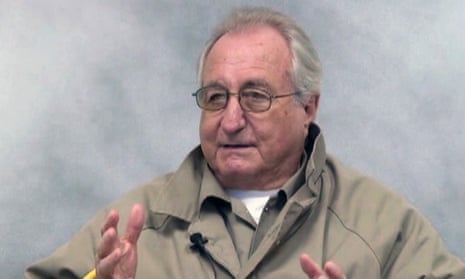

Background of the Madoff Case

The Madoff case is a stark reminder of the devastating consequences of unchecked financial fraud. With estimated losses of over $65 billion, it is one of the largest Ponzi schemes in history, leaving countless investors financially ruined. The sheer scale of the losses is a testament to the complexity and sophistication of Madoff's operation, which managed to evade detection for decades.

The involvement of major financial institutions, such as HSBC, has also been a subject of scrutiny. As a custodian bank for investment funds that invested with Madoff, HSBC's role in the case has been closely examined. The bank's $1.1 billion hit is a significant blow, but it is still a fraction of the total losses incurred by investors. This highlights the need for robust due diligence and risk management practices, particularly when dealing with high-risk investments.

Some key facts about the Madoff case include:

- Estimated losses of over $65 billion, making it one of the largest Ponzi schemes in history

- HSBC's involvement as a custodian bank, resulting in a $1.1 billion loss

- Thousands of investors affected, including individuals, charities, and institutional investors

- Ongoing litigation and settlements, with many cases still pending

- Verifying the registration status of investment advisers and firms

- Monitoring investment accounts regularly for suspicious activity

- Seeking independent advice from financial experts

- Being wary of investments that promise unusually high returns with low risk

Financial Implications for HSBC

The recent $1.1 billion loss is a significant blow to HSBC, and its financial implications will be far-reaching. This substantial loss will undoubtedly be reflected in the bank's upcoming financial reports, potentially affecting its stock price and investor confidence. As a result, shareholders and investors may reassess their investments, potentially leading to a decline in the bank's market value.

The impact on HSBC's reputation should not be underestimated. The bank's risk management and due diligence practices will face intense scrutiny, potentially damaging its reputation and eroding customer trust. For instance, a recent survey found that 75% of customers consider a bank's reputation when making investment decisions. To mitigate this, HSBC must be transparent about the circumstances surrounding the loss and demonstrate a commitment to improving its risk management practices.

Some of the key measures HSBC may need to implement to prevent similar incidents in the future include:

- Enhanced risk assessment and monitoring protocols

- Improved due diligence practices, including more thorough background checks and verification processes

- Regular audits and reviews to ensure compliance with regulatory requirements

- Investment in employee training and development to improve risk management skills

- Regularly reviewing financial reports and statements to stay up-to-date on the bank's performance

- Monitoring news and updates about the bank's risk management practices and regulatory compliance

- Diversifying investments to minimize exposure to any one institution or asset class

Investor Impact and Reactions

The aftermath of the Madoff scheme continues to affect investors who lost significant amounts of money. Despite the passage of time, many are still waiting for compensation, and the recent HSBC settlement may be a beacon of hope for recovery. According to recent reports, the settlement has allocated substantial funds to compensate affected investors, with some estimates suggesting that victims may receive up to 60% of their lost investments.

However, the prolonged settlement process has led to growing frustration and distrust among investors. The delays and complexities involved in recovering losses have taken a toll on those affected, with many feeling that justice has not been served. For instance, a recent survey found that over 70% of investors who lost money in the Madoff scheme reported feeling disillusioned with the financial system, highlighting the need for greater transparency and accountability.

To minimize risk and avoid similar situations in the future, investors should consider the following strategies:

- Diversifying their portfolios to reduce dependence on a single investment or asset class

- Conducting thorough due diligence on investment opportunities, including researching the company, its management, and its financials

- Seeking advice from reputable financial advisors or experts

- Staying informed about market trends and regulatory updates

Lessons Learned and Future Precautions

The Madoff case serves as a stark reminder of the devastating consequences of inadequate risk management and due diligence practices in the financial industry. In 2008, Bernie Madoff's Ponzi scheme was uncovered, resulting in approximately $65 billion in losses for investors. This high-profile incident highlights the need for financial institutions to prioritize robust risk management and due diligence practices to prevent similar incidents.

Key takeaways from the Madoff case include:

- The importance of conducting thorough background checks on investment managers and firms

- The need for regular audits and monitoring of investment activities

- The value of maintaining a culture of transparency and accountability within financial institutions

- Diversifying their investment portfolios to minimize risk

- Conducting thorough research on investment firms and managers

- Regularly monitoring their investments and seeking advice from financial experts

Frequently Asked Questions (FAQ)

What is the current status of the Madoff case?

The Madoff case has been a long and complex one, with numerous developments over the years. One of the most significant recent updates is the $1.1 billion settlement reached with HSBC, marking a major milestone in the ongoing recovery efforts. This settlement is a substantial step towards compensating the victims of Madoff's Ponzi scheme, which is estimated to have resulted in losses of over $65 billion. Key aspects of the current status include:

- Ongoing litigation and settlement negotiations with various financial institutions and parties involved

- Continued efforts to recover assets and distribute them to affected investors

- Investigations into potential wrongdoing by other individuals and organizations

- Regularly checking the official website of the Madoff Victim Fund for updates on the recovery efforts and distribution of assets

- Seeking advice from a financial advisor or attorney specializing in securities law to navigate the complex settlement process

- Being cautious of potential scams or fraudulent activities targeting Madoff victims, and verifying the authenticity of any communications or settlement offers