Mutual funds have become a cornerstone of modern investment portfolios, offering a diverse range of benefits to investors. They provide a convenient way to invest in a broad range of assets, from stocks and bonds to commodities and real estate. By pooling money from multiple investors, mutual funds can take advantage of economies of scale, reducing costs and increasing potential returns.

One of the key advantages of mutual funds is their ability to provide high returns over time. This is because they are often managed by experienced professionals who have a deep understanding of the markets and can make informed investment decisions. Additionally, mutual funds offer a level of diversification that can be difficult to achieve with individual investments, reducing risk and increasing potential for long-term growth.

Some of the benefits of mutual funds include:

- Professional management: Mutual funds are managed by experienced professionals who have a deep understanding of the markets and can make informed investment decisions.

- Diversification: Mutual funds offer a level of diversification that can be difficult to achieve with individual investments, reducing risk and increasing potential for long-term growth.

- Liquidity: Mutual funds offer a high level of liquidity, allowing investors to easily buy and sell shares as needed.

- Affordability: Mutual funds offer a cost-effective way to invest in a broad range of assets, making them accessible to investors with limited capital.

Overall, mutual funds offer a powerful tool for investors looking to build wealth over time. By providing a diversified portfolio of assets, managed by experienced professionals, mutual funds can help investors achieve their long-term financial goals. Whether you are a seasoned investor or just starting out, mutual funds are definitely worth considering as a key component of your investment portfolio.

Understanding Mutual Funds

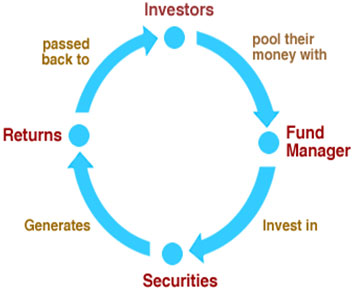

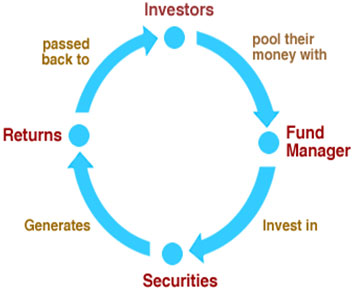

Mutual funds are investment vehicles that pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. They operate by collecting funds from various investors and using this collective amount to purchase a wide range of investments. This allows individual investors to gain access to a broad portfolio of assets that they may not have been able to afford on their own.

The operation of mutual funds involves a fund manager who is responsible for selecting the investments and managing the portfolio. The fund manager's goal is to generate returns that are higher than the costs of running the fund, thereby providing a profit to the investors. Mutual funds are typically traded at the end of the day, with the net asset value (NAV) being calculated based on the closing prices of the underlying securities.

The benefits of investing in mutual funds are numerous. One of the primary advantages is diversification, which reduces the risk of investing in a single security or asset class. By investing in a mutual fund, investors can gain exposure to a broad range of assets, including stocks, bonds, and commodities. Some of the key benefits of mutual funds include:

- Diversification: By investing in a mutual fund, investors can spread their risk across a wide range of assets, reducing the impact of any one security or asset class on their overall portfolio.

- Professional management: Mutual funds are managed by experienced professionals who have the expertise and resources to research and select investments.

- Economies of scale: Mutual funds can take advantage of economies of scale, allowing them to invest in a broader range of securities and reduce transaction costs.

- Liquidity: Mutual funds offer investors the ability to easily buy and sell their shares, providing liquidity and flexibility.

Investing in mutual funds also provides investors with access to professional management, which can be a significant advantage for those who do not have the time or expertise to manage their own investments. Professional fund managers have the resources and expertise to research and select investments, and to monitor and adjust the portfolio as market conditions change. This can help to reduce the risk of investing and increase the potential for long-term returns.

Overall, mutual funds offer a convenient and accessible way for investors to gain exposure to a broad range of assets and to benefit from professional management. By understanding how mutual funds operate and the benefits they offer, investors can make informed decisions about whether mutual funds are a suitable investment option for their needs and goals.

Top Performing Mutual Funds

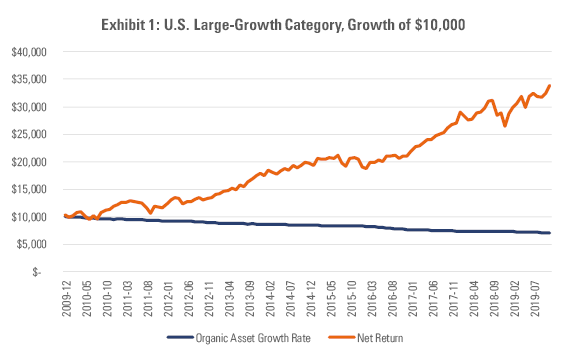

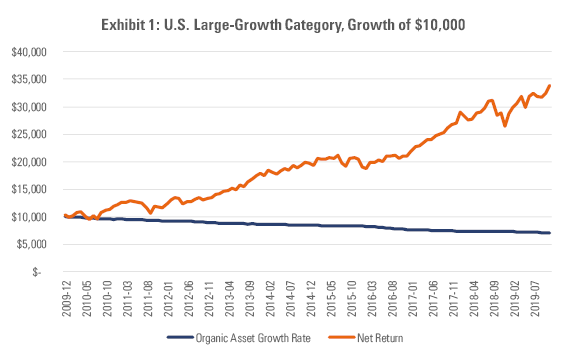

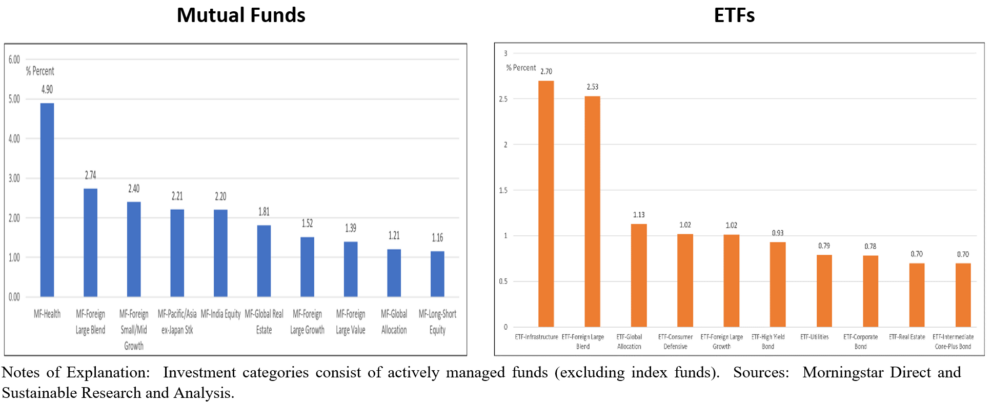

When it comes to investing in mutual funds, performance is a key factor to consider. Over the last 5 years, several mutual funds have demonstrated exceptional returns, making them attractive options for investors.

The top performing mutual funds have returned between 376% to 415% over the last 5 years. These funds have consistently outperformed the market, making them a great choice for investors looking to grow their wealth.

Here are the 11 top performing mutual funds:

- Franklin India Feeder - Franklin US Opportunities Fund

- PGIM India Global Equity Opportunities Fund

- Aditya Birla Sun Life Global Real Estate Fund

- UTI NIFTY INDEX FUND

- SBI MAGNUM MULTI CAP FUND

- HSBC GLOBAL INVESTMENT FUNDS - INDIAN EQUITY

- ICICI Prudential US Bluechip Equity Fund

- Franklin India Life Stage Fund of Funds

- Canara Robeco Emerging Equities Fund

- Invesco India Contra Fund

- HDFC TOP 200 FUND

A brief overview of each fund reveals that they have unique investment strategies and asset allocations. For example, the Franklin India Feeder - Franklin US Opportunities Fund invests primarily in the units of Franklin US Opportunities Fund, which in turn invests in a portfolio of equity securities of US companies. The PGIM India Global Equity Opportunities Fund, on the other hand, invests in a diversified portfolio of equity and equity-related securities of companies across the globe.

The Aditya Birla Sun Life Global Real Estate Fund has an investment strategy that focuses on investing in a portfolio of global real estate securities. The UTI NIFTY INDEX FUND, as the name suggests, tracks the NIFTY 50 index, providing investors with exposure to the Indian equity market. The SBI MAGNUM MULTI CAP FUND, invests in a diversified portfolio of equity and equity-related securities across various market capitalizations.

The HSBC GLOBAL INVESTMENT FUNDS - INDIAN EQUITY fund invests in a portfolio of Indian equity securities, while the ICICI Prudential US Bluechip Equity Fund invests in equity and equity-related securities of US companies. The Franklin India Life Stage Fund of Funds, invests in a portfolio of other mutual fund schemes, providing investors with a diversified portfolio.

The Canara Robeco Emerging Equities Fund, invests in a portfolio of equity and equity-related securities of companies that are expected to benefit from the growth in the Indian economy. The Invesco India Contra Fund, has an investment strategy that focuses on investing in a portfolio of equity and equity-related securities that are undervalued. The HDFC TOP 200 FUND, invests in a portfolio of equity and equity-related securities of the top 200 companies in terms of market capitalization.

Each of these funds has its own unique characteristics, and investors should carefully evaluate their investment objectives, risk tolerance, and time horizon before investing. It is also important to note that past performance is not a guarantee of future results, and investors should consult with a financial advisor before making any investment decisions.

Investment Strategies for High Returns

When it comes to investing, one of the most crucial aspects to consider is the time frame. Long-term investment strategies are essential for achieving high returns, as they allow investors to ride out market fluctuations and benefit from the compounding effect of their investments. This approach helps to reduce the impact of short-term market volatility, giving investors a higher potential for long-term growth.

A key benefit of long-term investment strategies is the ability to mitigate risk. By investing for an extended period, investors can spread out their risk and increase their chances of earning higher returns. This is because long-term investments tend to be less affected by short-term market fluctuations, providing a more stable foundation for growth.

Dollar-cost averaging and regular investment plans are two strategies that can help investors mitigate risk and achieve high returns. These approaches involve investing a fixed amount of money at regular intervals, regardless of the market's performance. This helps to reduce the impact of market volatility, as investors are not trying to time the market or make large investments at any one time.

Some of the benefits of dollar-cost averaging and regular investment plans include:

- Reduced risk: By investing a fixed amount of money at regular intervals, investors can spread out their risk and reduce the impact of market fluctuations.

- Increased discipline: Regular investment plans help investors to stay disciplined and avoid making emotional decisions based on short-term market movements.

- Lower costs: Dollar-cost averaging can help reduce the average cost of investments over time, as investors are not trying to time the market or make large investments at any one time.

- Higher potential returns: By investing for the long-term and using dollar-cost averaging and regular investment plans, investors can increase their potential for higher returns and achieve their financial goals.

In conclusion, long-term investment strategies, combined with dollar-cost averaging and regular investment plans, can provide investors with a powerful approach to achieving high returns. By investing for the long-term and using these strategies, investors can mitigate risk, increase their discipline, and potentially earn higher returns over time.

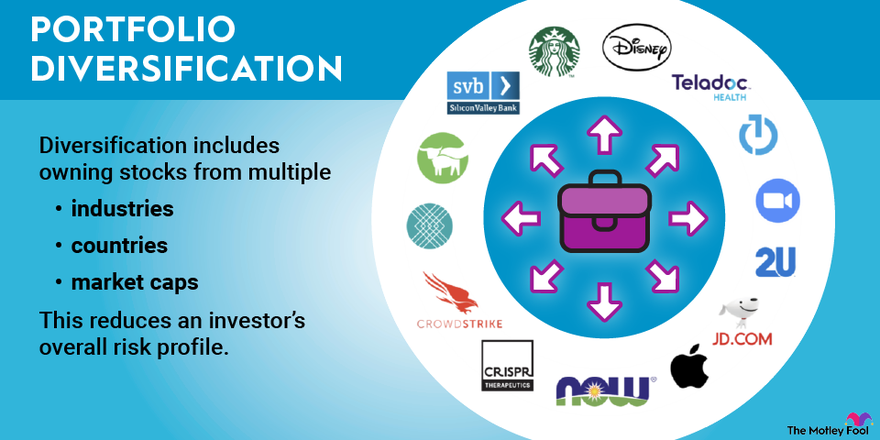

Risk Management and Diversification

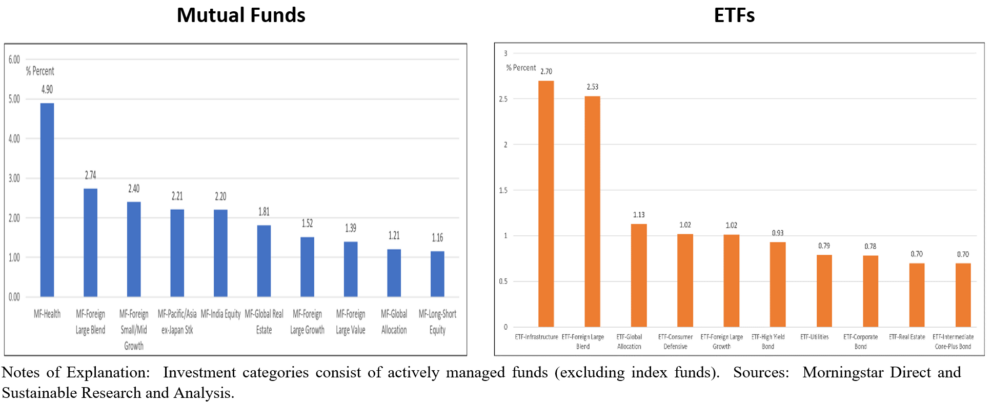

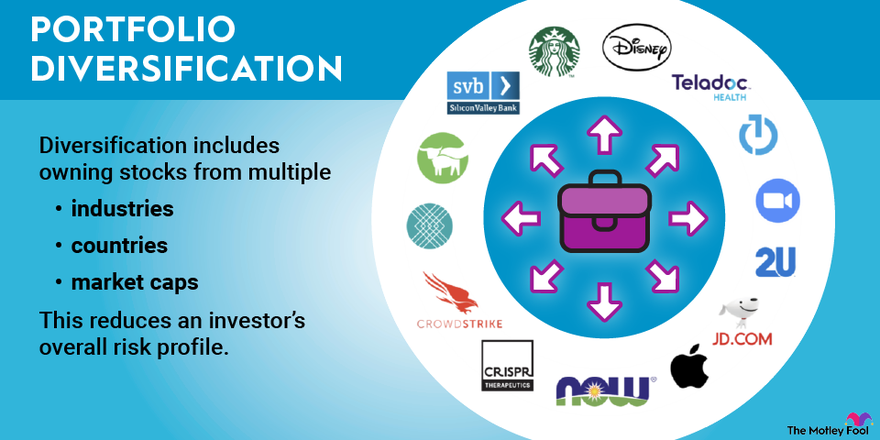

Diversification is a crucial aspect of investing, as it helps to minimize risk and maximize returns. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their exposure to any one particular market or security. This approach can help to mitigate potential losses and increase the potential for long-term growth.

When it comes to mutual funds, diversification is especially important. Mutual funds are a type of investment vehicle that pools money from many investors to invest in a variety of securities. By investing in a mutual fund, investors can gain exposure to a broad range of assets, which can help to reduce risk. However, it is still important for investors to assess and manage risk when investing in mutual funds.

To assess risk, investors should consider the following factors:

- Volatility: How much has the fund's value fluctuated in the past?

- Correlation: How closely does the fund's performance track the overall market or other asset classes?

- Concentration: Is the fund heavily invested in any one particular security or sector?

- Fees and expenses: What are the costs associated with investing in the fund?

In addition to assessing risk, investors should also have a plan in place to manage risk. This can involve setting clear investment goals and risk tolerance, as well as regularly reviewing and rebalancing the portfolio. Investors should also consider diversifying across different types of mutual funds, such as equity, fixed income, and money market funds.

Some common strategies for managing risk in mutual fund investing include:

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of the market's performance

- Asset allocation: Dividing investments among different asset classes to balance risk and potential returns

- Rebalancing: Periodically reviewing and adjusting the portfolio to ensure it remains aligned with investment goals and risk tolerance

By taking a diversified and informed approach to mutual fund investing, investors can help to minimize risk and achieve their long-term financial goals. It is essential for investors to stay informed and adapt to changing market conditions to ensure their investment portfolio remains on track.

Frequently Asked Questions (FAQ)

What are the risks associated with investing in mutual funds?

Investing in mutual funds can be a great way to diversify your portfolio and potentially earn higher returns, but it also comes with its own set of risks. Market volatility is one of the primary risks associated with mutual funds, as the value of your investment can fluctuate significantly over short periods of time. This means that the value of your investment may be lower than your initial investment when you decide to withdraw your money.

Another risk associated with mutual funds is credit risk, which occurs when the issuer of a security held by the fund defaults on their payments. This can lead to a decline in the value of the security and, subsequently, the value of the mutual fund. To mitigate this risk, it is essential to invest in mutual funds that have a diversified portfolio with a mix of low- and high-risk securities.

Liquidity risk is also a concern for mutual fund investors, as it refers to the ability to quickly buy or sell securities without significantly affecting their price. If a mutual fund holds a large portion of illiquid securities, it may be difficult to sell them quickly, which can lead to a decline in the value of the fund. To minimize this risk, investors can consider investing in mutual funds with a high level of liquidity.

Some of the key risks associated with investing in mutual funds include:

- Market volatility, which can lead to fluctuations in the value of your investment

- Credit risk, which occurs when the issuer of a security defaults on their payments

- Liquidity risk, which refers to the ability to quickly buy or sell securities without significantly affecting their price

These risks can be mitigated through diversification and a long-term investment strategy, which can help to reduce the impact of market fluctuations and other risks on your investment.

By adopting a long-term investment strategy, you can ride out market fluctuations and potentially earn higher returns over time. Diversification is also essential, as it involves spreading your investments across different asset classes and sectors to minimize risk. By understanding the risks associated with mutual funds and taking steps to mitigate them, you can make informed investment decisions and achieve your financial goals.

How do I choose the right mutual fund for my investment goals?

When it comes to investing in mutual funds, selecting the right one can be a daunting task, especially for those new to investing. The first step in choosing a mutual fund is to define your investment objectives. What are you trying to achieve through your investments? Are you saving for retirement, a down payment on a house, or a big purchase? Understanding your goals will help you narrow down the types of funds that are suitable for you.

Investment objectives are closely tied to risk tolerance, which is another crucial factor to consider. Risk tolerance refers to your ability to withstand market fluctuations and potential losses. If you are risk-averse, you may want to opt for a more conservative fund with lower potential returns but also lower potential losses. On the other hand, if you are willing to take on more risk, you may want to consider a fund with higher potential returns.

Time horizon is also an essential factor to consider when choosing a mutual fund. When do you need the money? If you have a long time horizon, you may be able to ride out market fluctuations and take on more risk. However, if you need the money in the short term, you may want to opt for a more conservative fund. Evaluating a fund's past performance is also important, but it's essential to keep in mind that past performance is not a guarantee of future results.

To evaluate a mutual fund, consider the following factors:

- Past performance: Look at the fund's historical returns and compare them to its benchmark and peers.

- Management fees: Consider the fees associated with the fund, as high fees can eat into your returns.

- Investment strategy: Understand the fund's investment approach and ensure it aligns with your goals and risk tolerance.

- Fund manager experience: Look at the experience and track record of the fund manager.

Ultimately, choosing the right mutual fund requires careful consideration of several factors. By taking the time to evaluate your investment objectives, risk tolerance, time horizon, and the fund's past performance and management fees, you can make an informed decision and select a fund that aligns with your investment goals. It's also essential to diversify your portfolio by investing in a mix of funds to minimize risk and maximize returns.

Can I invest in mutual funds through a tax-advantaged retirement account?

Investing in mutual funds through tax-advantaged retirement accounts can be a great way to optimize investment returns. Many people are aware of the benefits of investing in mutual funds, but may not know that they can also be invested in through retirement accounts. This can provide an added layer of tax benefits, making it an attractive option for those looking to save for retirement.

Mutual funds can be invested in through a variety of tax-advantaged retirement accounts, including 401(k) and IRA accounts. These accounts offer tax benefits that can help investment returns go further. For example, contributions to a 401(k) may be tax-deductible, reducing taxable income for the year.

Some of the key benefits of investing in mutual funds through tax-advantaged retirement accounts include:

- Tax-deferred growth, allowing investments to grow without being subject to taxes until withdrawal

- Tax-deductible contributions, reducing taxable income for the year

- Flexibility to choose from a wide range of mutual funds, allowing investors to diversify their portfolios

- Potential for long-term growth, making it easier to reach retirement goals

Investing in mutual funds through tax-advantaged retirement accounts can be a great way to save for retirement. It is essential to understand the rules and regulations surrounding these accounts, including any contribution limits or withdrawal requirements. By doing so, investors can make informed decisions and optimize their investment returns.

Overall, investing in mutual funds through tax-advantaged retirement accounts can be a great way to save for retirement and optimize investment returns. With the potential for tax-deferred growth, tax-deductible contributions, and flexibility to choose from a wide range of mutual funds, it is an option worth considering for those looking to secure their financial future.