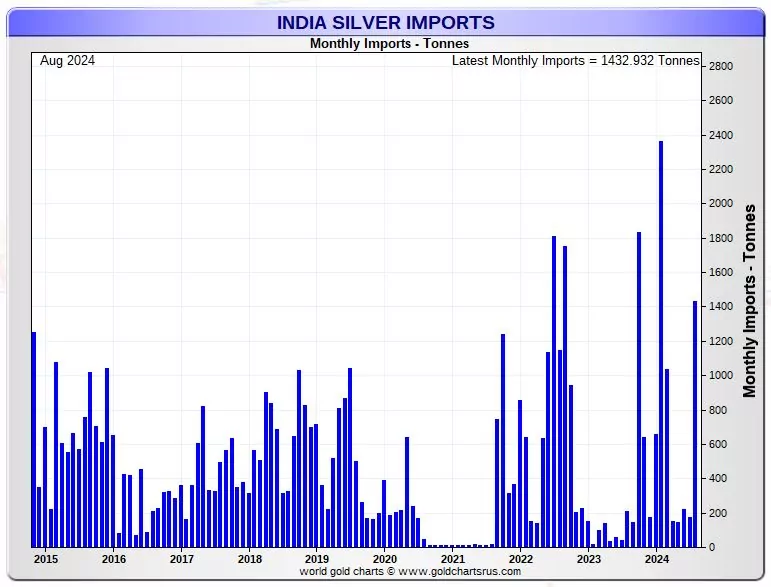

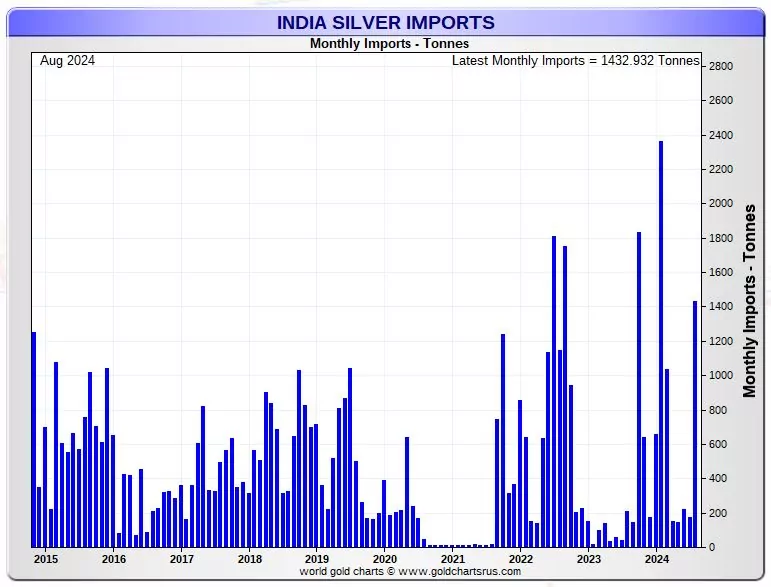

India has been one of the largest consumers of silver in the world, with a significant portion of its demand being met through imports. Recently, the Indian government has taken a decision to restrict silver imports, which is expected to have a significant impact on the market.

The decision to restrict silver imports is aimed at reducing the country's trade deficit and promoting domestic production. The government has imposed certain restrictions on the import of silver, which is expected to affect the supply of silver in the country.

Some of the key aspects of the restriction on silver imports include:

- Limitations on the quantity of silver that can be imported

- Imposition of higher duties on silver imports

- Restrictions on the types of silver products that can be imported

These restrictions are expected to have a significant impact on the silver market in India, and are likely to affect the prices of silver products in the country.

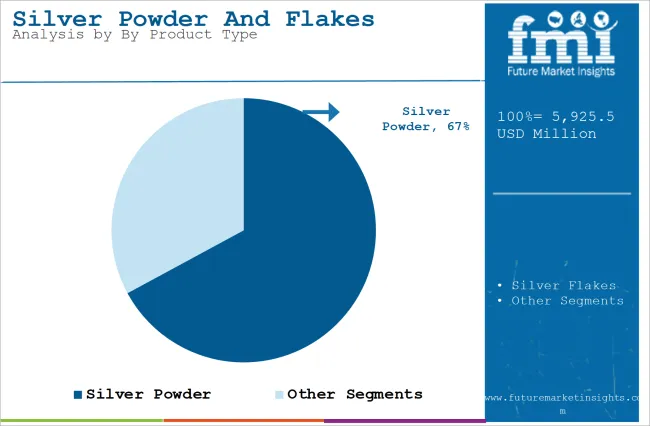

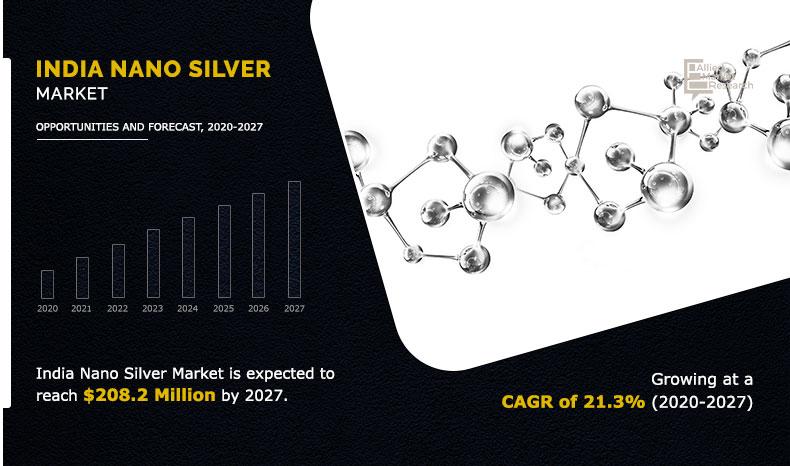

The potential impact of the restriction on silver imports can be seen in various sectors, including jewelry, electronics, and solar panels. The restriction is expected to lead to a shortage of silver in the country, which could result in higher prices for silver products. This could have a significant impact on the demand for silver products, and could also affect the overall growth of the industry.

The restriction on silver imports is also expected to have an impact on the global silver market. India is one of the largest consumers of silver, and any change in its import policies is likely to have a ripple effect on the global market. The restriction could lead to an increase in silver prices globally, which could have a significant impact on the demand for silver products worldwide.

Background and Reasoning

The historical context of silver imports in India dates back to the colonial era, when the country was a major hub for silver trade. India's strategic location and extensive trade networks made it an attractive destination for silver imports from countries like China, Europe, and the Middle East. Over time, the demand for silver in India continued to grow, driven by its use in various industries such as jewelry, electronics, and healthcare.

In the early 20th century, the Indian government began to impose restrictions on silver imports to protect the domestic industry and conserve foreign exchange. The government's decision to restrict imports was driven by several factors, including the need to reduce the country's trade deficit and promote self-sufficiency in silver production. Some of the key reasons behind the government's decision include:

- Conserving foreign exchange reserves

- Protecting the domestic silver industry

- Reducing the country's trade deficit

- Promoting self-sufficiency in silver production

The current state of the silver market in India is characterized by a mix of challenges and opportunities. On one hand, the demand for silver in India remains high, driven by its use in various industries. On the other hand, the supply of silver is constrained by the government's restrictions on imports, which has led to a shortage of silver in the domestic market. As a result, silver prices in India have been volatile, affecting the profitability of industries that rely on silver.

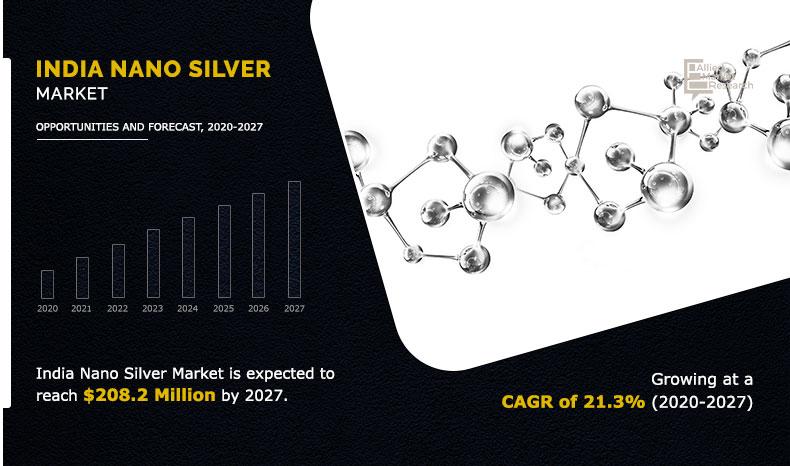

Despite these challenges, the Indian government has taken steps to promote the development of the domestic silver industry. For example, the government has introduced policies to encourage silver mining and recycling, which are expected to increase the supply of silver in the domestic market. Additionally, the government has established a number of initiatives to promote the use of silver in various industries, such as jewelry and electronics. These initiatives are expected to drive growth in the silver market in India and reduce the country's dependence on imports.

Impact on the Indian Economy

The Indian economy is a complex and diverse system, and any changes in global trade or economic conditions can have a significant impact on it. One of the key areas of concern is the country's trade balance. India's trade deficit has been a persistent issue, and any fluctuations in global demand or supply can affect the country's ability to export goods and services.

The potential effects on India's trade balance are multifaceted. On one hand, a decline in global demand can lead to a decrease in exports, which can worsen the trade deficit. On the other hand, a depreciation of the rupee can make Indian exports more competitive, which can help to boost exports and improve the trade balance. Some of the key factors that can impact India's trade balance include:

- Changes in global demand for Indian goods and services

- Fluctuations in commodity prices, such as oil and gold

- Shifts in global trade policies, such as tariffs and quotas

- Competitiveness of Indian industries, such as textiles and pharmaceuticals

The implications for India's jewelry and electronics industries are significant. These industries are major contributors to the country's exports and employment. Any changes in global demand or trade policies can have a direct impact on these industries. For example, a decline in global demand for jewelry can lead to a decrease in exports, which can affect the livelihoods of thousands of workers in the industry. Similarly, changes in trade policies, such as tariffs on electronics, can affect the competitiveness of Indian electronics manufacturers.

The possible consequences for employment and economic growth are far-reaching. A decline in exports or a worsening trade balance can lead to job losses and a slowdown in economic growth. On the other hand, a boost in exports or an improvement in the trade balance can lead to job creation and a pickup in economic growth. Some of the key factors that can impact employment and economic growth include:

- Investment in key industries, such as manufacturing and infrastructure

- Government policies, such as tax incentives and trade agreements

- Global economic conditions, such as recession or growth

- Competitiveness of Indian industries, such as IT and tourism

In conclusion, the impact of changes in global trade or economic conditions on the Indian economy is complex and multifaceted. While there are potential risks, such as a decline in exports or a worsening trade balance, there are also opportunities, such as a boost in exports or an improvement in the trade balance. By understanding these factors and developing policies to address them, India can mitigate the risks and capitalize on the opportunities to achieve sustainable economic growth and development.

Global Market Implications

The recent ban on silver exports is expected to have far-reaching implications for the global market. One of the primary concerns is the potential influence on global silver prices. As a major silver-producing country, the ban is likely to lead to a shortage of silver in the global market, causing prices to rise. This, in turn, may affect various industries that rely heavily on silver, such as electronics, jewelry, and solar panels.

The ban may also have a significant impact on other countries' silver imports and exports. Countries that rely heavily on silver imports may need to find alternative sources, which could lead to changes in their trade agreements and partnerships. Some countries may benefit from the ban, as they may be able to increase their own silver exports to meet the growing demand.

- Countries with significant silver reserves, such as Peru and Chile, may see an increase in their silver exports.

- Countries with limited silver reserves, such as India and China, may need to rely on alternative sources, such as recycling or importing from other countries.

The ban may also have effects on international trade agreements. The World Trade Organization (WTO) may need to intervene to resolve any trade disputes that arise from the ban.

- The WTO may need to review existing trade agreements to ensure that they are fair and equitable for all countries involved.

- The ban may also lead to the creation of new trade agreements, as countries seek to secure stable sources of silver.

In conclusion, the ban on silver exports is a complex issue with far-reaching implications for the global market. As the situation continues to evolve, it is essential to monitor the effects on global silver prices, other countries' silver imports and exports, and international trade agreements. This will help to identify opportunities and challenges, and to develop strategies for mitigating any negative impacts.

What to Expect Next

As the import restriction continues, it is essential to speculate on the potential duration and scope of this policy. The Indian government may extend the restriction for an indefinite period, depending on the country's economic and trade policies. This could significantly impact the silver market, leading to fluctuations in prices and supply.

The scope of the import restriction may also expand to include other precious metals, such as gold and platinum. This would have far-reaching consequences for the entire precious metals market in India. To understand the potential implications, consider the following factors:

- Impact on domestic production and manufacturing

- Effects on import-dependent industries, such as jewelry and electronics

- Possible changes in consumer behavior and demand patterns

In terms of future developments in India's silver market policy, several possibilities emerge. The government may introduce new regulations to promote domestic silver production, such as subsidies or tax incentives for mining companies. Alternatively, they may establish a silver reserve to stabilize prices and ensure a steady supply. Other potential developments include:

- Implementation of a silver recycling program to reduce waste and increase domestic supply

- Introduction of new silver-based products, such as coins or bars, to cater to investor demand

- Expansion of silver trading on Indian commodity exchanges to increase market transparency and liquidity

The potential for alternative sources of silver supply is also worth examining. India may explore new trade agreements with other countries to secure silver imports. For instance, they could negotiate with neighboring countries, such as China or Nepal, to establish a stable silver supply chain. Other alternatives include:

- Increasing silver production from domestic mines, such as those in Rajasthan or Gujarat

- Encouraging silver recycling from scrap materials, such as old jewelry or electronics

- Developing new silver-based technologies, such as solar panels or water purification systems, to reduce dependence on imports

Ultimately, the future of India's silver market will depend on a combination of government policies, market trends, and external factors. As the situation continues to evolve, it is crucial to monitor developments and adjust strategies accordingly. By understanding the potential implications of the import restriction and exploring alternative sources of silver supply, stakeholders can navigate the changing landscape and capitalize on emerging opportunities.

Frequently Asked Questions (FAQ)

Why did India restrict silver imports?

The government's decision to restrict silver imports is likely due to a combination of factors, including a desire to reduce the country's trade deficit and protect domestic industries. This move is part of a broader effort to promote economic self-sufficiency and reduce reliance on foreign goods.

One of the primary motivations behind this decision is to reduce the country's trade deficit. By limiting silver imports, the government aims to decrease the outflow of foreign exchange and mitigate the pressure on the country's currency. This, in turn, can help to stabilize the economy and promote growth.

The restriction on silver imports is also intended to protect domestic industries, particularly those involved in the production of silver jewelry, coins, and other silver products. By limiting the availability of cheap imported silver, the government hopes to create a more level playing field for domestic manufacturers and encourage the growth of these industries.

Some of the key factors that contributed to this decision include:

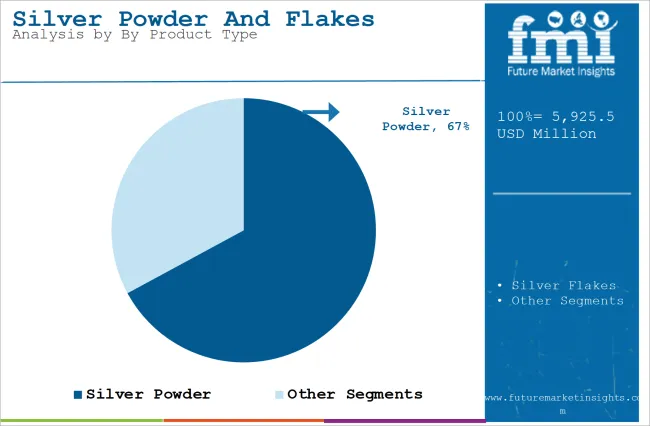

- High demand for silver in India, driven by its use in various industries such as jewelry, electronics, and solar panels

- Dependence on imported silver to meet domestic demand, which has contributed to the country's trade deficit

- Need to promote domestic silver production and reduce reliance on foreign suppliers

- Desire to stabilize the economy and promote growth by reducing the outflow of foreign exchange

The restriction on silver imports is expected to have a significant impact on various industries, including jewelry, electronics, and renewable energy. While it may lead to short-term disruptions and increased costs for some manufacturers, it is hoped that the long-term benefits of promoting domestic industries and reducing the trade deficit will outweigh these costs.

How will the ban affect Indian consumers?

The ban is likely to have a significant impact on Indian consumers, and the extent of this impact will vary depending on several factors. One of the primary concerns is whether domestic industries will be able to meet the demand for goods and services that were previously imported. If domestic industries are able to ramp up production to meet this demand, the impact on consumers may be minimal.

However, if domestic industries are unable to meet demand, consumers may face shortages and price increases. The potential for price increases due to reduced supply is a major concern, as it could lead to higher costs of living for Indian consumers. This could be particularly challenging for low-income households, who may already be struggling to make ends meet.

Some of the key factors that will influence the impact on consumers include:

- The ability of domestic industries to scale up production to meet demand

- The availability of alternative sources of supply

- The level of competition in the market, which can help to keep prices in check

- The government's policies and regulations, which can influence the availability and affordability of goods and services

In terms of specific products, the impact of the ban will depend on the level of domestic production and the availability of alternative sources of supply. For example, if a particular product is largely imported, the ban may lead to shortages and price increases. On the other hand, if domestic industries are able to meet demand, the impact may be minimal.

Overall, the impact of the ban on Indian consumers will depend on a complex interplay of factors, including the response of domestic industries, the availability of alternative sources of supply, and government policies and regulations. As the situation evolves, it will be important for consumers to stay informed and adapt to any changes in the market.

Can the ban be lifted before March 31, 2026?

The current ban has been implemented with a specific expiration date of March 31, 2026. As the deadline approaches, many are wondering if there is a possibility of the ban being lifted earlier.

While it is possible that the government may reconsider or modify the ban, there is currently no indication that it will be lifted before the scheduled expiration date. The government's decision to implement the ban was likely made after careful consideration of various factors, and any changes to the ban would require a thorough review of these factors.

Some of the key factors that may influence the government's decision to lift the ban include:

- Changes in circumstances that led to the implementation of the ban

- New information or evidence that was not available at the time of the ban's implementation

- Pressure from stakeholders or interest groups

- Shifts in government policies or priorities

It is also worth noting that the government may choose to modify the ban instead of lifting it entirely. This could involve relaxing certain restrictions or introducing new exemptions. However, any such modifications would still require careful consideration and consultation with relevant stakeholders.

Ultimately, the decision to lift or modify the ban will depend on a range of complex factors and considerations. Without clear indication from the government, it is difficult to predict with certainty what will happen before the scheduled expiration date of March 31, 2026. As such, it is likely that the ban will remain in place until then, unless there are significant developments that prompt the government to reconsider its position.