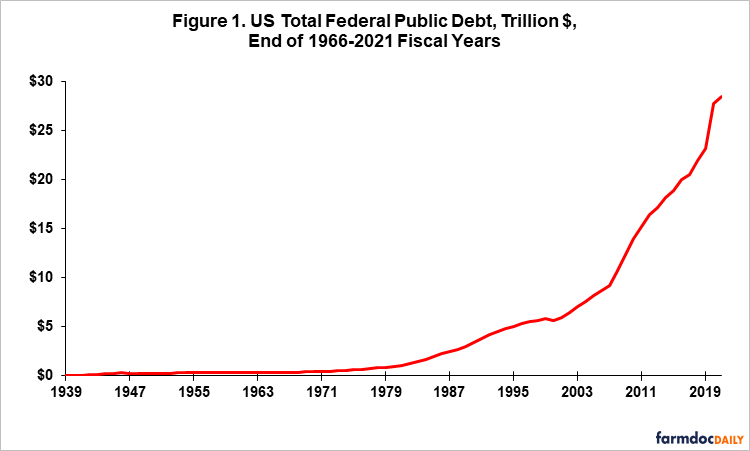

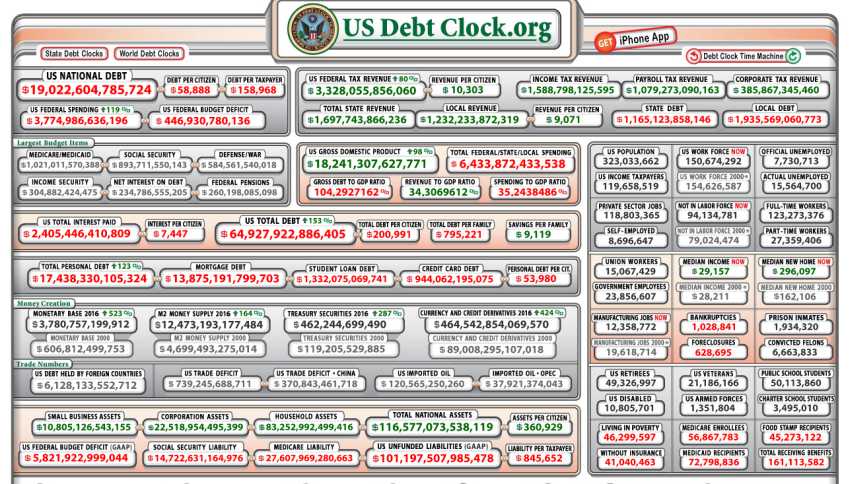

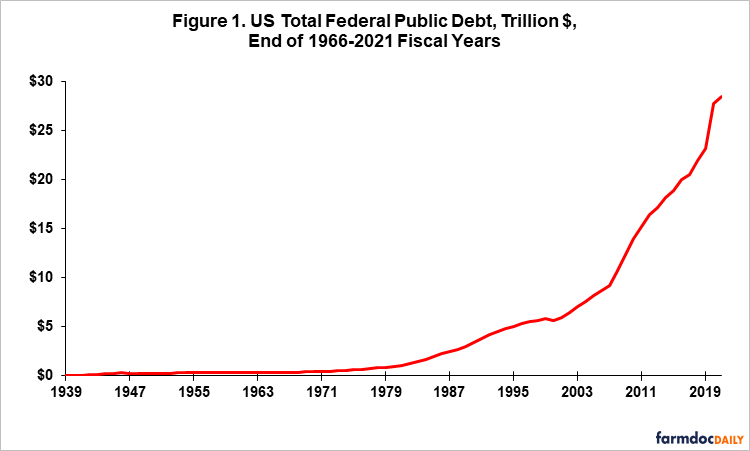

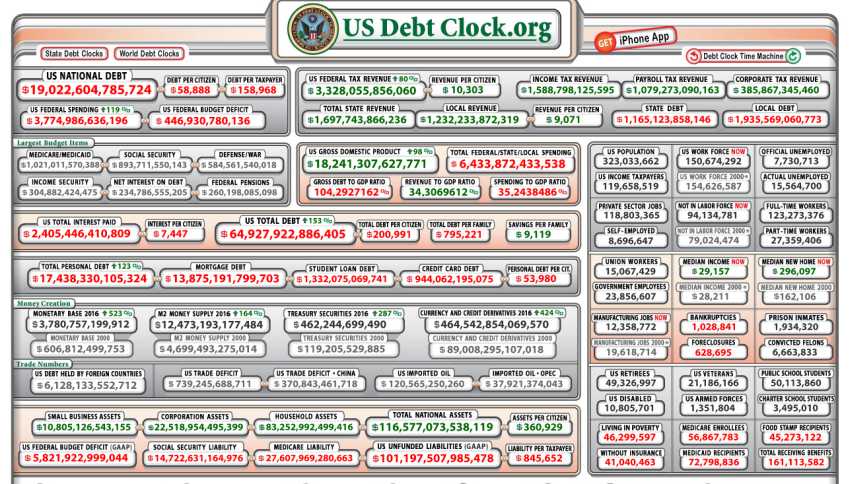

The United States is facing a significant challenge in managing its national debt, with projections indicating that it will soon surpass that of Italy and Greece. This development has raised eyebrows among economists and policymakers, who are concerned about the potential implications for the nation's fiscal health and economic stability. According to recent data, the US debt has been steadily increasing over the years, with the total public debt outstanding reaching over $28 trillion as of 2022.

The passage of Trump's tax reform bill has been cited as a major contributor to this trend, as it has led to a significant reduction in government revenue. This, combined with increased spending, has resulted in a substantial increase in the national debt. Some of the key factors contributing to this trend include:

- Reduced tax revenue: The tax reform bill reduced the corporate tax rate from 35% to 21%, resulting in a loss of revenue for the government.

- Increased spending: The government has continued to spend heavily on various programs, including defense, social security, and healthcare.

- Interest payments: The government is also paying a significant amount of interest on its debt, which is adding to the overall burden.

To put this into perspective, the US debt-to-GDP ratio has been increasing steadily over the years, reaching over 130% as of 2022. This is higher than many other developed countries, including Italy and Greece, which have struggled with debt crises in the past. For example, Greece's debt-to-GDP ratio peaked at around 180% in 2014, leading to a severe economic crisis. The US is not yet at that level, but the trend is concerning and warrants attention from policymakers.

So, what can be done to address this issue? Some practical steps that can be taken include:

- Implementing fiscal reforms: The government can implement reforms to reduce spending and increase revenue, such as closing tax loopholes and reducing subsidies.

- Investing in economic growth: Investing in education, infrastructure, and research can help boost economic growth and increase revenue.

- Reducing interest payments: The government can take steps to reduce interest payments on its debt, such as refinancing at lower interest rates.

Individuals can also play a role in promoting fiscal responsibility by staying informed and engaged on the issue. This includes:

- Staying up-to-date on the latest developments: Readers can stay informed about the latest developments on the US debt and fiscal policy.

- Contacting representatives: Individuals can contact their elected representatives to express their concerns and advocate for fiscal responsibility.

- Supporting organizations: Readers can support organizations that promote fiscal responsibility and advocate for policy changes.

Ultimately, addressing the US debt will require a sustained effort from policymakers, individuals, and organizations. By working together, it is possible to promote fiscal responsibility and ensure the long-term economic stability of the nation.

The Current State of US Debt

The national debt has reached a staggering $22 trillion, with projections indicating a significant increase in the coming years. This alarming trend has sparked concerns among experts, who warn that high debt levels can have far-reaching consequences for the economy. As of 2022, the debt-to-GDP ratio stands at approximately 107%, surpassing the levels seen during World War II. This unprecedented level of debt poses significant risks to the nation's economic stability and growth.

Experts point to several potential consequences of high debt levels, including:

- Decreased economic growth: High debt levels can lead to decreased economic growth, as a larger proportion of government revenue is dedicated to servicing the debt, rather than investing in vital public services and infrastructure.

- Higher interest rates: As the national debt continues to grow, interest rates may rise to attract investors and maintain confidence in the US economy, making borrowing more expensive for consumers and businesses.

- Reduced government spending power: High debt levels can limit the government's ability to respond to economic downturns or invest in critical areas, such as education, healthcare, and national defense.

To mitigate these effects, lawmakers could consider implementing fiscal policies that promote sustainable economic growth and reduce the national debt. Recent data suggests that a combination of tax reforms, spending reductions, and investments in key sectors, such as renewable energy and infrastructure, could help stimulate economic growth while reducing the debt burden. For example, the Congressional Budget Office estimates that a 1% increase in GDP growth could reduce the national debt by approximately $1.4 trillion over the next decade.

Individuals can also play a role in promoting fiscal responsibility by:

- Staying informed about the national debt and its implications for the economy

- Supporting policymakers who prioritize sustainable economic growth and debt reduction

- Advocating for fiscal policies that promote transparency, accountability, and long-term sustainability

By working together, lawmakers, experts, and individuals can help mitigate the risks associated with high debt levels and promote a more stable and prosperous economic future. As the nation navigates this complex issue, it is essential to prioritize fiscal responsibility, invest in key sectors, and promote sustainable economic growth to ensure a brighter future for generations to come.

Comparison with Italy and Greece

When examining the debt situations of various countries, a striking comparison can be made between Italy and Greece. Italy's debt-to-GDP ratio stands at around 132%, while Greece's ratio is approximately 181%. These high debt levels are a significant concern, as they can limit a country's ability to respond to economic shocks and make it challenging to implement fiscal policies.

To put these numbers into perspective, the US debt-to-GDP ratio is currently around 105%, but is expected to rise to 150% by 2030 if current trends continue. This highlights the importance of monitoring and managing debt levels to avoid potential economic instability. Some key factors contributing to high debt levels include:

- Large budget deficits

- Low economic growth rates

- Inefficient tax systems

- High levels of government spending

Understanding these factors can help policymakers and individuals alike make informed decisions about fiscal management.

The debt situations in Italy and Greece serve as cautionary tales about the potential consequences of high debt levels. For example, Greece's high debt-to-GDP ratio has led to:

- Severe austerity measures

- High unemployment rates

- Reduced economic growth

- Increased poverty levels

These consequences underscore the need for effective fiscal management and sustainable debt levels.

To avoid similar outcomes, countries and individuals can take several steps:

- Implement responsible budgeting practices

- Invest in economic growth initiatives

- Develop efficient tax systems

- Prioritize debt reduction and management

By taking a proactive approach to fiscal management, countries can mitigate the risks associated with high debt levels and promote economic stability and growth. As the US and other countries navigate their own debt challenges, they can learn valuable lessons from the experiences of Italy and Greece, and take steps to ensure a more sustainable fiscal future.

Trump's Tax Reform Bill and Its Impact

The Tax Cuts and Jobs Act, a landmark legislation signed into law in 2017, has been a subject of intense debate among economists, policymakers, and the general public. Proponents of the bill argue that it will stimulate economic growth and increase tax revenue, while critics claim it will exacerbate income inequality and worsen the nation's fiscal situation. As of 2022, the national debt has surpassed $30 trillion, with the tax reform bill expected to contribute significantly to this figure.

To evaluate the effectiveness of the tax reform bill, it's essential to monitor its impact on key economic indicators. Some of the key areas to focus on include:

- Economic growth: The bill's proponents argue that it will boost economic growth by reducing corporate and individual tax rates, thereby increasing investment and consumption.

- Tax revenue: Critics claim that the bill will lead to a decline in tax revenue, exacerbating the national debt and undermining the nation's fiscal sustainability.

- National debt: The bill's impact on the national debt will be a critical factor in determining its overall effectiveness, with some estimates suggesting it will add $1.5 trillion to the debt over the next decade.

Recent data suggests that the tax reform bill has had a mixed impact on the economy. According to the Bureau of Economic Analysis, the GDP growth rate increased to 2.9% in 2018, up from 2.3% in 2017. However, this growth rate has since slowed down, with the GDP growth rate standing at 2.1% in 2022. To make informed decisions about the tax reform bill, readers can follow these practical tips:

* Stay up-to-date with the latest economic data and statistics, including GDP growth rates, tax revenue, and national debt figures.

* Analyze the impact of the tax reform bill on different sectors of the economy, including corporations, small businesses, and individuals.

* Evaluate the bill's effectiveness in stimulating economic growth, increasing tax revenue, and reducing the national debt.

In terms of actionable advice, individuals and businesses can take the following steps to navigate the tax reform bill's impact:

* Consult with a financial advisor or tax professional to understand how the bill affects your specific situation and to identify potential opportunities for tax savings.

* Monitor changes to tax rates, deductions, and credits, and adjust your financial planning accordingly.

* Stay informed about potential future changes to the tax code, including any proposed reforms or amendments to the Tax Cuts and Jobs Act. By staying informed and taking a proactive approach, readers can make the most of the tax reform bill's benefits while minimizing its drawbacks.

Potential Consequences and Solutions

The current state of high debt levels in the US is a pressing concern that warrants attention from lawmakers and individuals alike. As of 2022, the national debt has surpassed $30 trillion, with the debt-to-GDP ratio exceeding 130%. This alarming trend can have far-reaching consequences, including a decrease in the value of the US dollar, increased borrowing costs, and reduced government spending power.

One of the primary concerns is the potential decline in the value of the US dollar. A weaker dollar can lead to higher import prices, contributing to inflation and reducing the purchasing power of consumers. For instance, in 2022, the US dollar index fell by over 10%, resulting in higher costs for imported goods. To mitigate this risk, individuals can consider diversifying their investments, including foreign currencies or dollar-hedged assets.

To address the issue of high debt levels, lawmakers can consider implementing policies that promote fiscal responsibility. Some potential solutions include:

- Reducing government spending: By cutting unnecessary expenditures and streamlining government programs, lawmakers can help reduce the deficit and slow the growth of debt.

- Increasing tax revenue: Implementing tax reforms or closing tax loopholes can help generate additional revenue, which can be used to pay down debt or fund essential programs.

- Implementing a balanced budget amendment: This constitutional amendment would require the government to balance its budget, preventing future generations from being burdened with excessive debt.

These measures can help restore fiscal discipline and ensure the long-term sustainability of the US economy.

Individuals can also take proactive steps to prepare for potential economic uncertainty. Building an emergency fund, for example, can provide a financial safety net in case of unexpected expenses or job loss. Reducing debt, such as credit card balances or mortgages, can also help alleviate financial stress. Additionally, diversifying investments can help mitigate risk and ensure that savings are protected. Some practical tips for individuals include:

- Creating a budget and tracking expenses to identify areas for cost reduction

- Building an emergency fund to cover at least 3-6 months of living expenses

- Pay off high-interest debt, such as credit card balances, as soon as possible

- Considering alternative investments, such as index funds or real estate, to diversify portfolios

By taking these steps, individuals can help protect their financial well-being and reduce their vulnerability to economic uncertainty.

Frequently Asked Questions (FAQ)

What is the current US debt-to-GDP ratio?

The US debt-to-GDP ratio has been a subject of concern in recent years, with significant implications for the country's economic stability and growth. As of 2022, the total US debt stands at over $31 trillion, with a debt-to-GDP ratio of around 105%. This means that the country's debt is equivalent to approximately 105% of its annual economic output.

To understand the significance of this ratio, it's essential to consider its potential impact on the economy. A high debt-to-GDP ratio can lead to:

- Increased interest payments on debt, which can divert funds away from essential public services and investments

- Reduced credit rating, making it more expensive for the government to borrow money

- Higher inflation, as the government may be forced to print more money to service its debt

These factors can have far-reaching consequences for the US economy, including reduced economic growth, higher unemployment, and decreased standards of living.

According to recent projections, the US debt-to-GDP ratio is expected to rise to 150% by 2030 if current trends continue. This highlights the need for effective fiscal management and sustainable economic growth. To achieve this, policymakers can consider implementing measures such as:

- Reducing government spending and deficits

- Implementing tax reforms to increase revenue

- Investing in education, infrastructure, and innovation to boost economic growth

Individuals can also play a role in promoting fiscal responsibility by making informed decisions about their own finances and supporting policies that prioritize sustainable economic growth.

In terms of practical tips, readers can take the following steps to stay informed and engaged:

- Stay up-to-date with the latest economic news and data

- Support organizations that advocate for fiscal responsibility and sustainable economic growth

- Make informed decisions about their own finances, such as saving for the future and investing in assets that promote long-term growth

By working together, we can promote a more sustainable and stable economic future for the United States.

How does the US debt compare to other countries?

The United States currently holds the highest debt in the world, with a staggering total of over $31 trillion. This surpasses the debt of countries like Italy, which has a debt of around $2.7 trillion, and Greece, with a debt of approximately $340 billion. The US debt-to-GDP ratio has also been increasing, reaching over 130% in recent years. This significant debt burden has sparked concerns about the nation's fiscal stability and the potential impact on the economy.

To put this into perspective, consider the following countries with high debt levels:

- Japan: with a debt-to-GDP ratio of over 250%, Japan has one of the highest debt levels in the world.

- Italy: Italy's debt-to-GDP ratio stands at around 150%, with a total debt of over $2.7 trillion.

- Greece: Greece's debt-to-GDP ratio is approximately 180%, with a total debt of around $340 billion.

These countries have implemented various measures to address their debt, such as austerity programs and economic reforms. In contrast, the US debt is expected to continue growing in the coming years, emphasizing the need for the nation to develop a comprehensive plan to address its fiscal situation.

The growing US debt has significant implications for the economy, including increased interest payments, reduced government spending, and a higher risk of default. To mitigate these risks, it is essential for policymakers to develop a long-term plan to reduce the debt and promote fiscal sustainability. Some practical steps that can be taken include:

- Implementing a balanced budget amendment to limit government spending.

- Increasing tax revenue through tax reforms and closing loopholes.

- Reducing healthcare costs by implementing cost-saving measures and increasing efficiency.

By taking these steps, the US can work towards reducing its debt burden and promoting a more stable and sustainable economy.

Individuals can also play a role in promoting fiscal responsibility by making informed decisions about their own finances and staying engaged in the national conversation about debt and fiscal policy. Some actionable advice for readers includes:

- Staying informed about the latest developments in US debt and fiscal policy.

- Supporting policymakers who prioritize fiscal responsibility and debt reduction.

- Making smart financial decisions, such as saving for retirement and paying off high-interest debt.

By working together, we can promote a more sustainable fiscal future for the US and ensure the long-term health of the economy.

What can individuals do to prepare for potential economic uncertainty?

Building an emergency fund is a crucial step in preparing for economic uncertainty. This fund should cover at least 3-6 months of living expenses, providing a financial safety net in case of unexpected events such as job loss or medical emergencies. According to a recent survey, nearly 60% of Americans cannot afford a $1,000 emergency expense, highlighting the importance of prioritizing emergency savings. To start building an emergency fund, individuals can begin by setting aside a small amount each month and gradually increasing the amount over time.

Reducing debt is another essential strategy for mitigating the impact of economic uncertainty. High levels of debt can make individuals more vulnerable to financial shocks, such as interest rate hikes or job loss. To reduce debt, individuals can:

- Pay off high-interest loans and credit cards as quickly as possible

- Consolidate debt into lower-interest loans or credit cards

- Create a debt repayment plan and stick to it

By reducing debt, individuals can free up more money in their budget for savings and investments, making them better equipped to withstand economic uncertainty.

Diversifying investments is also critical for managing risk in uncertain economic times. A diversified portfolio can help individuals weather market fluctuations and reduce their exposure to any one particular asset or industry. Some ways to diversify investments include:

- Investing in a mix of stocks, bonds, and other assets

- Spreading investments across different industries and sectors

- Considering alternative investments, such as real estate or commodities

For example, a study by the investment firm, BlackRock, found that a diversified portfolio with a mix of stocks and bonds can reduce volatility by up to 30% compared to a portfolio with only stocks.

Staying informed about economic trends and fiscal policies is also vital for making informed decisions and mitigating potential risks. Individuals can stay up-to-date by:

- Following reputable financial news sources and websites

- Reading books and articles on personal finance and economics

- Attending seminars and workshops on investing and financial planning

By staying informed, individuals can anticipate potential economic shifts and adjust their financial plans accordingly. For instance, if interest rates are expected to rise, individuals may want to consider paying off high-interest debt or adjusting their investment portfolio to minimize exposure to interest rate risk.