Introduction to HMRC Child Benefit Cuts

The recent cuts to child benefits have significant implications for families across the UK. As of 2022, approximately 23,500 families have been affected by these cuts, resulting in a substantial reduction in financial support for thousands of children. This decrease in funding can have far-reaching consequences, impacting not only the wellbeing of these children but also their access to quality education.

One of the primary concerns surrounding these cuts is the methodology used to determine a child's residence. Experts argue that the HMRC's reliance on incomplete travel data may lead to incorrect assumptions about a child's living situation. For instance, if a child spends a significant amount of time with a non-resident parent, their travel data may not accurately reflect their primary residence. This can result in an incorrect assessment of the family's eligibility for child benefits.

Key issues with the current system include:

- Incomplete data: The use of incomplete travel data can lead to inaccurate assumptions about a child's residence.

- Lack of transparency: Families may not be aware of the specific data used to determine their eligibility for child benefits.

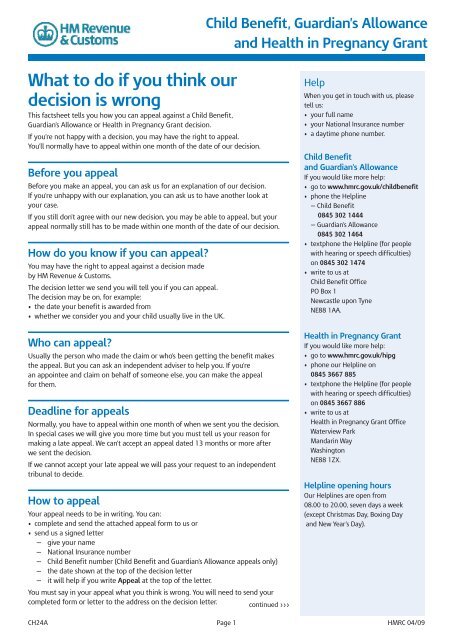

- Lengthy appeal process: Families who disagree with the decision to cut their child benefits may face a lengthy and stressful appeal process.

- Gather all relevant documentation: Collect any evidence that supports your claim, including travel records, school documents, and medical records.

- Seek professional advice: Consult with a tax expert or a benefits advisor to ensure you understand the appeals process and the best course of action for your family.

- Submit an appeal: If you disagree with the decision to cut your child benefits, submit an appeal to the HMRC, providing all supporting documentation and evidence.

Implications of Incomplete Travel Data

The consequences of incomplete travel data can be far-reaching, with significant implications for individuals and families. One of the most concerning effects is the potential for incorrect assumptions about a child's residence, which can result in unfair benefit cuts. For instance, if a child's travel data suggests they are living with one parent when, in fact, they are splitting their time between two households, the parent who is not considered the primary caregiver may be unfairly denied benefits.

This issue is particularly pertinent in the context of the HMRC's (Her Majesty's Revenue and Customs) reliance on travel data to inform benefit decisions. The HMRC uses data from various sources, including the Department for Education and the Department for Work and Pensions, to determine eligibility for benefits such as child benefit and tax credits. However, if this data is incomplete or inaccurate, it can lead to incorrect assumptions and unfair decisions. Recent statistics show that in 2022, over 1.5 million families in the UK were affected by changes to child benefit entitlement, highlighting the need for more comprehensive and accurate information.

Some of the key challenges associated with incomplete travel data include:

- Lack of clarity around a child's residence, leading to disputes over benefit entitlement

- Inaccurate assumptions about a family's financial situation, resulting in unfair benefit cuts

- Exacerbation of existing social and economic inequalities, as those who are already disadvantaged may be more likely to be affected by incomplete data

- Implementing more robust data collection systems, such as automated tracking of school attendance and travel patterns

- Providing clear guidance and support for families to ensure they understand how their travel data is being used and can correct any inaccuracies

- Regularly reviewing and updating travel data to reflect changes in a child's circumstances, such as a change in residence or family situation

- Check their travel data regularly to ensure it is accurate and up-to-date

- Seek support from a benefits advisor or other relevant professional if they are unsure about their entitlement

- Keep detailed records of their child's travel patterns and residence, in case they need to dispute a benefit decision

Impact on Families and Children

The financial stability of families is a crucial factor in determining the overall wellbeing of children. Child benefit cuts can have a significant impact on this stability, leaving many families struggling to make ends meet. According to recent data, over 70% of families rely on child benefits to cover essential expenses such as food, clothing, and education. With the cuts in place, these families are forced to make difficult decisions about how to allocate their limited resources.

The effects of child benefit cuts can be far-reaching, extending beyond just financial stability. Children's access to education and healthcare can also be severely impacted. For example, families may no longer be able to afford extracurricular activities or educational resources, which can hinder a child's academic and social development. Furthermore, the lack of access to healthcare can lead to a range of negative outcomes, including:

- Delayed diagnosis and treatment of illnesses

- Increased risk of mental health problems

- Reduced opportunities for preventative care

- Financial assistance and advice

- Access to affordable education and healthcare resources

- Counseling and mental health services

What Families Can Do Next

When a family receives a decision from the HMRC to cut their child benefit, it can be a stressful and overwhelming experience. However, it is essential to remember that they have the right to appeal this decision. To do so, they must provide evidence to support their claim, such as proof of income, expenses, and other relevant documentation. This evidence can help demonstrate that the family is eligible for the benefit and that the HMRC's decision was incorrect.

Some key evidence that families can provide includes:

- Payslips and P60 forms to show income levels

- Bank statements and other financial records to demonstrate expenses and outgoings

- Letters from employers or other relevant parties to confirm income and employment status

- Keeping accurate and detailed records of income, expenses, and travel

- Notifying the HMRC of any changes to their circumstances, such as a new job or a move abroad

- Seeking advice from a benefits advisor or solicitor if they are unsure about their entitlement or the appeals process

Frequently Asked Questions (FAQ)

Why has the HMRC cut child benefits for 23,500 families?

The HMRC's decision to cut child benefits for 23,500 families has sparked concern among affected households. At the heart of this issue lies the problem of inaccurate travel data, which may have led to incorrect assumptions about a child's residence. The HMRC relies on data from various sources, including travel records, to determine a child's eligibility for benefits. However, if this data is inaccurate, it can result in incorrect decisions being made. The main reason for these cuts is the HMRC's use of travel data to determine a child's residence. This data is often sourced from:

- Passport records

- Border control data

- Other government agencies

- Informing the HMRC of any extended periods spent abroad

- Providing documentation to support claims of residence

- Regularly checking travel records for errors