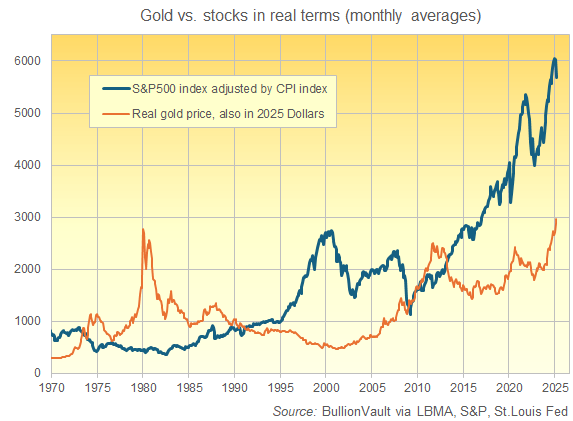

As the global economy continues to navigate the complexities of inflation, currency fluctuations, and geopolitical uncertainty, investors are increasingly turning to safe-haven assets like gold to hedge against market volatility. The gold market, in particular, has been a topic of great interest in recent years, with its price trending upward in response to central banks' stimulus packages and negative interest rates. In this article, we will delve into the intricacies of the gold market, examining the key factors that influence gold prices and predicting the trend for late 2025. Our analysis will provide valuable insights for investors seeking to diversify their portfolios and capitalize on the opportunities presented by this precious metal.

Understanding the Gold Market

The gold market is a complex ecosystem, driven by a delicate balance of supply and demand, as well as macroeconomic factors. On the supply side, gold mining production, scrap gold recycling, and central bank sales contribute to the overall availability of gold. Meanwhile, demand is fueled by jewelry fabrication, coin and bar investments, and industrial applications.- Investment demand: This segment includes coins, bars, and exchange-traded funds (ETFs), which allow investors to gain exposure to gold prices without physically holding the metal.

- Jewelry demand: Gold jewelry is a significant component of overall demand, driven by cultural and aesthetic appeal, particularly in countries like India and China.

- Industrial demand: Gold is used in various industrial applications, including electronics, dentistry, and aerospace.

Gold Price Trend Prediction for Late 2025

Based on our analysis of historical trends, current market conditions, and expert opinions, we will present a comprehensive forecast for the gold price trend in late 2025. Our prediction will take into account the following key factors:- Monetary policy: The stance of central banks, including interest rates and quantitative easing, will influence gold prices.

- Geopolitical uncertainty: Ongoing tensions and conflicts will continue to drive safe-haven demand for gold.

- Supply and demand imbalance: Shifts in the balance between gold supply and demand will impact prices.

Current Gold Market Trends and Analysis

Gold Prices: A Rollercoaster Ride of Fluctuations

As of late, the gold market has been experiencing a wild ride of price fluctuations. The current gold price has been oscillating between $1,550 and $1,650 per ounce, leaving investors and analysts alike to wonder what's driving these changes. To put things into perspective, gold prices have increased by approximately 15% since the start of the year, with some peaks reaching as high as $1,700 per ounce.So, what's behind these recent fluctuations? The answer lies in the complex interplay of global economic events and central banks' actions.

The Impact of Global Economic Events on Gold Prices

Gold has long been considered a safe-haven asset, meaning its value tends to increase during times of economic uncertainty or turmoil. Recently, several global events have contributed to the fluctuations in gold prices:- Covid-19 pandemic: The ongoing pandemic has led to widespread lockdowns, supply chain disruptions, and a significant decline in economic activity. As a result, investors have turned to gold as a hedge against potential losses in other asset classes.

- US-China trade tensions: The ongoing trade war between the US and China has created a sense of uncertainty in the global economy, driving investors to seek refuge in gold.

- Geopolitical tensions: Escalating tensions between nations, such as the US and Iran, have contributed to the increased demand for gold as a safe-haven asset.

These global economic events have led to an increase in gold prices as investors seek to diversify their portfolios and mitigate potential losses.

The Role of Central Banks in Shaping Gold Market Trends

Central banks play a significant role in shaping gold market trends through their monetary policies and gold reserves management. Here are a few ways central banks influence the gold market:- Gold reserves accumulation: Central banks have been increasing their gold reserves in recent years, which has contributed to the upward pressure on gold prices. According to the World Gold Council, central banks added 650 tonnes of gold to their reserves in 2020 alone.

- Interest rate policies: Central banks' interest rate decisions have a direct impact on gold prices. Low interest rates make gold more attractive as an investment, as the opportunity cost of holding gold decreases.

- Quantitative easing: Central banks' quantitative easing policies have led to an increase in the money supply, which can drive up gold prices due to concerns about inflation and currency devaluation.

In conclusion, the current gold market trends are influenced by a complex array of factors, including global economic events and central banks' actions. As investors, it's essential to stay informed about these developments to make informed investment decisions.

Factors Influencing Gold Price in Late 2025

Interest Rates and Gold Prices: A Delicate Dance

Interest rates play a crucial role in shaping gold prices. The relationship between the two is often inverse, meaning that when interest rates rise, gold prices tend to fall, and vice versa. This phenomenon can be attributed to the opportunity cost of holding gold. When interest rates are high, investors are more likely to opt for yield-generating assets, such as bonds, over non-yielding assets like gold. Conversely, when interest rates are low, gold becomes a more attractive option, driving up its price. For instance, in 2020, when central banks slashed interest rates to combat the COVID-19 pandemic, gold prices surged to record highs. As interest rates are expected to rise in late 2025, gold prices may experience downward pressure. However, it's essential to note that the impact of interest rates on gold prices can be nuanced, and other factors, such as inflation and geopolitical tensions, can also influence the price of gold.Inflation, Deflation, and Gold Demand

Inflation and deflation have a significant impact on gold demand and, subsequently, its price. During periods of high inflation, investors often seek refuge in gold as a hedge against currency devaluation and erosion of purchasing power. This increased demand for gold can drive up its price. On the other hand, deflationary environments can lead to decreased gold demand, as investors may prefer to hold cash or other low-risk assets. However, in some cases, deflation can also lead to increased gold demand, particularly if it's accompanied by economic uncertainty or recession fears. In late 2025, the inflation landscape is expected to play a crucial role in shaping gold prices. With central banks struggling to contain inflationary pressures, gold may emerge as a safe-haven asset, driving up its price. However, if deflationary forces gain traction, gold prices may experience downward pressure.Geopolitical Tensions: A Wild Card for Gold Prices

Geopolitical tensions can have a profound impact on gold prices, often serving as a wildcard factor. During times of heightened geopolitical uncertainty, investors tend to seek safe-haven assets, such as gold, driving up its price. In late 2025, several geopolitical hotspots, including the ongoing Russia-Ukraine conflict, tensions between the US and China, and the Middle East's fragile political landscape, are likely to influence gold prices. Any escalation of these conflicts can lead to increased gold demand, driving up its price. Additionally, the ongoing COVID-19 pandemic has exposed vulnerabilities in global supply chains, leading to increased concerns about economic stability. This uncertainty can also drive gold prices higher as investors seek a safe-haven asset. In conclusion, the factors influencing gold prices in late 2025 are complex and multifaceted. While interest rates, inflation, and deflation are key drivers, geopolitical tensions can also play a significant role. As investors navigate the uncertain landscape of 2025, a deep understanding of these factors is crucial for making informed investment decisions.

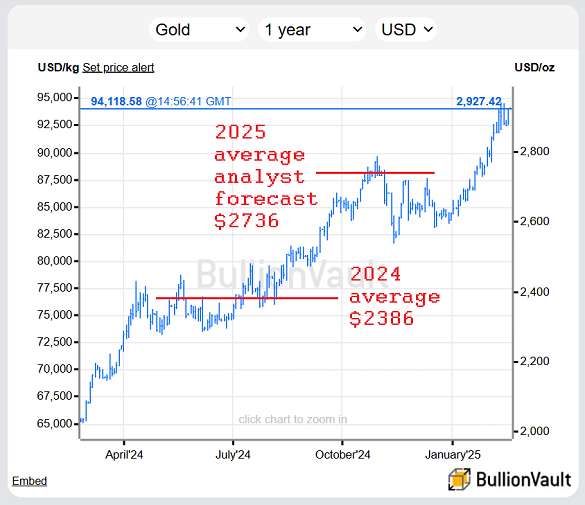

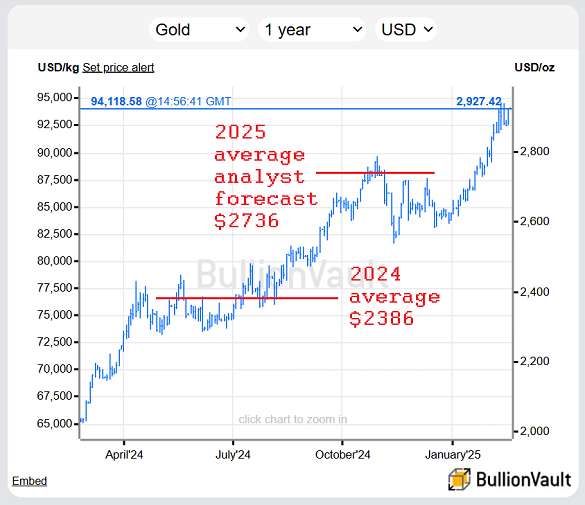

Gold Price Prediction for Late 2025: Expert Opinions and Forecasts

Expert Opinions: A Mixed Bag of Forecasts

When it comes to predicting gold prices, experts often have differing opinions, shaped by their unique perspectives and analysis of market trends. Here are a few notable forecasts for late 2025:- Bullish Outlook: Goldman Sachs' commodities team predicts gold prices will reach $2,000 per ounce by the end of 2025, driven by central banks' continued gold purchases and increasing investor demand.

- Bearish Outlook: Conversely, analysts at Citigroup expect gold prices to decline to around $1,400 per ounce by late 2025, citing rising interest rates and a strengthening US dollar.

- Moderate Growth: A more moderate forecast comes from the World Gold Council, which predicts gold prices will average around $1,700 per ounce in 2025, driven by a combination of investment and jewelry demand.

Comparing and Contrasting Gold Price Predictions

While these forecasts may seem disparate, they're not entirely mutually exclusive. A closer examination of the underlying factors driving these predictions reveals some common themes:- Inflation and Interest Rates: Rising inflation and interest rates are expected to impact gold prices, with some experts believing these factors will drive prices up (bullish outlook) and others predicting they'll lead to a decline (bearish outlook).

- Central Bank Demand: Many experts agree that central banks will continue to purchase gold, supporting prices and driving demand.

- Geopolitical Risks: The ongoing COVID-19 pandemic, trade tensions, and other geopolitical risks may lead to increased investor demand for gold as a safe-haven asset.

Risks and Opportunities Associated with Gold Price Predictions

While these forecasts provide valuable insights, it's essential to acknowledge the potential risks and opportunities associated with each:- Risks: A decline in gold prices could lead to losses for investors, particularly those who have invested in gold-based instruments or mining stocks. Conversely, a rapid increase in prices could lead to a bubble, followed by a sharp correction.

- Opportunities: A moderate increase in gold prices could provide a hedge against inflation and currency fluctuations, making gold an attractive asset for investors seeking diversification. Additionally, a rise in gold prices could benefit gold mining companies and related industries.

Investment Strategies for a Volatile Gold Market

Navigating the Volatile Gold Market: A Guide to Smart Investing

In recent years, the gold market has experienced unprecedented volatility, leaving many investors wondering how to navigate this tumultuous landscape. As a safe-haven asset, gold is often sought after during times of economic uncertainty, but its price fluctuations can be daunting for even the most seasoned investors. In this article, we'll explore investment strategies for a volatile gold market, including diversification, gold ETFs and mutual funds, and timing your investments for maximum returns.Diversification: The First Line of Defense

When investing in a volatile gold market, diversification is key. Spreading your investments across different asset classes can help mitigate risk and increase potential returns. A diversified portfolio should include a mix of low-risk investments, such as bonds and money market funds, along with higher-risk investments like stocks and commodities. In the context of gold investing, diversification can be achieved by allocating your portfolio across different types of gold investments, including:- Physical gold: Coins, bars, and bullion provide a tangible store of value and can be a hedge against inflation and market downturns.

- Gold mining stocks: Investing in gold mining companies can provide exposure to the gold price while also offering the potential for dividend income and capital appreciation.

- Gold ETFs and mutual funds: These investment vehicles track the price of gold and offer a convenient way to invest in the precious metal without the need for physical storage.

The Benefits of Gold ETFs and Mutual Funds

Gold ETFs (Exchange-Traded Funds) and mutual funds have become increasingly popular among investors due to their ease of use, diversification benefits, and low costs. These investment vehicles offer a convenient way to invest in gold without the need for physical storage or the risks associated with individual mining stocks. The benefits of gold ETFs and mutual funds include:- Liquidity: Gold ETFs and mutual funds can be easily bought and sold on major stock exchanges, providing investors with quick access to their funds.

- Diversification: Many gold ETFs and mutual funds track a diversified basket of gold-related assets, reducing the risk of individual investments.

- Low costs: Gold ETFs and mutual funds often have lower fees compared to other investment vehicles, making them an attractive option for cost-conscious investors.

Timing Your Gold Investments for Maximum Returns

Timing is everything when it comes to investing in gold. While it's impossible to predict with certainty when the gold price will rise or fall, there are certain strategies that can help you maximize your returns. Some tips for timing your gold investments include:- Buy during periods of low demand: Investing in gold during periods of low demand can provide an opportunity to buy at a lower price.

- Monitor economic indicators: Keeping an eye on economic indicators such as inflation rates, interest rates, and GDP growth can help you anticipate potential changes in the gold price.

- Avoid emotional investing: Investing based on emotions can lead to impulsive decisions that may result in losses. Instead, focus on making informed, data-driven investment decisions.

Frequently Asked Questions (FAQ)

What are the key drivers of gold price fluctuations?

Understanding the complex dynamics that influence gold prices is crucial for investors, traders, and enthusiasts alike. Gold, often referred to as a safe-haven asset, is sensitive to various economic and geopolitical factors that can cause its price to fluctuate. In this section, we'll delve into the key drivers of gold price fluctuations, exploring the intricate relationships between interest rates, inflation, geopolitical tensions, and central bank policies.

Interest Rates: A Precursor to Gold Price Movements

Interest rates play a significant role in shaping gold prices. When interest rates rise, it becomes more attractive to hold currencies and invest in high-yielding assets, reducing the appeal of gold. Conversely, when interest rates fall, investors often seek refuge in gold as a hedge against inflation and currency devaluation. The inverse relationship between interest rates and gold prices is rooted in the opportunity cost of holding gold. As interest rates increase, the opportunity cost of holding gold – which does not generate interest – rises, making it less attractive to investors.Inflation: A Catalyst for Gold Price Increases

Inflation, or the rate at which prices for goods and services are rising, has a profound impact on gold prices. Gold is often viewed as a hedge against inflation, as its value tends to increase when inflation rises. This is because gold is seen as a store of value, and its purchasing power is maintained even as the value of fiat currencies erodes. As inflation increases, investors seek to protect their wealth by investing in gold, driving up its price.Geopolitical Tensions: A Source of Uncertainty and Volatility

Geopolitical tensions, including conflicts, sanctions, and political unrest, can significantly influence gold prices. During times of heightened uncertainty, investors often turn to gold as a safe-haven asset, driving up its price. The fear of potential economic instability, currency devaluation, or even war can lead to increased demand for gold, pushing its price higher.Central Bank Policies: A Behind-the-Scenes Influencer

Central bank policies, including monetary easing, quantitative easing, and forward guidance, can have a profound impact on gold prices. When central banks implement expansionary monetary policies, it can lead to currency devaluation, higher inflation expectations, and increased demand for gold. Conversely, contractionary monetary policies can reduce demand for gold and drive its price lower.- Monetary easing: Central banks' decision to lower interest rates or implement quantitative easing can lead to increased demand for gold, driving up its price.

- Currency devaluation: A central bank's decision to devalue its currency can lead to increased demand for gold, as investors seek to protect their wealth from currency fluctuations.

- Forward guidance: Central banks' communication about future monetary policy decisions can influence gold prices, as investors adjust their expectations and position themselves accordingly.

Is it a good idea to invest in gold in late 2025?

As the global economy continues to navigate the complexities of inflation, geopolitical tensions, and market volatility, many investors are turning to gold as a potential safe-haven asset. But is investing in gold in late 2025 a wise decision? The answer lies in understanding the benefits and drawbacks of gold investment and how it aligns with your individual financial goals and risk tolerance.

The Case for Gold Investment

Gold has traditionally been viewed as a hedge against inflation, as its value tends to increase when inflation rises. With central banks around the world printing more money to stimulate economic growth, the risk of inflation is ever-present. Additionally, gold's value often increases during times of geopolitical uncertainty, providing a sense of security for investors. Furthermore, gold is a tangible asset, providing a sense of control and ownership that may be lacking in paper-based investments. In late 2025, the global economy is still recovering from the COVID-19 pandemic, and the risk of another economic downturn cannot be ruled out. In such an environment, gold's store of value properties make it an attractive addition to a diversified portfolio.The Risks of Gold Investment

While gold has its benefits, it's essential to be aware of the potential drawbacks. Gold does not generate passive income, unlike dividend-paying stocks or bonds, which can impact its overall return on investment. Additionally, gold prices can be volatile, and market fluctuations can result in significant losses if not managed properly. Furthermore, the opportunity cost of investing in gold should not be overlooked. The money invested in gold could be invested in other assets with potentially higher returns, such as stocks or real estate.A Balanced Approach

So, is investing in gold in late 2025 a good idea? The answer lies in adopting a balanced approach. A diversified portfolio with a moderate gold allocation (around 5-10%) can provide a hedge against market volatility and inflation while minimizing the risks associated with gold investment. Here are some tips for incorporating gold into your investment strategy:- Define your financial goals: Determine whether gold aligns with your short-term or long-term investment objectives.

- Assess your risk tolerance: Consider how much risk you're willing to take on and whether gold's volatility aligns with your risk tolerance.

- Diversify your portfolio: Spread your investments across different asset classes, including stocks, bonds, and real estate, to minimize risk.

- Set a moderate gold allocation: Limit your gold investment to a moderate percentage of your overall portfolio to avoid overexposure.

How can I stay up-to-date with gold price predictions and market trends?

Staying informed about gold price predictions and market trends is crucial for investors, traders, and enthusiasts alike. In today's fast-paced financial landscape, it's essential to have access to reliable sources of information to make informed decisions. Here are some ways to stay up-to-date with gold market developments:

Follow Reputable Financial News Sources

Staying informed about gold price predictions and market trends begins with following reputable financial news sources. These sources provide timely and accurate information about market fluctuations, economic indicators, and expert opinions. Some popular financial news sources include:- Bloomberg: A leading provider of financial news, data, and analytics.

- Reuters: A trusted source of international news, including business and financial updates.

- Kitco: A specialized news site focused on precious metals, including gold, silver, and platinum.

- Forbes: A well-respected business magazine that covers a wide range of financial topics, including gold investing.

Gold Market Experts and Analysts

In addition to following financial news sources, it's essential to stay informed about the opinions and predictions of gold market experts and analysts. These individuals have extensive knowledge of the gold market and can provide valuable insights into market trends and price predictions. Some notable gold market experts include:- Jim Rickards: A renowned economist and expert on gold and currency markets.

- Peter Schiff: A well-known economist and gold advocate who provides insights into market trends and price predictions.

- Martin Armstrong: A prominent economist and expert on gold, silver, and other precious metals.

Economic Indicators and Data

Economic indicators and data are crucial for understanding gold price predictions and market trends. By tracking key indicators, you'll be able to identify trends, patterns, and potential market shifts. Some essential economic indicators to track include:- GDP growth rates: A key indicator of economic health and growth.

- Inflation rates: A measure of the rate of change in prices of goods and services.

- Interest rates: A key factor in determining the attractiveness of gold as an investment.

- Unemployment rates: A measure of the health of the labor market and overall economy.