Filing income tax returns online in India can seem like a daunting task, especially for those who are new to the process. However, with the right guidance, it can be a relatively smooth and straightforward experience. In this blog post, we will take you through the necessary steps and requirements to file your income tax returns online in India.

Why E-Filing is the Way to Go

In recent years, the Indian government has made significant efforts to promote digitalization and encourage taxpayers to e-file their returns. And for good reason! E-filing offers several benefits, including convenience, speed, and accuracy. By filing your returns online, you can avoid the hassle of physical paperwork, reduce the likelihood of errors, and receive your refund (if eligible) faster. What to Expect from this Guide In the following sections, we will cover the entire process of filing income tax returns online in India, from gathering necessary documents to submitting your returns. We will also highlight important deadlines, tax slabs, and exemptions to ensure you are well-equipped to navigate the process with confidence.- We will walk you through the registration process on the Income Tax Department's website and explain how to obtain your login credentials.

- We will discuss the various types of income that need to be reported, including salary, interest, and capital gains.

- We will provide tips on how to calculate your taxable income, claim deductions, and exemptions.

- We will guide you through the process of filing your returns, including uploading necessary documents and making payments.

- We will also cover common errors to avoid and what to do in case of an audit or notice from the Income Tax Department.

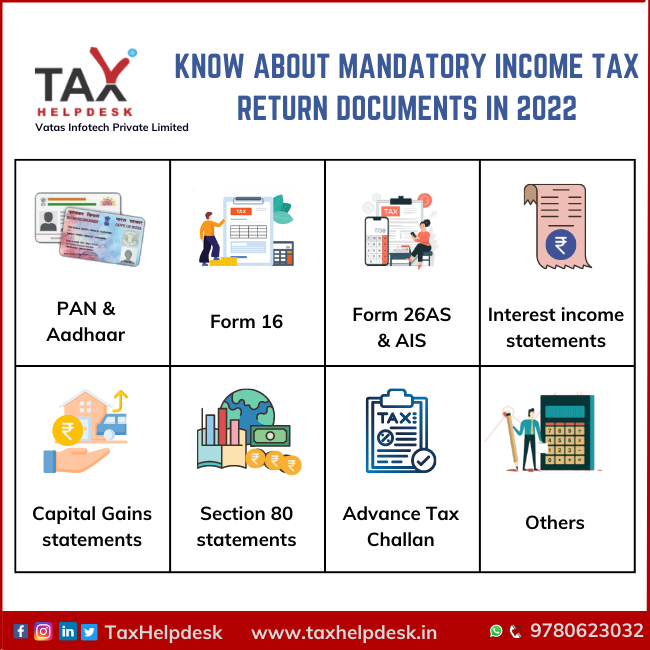

Before You Start: Gathering Necessary Documents

Employer-Provided Documents

The first set of documents you need to gather are from your employer(s). These documents provide details about your income and taxes deducted at source.- Form 16: This is a certificate issued by your employer, detailing the total income paid and taxes deducted from your salary. It's a crucial document for filing your income tax return.

- Form 16A: If you've received income from other sources, such as interest on fixed deposits or winnings from lotteries, your employer or the payer will issue Form 16A. This form shows the taxes deducted on such income.

- Form 16B: In cases where you've sold a property, the buyer is required to deduct TDS (Tax Deducted at Source) and issue Form 16B. This form provides details about the TDS deducted and deposited with the government.

Details of Income from Other Sources

In addition to income from your employer, you may have earned income from other sources, such as:- Interest income from bank deposits, bonds, or other investments

- Rent received from letting out a property

- Capital gains from the sale of assets, such as shares or mutual funds

- Income from freelancing or consulting services

Deductions and Exemptions Claimed

You may be eligible for various deductions and exemptions under the Income-tax Act, such as:- Section 80C: Deductions for investments in tax-saving instruments, such as life insurance premiums, PPF, and ELSS

- Section 80D: Deductions for medical insurance premiums

- Section 80G: Deductions for donations to charitable institutions

- HRA (House Rent Allowance): Exemption for rent paid, subject to certain conditions

Step 1: Register and Login to the Income Tax Portal

Getting Started with the Income Tax Portal

Before you can begin filing your income tax returns or access various services offered by the income tax department, you need to register and login to the income tax portal. This step is crucial in ensuring a smooth and hassle-free experience. In this section, we will guide you through the process of creating a new account, logging in, and updating your personal details. Creating a New Account To register on the income tax portal, follow these simple steps:- Visit the official income tax website ([www.incometaxindia.gov.in](http://www.incometaxindia.gov.in)) and click on the "Register" button.

- Fill in the required details such as your PAN (Permanent Account Number), name, date of birth, and other personal information.

- Choose a username and password for your account, and provide a valid email address and mobile number.

- Submit the registration form and wait for the verification email and SMS.

- Click on the "Login" button on the income tax website and enter your username and password.

- Click on the "Verify" button next to your email address and mobile number.

- Enter the verification codes sent to your email address and mobile number.

- Once verified, you will be logged in to your account.

- Click on the "Profile" or "My Account" section and update your personal details such as address, occupation, and other information.

- Click on the "Change Password" option and enter a new password for your account.

- Make sure to choose a strong and unique password to protect your account from unauthorized access.

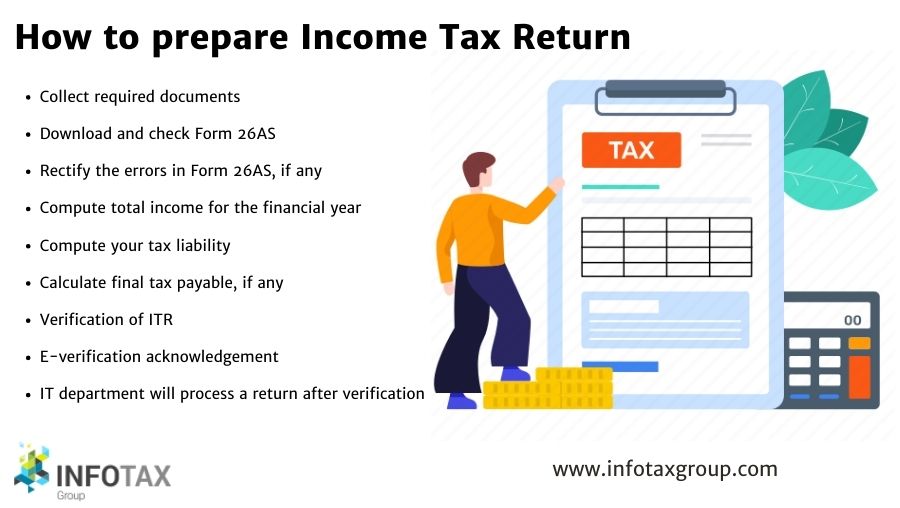

Step 2: Prepare and Submit Your Income Tax Return

Selecting the Correct ITR Form

Now that you have gathered all the necessary documents, it's time to prepare and submit your income tax return. The first step in this process is to choose the correct ITR (Income Tax Return) form. The Indian government has introduced seven types of ITR forms, each catering to different types of taxpayers. You can choose from ITR-1 to ITR-7, depending on your income sources and tax liabilities.- ITR-1 (Sahaj): For individuals with income from salary, one house property, and other sources (interest, etc.).

- ITR-2: For individuals and Hindu Undivided Families (HUFs) with income from salary, more than one house property, and other sources.

- ITR-3: For individuals and HUFs with income from business or profession, along with other sources.

- ITR-4: For individuals and HUFs with income from business or profession, and presumptive income from business or profession.

- ITR-5: For firms, Limited Liability Partnerships (LLPs), and Association of Persons (AOPs).

- ITR-6: For companies, other than those claiming exemption under Section 11.

- ITR-7: For persons, including companies, required to furnish return under Sections 139(4A), 139(4B), 139(4C), and 139(4D).

Filling in Personal and Income Details

After downloading the preparation utility, fill in your personal details, including your name, address, date of birth, PAN (Permanent Account Number), and Aadhaar number. Next, provide your income details, including:- Salary income: Include all salary income earned during the financial year, along with the tax deducted at source (TDS).

- Interest income: Mention interest earned from savings accounts, fixed deposits, and other sources.

- Capital gains: Disclose any capital gains or losses from the sale of assets, such as property, shares, or mutual funds.

- Rent income: If you receive rent from a property, include it in your income details.

- Other income: Any other income, such as freelance work or consulting fees, should be disclosed.

Calculating Total Income and Tax Liability

Once you have filled in all your income details, calculate your total income by adding up all the income sources mentioned above. Next, calculate your tax liability by considering the tax rates applicable to your income slab. You can claim deductions and exemptions under various sections of the Income-tax Act, 1961, to reduce your tax liability. Important: Ensure that you calculate your total income and tax liability correctly, as any errors can lead to penalties and fines. If you are unsure about any aspect of the calculation, consider consulting a tax professional or chartered accountant. By following these steps, you can accurately prepare and submit your income tax return, ensuring a smooth and hassle-free tax filing experience.

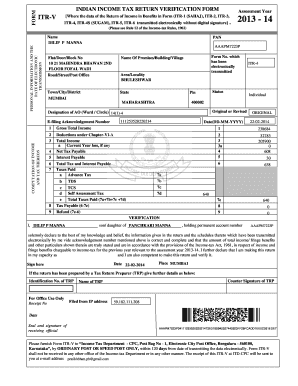

Step 3: Verify and Confirm Your Income Tax Return

Verification: The Crucial Step in ITR Filing

Once you've submitted your income tax return (ITR), the next critical step is to verify it. Verification is essential to ensure that your return is processed correctly and to avoid any potential errors or rejections. In this section, we'll guide you through the verification process, highlighting the various methods, common errors to watch out for, and the steps to take if corrections are required. Verification Methods The Income Tax Department offers three convenient methods to verify your ITR:- Aadhaar OTP: If you've linked your Aadhaar card with your PAN, you can use the OTP (One-Time Password) sent to your registered mobile number to verify your return.

- Net Banking: You can log in to your net banking account and verify your return through the e-Verify option.

- EVC (Electronic Verification Code): You can generate an EVC through the e-Filing portal and use it to verify your return.

Checking for Errors and Discrepancies

After submitting your ITR, it's essential to review your return carefully to ensure that all information is accurate and complete. Some common errors to watch out for include:- Incorrect or missing PAN details

- Error in calculation of total income or tax liability

- Incomplete or incorrect bank account information

- Mismatch in personal details, such as name, date of birth, or address

Making Corrections and Re-Upload

If you've identified any errors or discrepancies in your ITR, don't panic! You can make corrections and re-upload your return. Here's what you need to do:- Log in to the e-Filing portal and access your ITR.

- Make the necessary corrections and ensure that all information is accurate and complete.

- Re-upload your corrected ITR and verify it using one of the methods mentioned above.

Frequently Asked Questions (FAQ)

What is the last date to file income tax return online?

Understanding the Deadline for Filing Income Tax Return Online

As the financial year comes to a close, it's essential to stay on top of your tax obligations. One crucial aspect of this is filing your income tax return (ITR) online. But, have you ever wondered what the last date is to file your ITR online? Well, the answer varies from year to year, but generally, it's usually September 30th for individuals.- Why is it important to file your ITR on time? Filing your ITR within the stipulated deadline helps you avoid late fees, penalties, and interest on your tax dues. Moreover, timely filing ensures you don't miss out on any refunds you might be eligible for.

What happens if you miss the deadline?

In the event you miss the deadline, you'll be liable to pay a penalty of ₹5,000, which can go up to ₹10,000 in certain cases. Additionally, you'll be charged interest on your outstanding tax amount at the rate of 1% per month or part thereof. It's essential to prioritize filing your ITR on time to avoid these additional costs.Exceptions to the September 30th deadline

While September 30th is the general deadline for individuals, there are certain exceptions to this rule. For instance, if you're an individual with a business or profession, your deadline might be October 31st or November 30th, depending on whether your accounts need to be audited or not. It's crucial to check the specific deadline applicable to your situation to ensure timely filing.How to file your ITR online?

Filing your ITR online is a relatively straightforward process. You can log in to the Income Tax Department's e-filing portal (https://incometaxindiaefiling.gov.in/) and follow these steps:- Register or log in to your account

- Fill out the required ITR form (ITR-1, ITR-2, ITR-3, or ITR-4)

- Upload the necessary documents and attachments

- Verify and submit your ITR

Do I need to attach any documents while filing income tax return online?

Understanding Document Requirements for Online ITR Filing

When it comes to filing income tax returns online, one of the most common questions taxpayers have is whether they need to attach any documents to their return. The answer is a resounding "no" - but with a crucial caveat. No Attachments Required Unlike the traditional paper-based method of filing income tax returns, the online process does not require you to attach any documents to your return. This is because the Income Tax Department has implemented a system of electronic verification and validation, which eliminates the need for physical attachments. However, this does not mean that you can ignore the importance of maintaining a comprehensive set of documents related to your income and expenses. In fact, it is essential to keep these documents ready for verification purposes, in case the tax authorities require them.Documents to Keep Handy

While you don't need to attach any documents to your online return, you must keep the following documents ready for verification purposes:- Form 16: This is the certificate of tax deducted at source (TDS) provided by your employer.

- Form 16A: This is the TDS certificate for income from other sources, such as interest on fixed deposits or rent.

- Proof of income: This includes documents such as salary slips, pension certificates, and interest certificates.

- Proof of deductions: This includes documents such as receipts for charitable donations, medical expenses, and home loan interest.

- Proof of investments: This includes documents such as life insurance policies, PPF account statements, and ELSS investment proofs.

Conclusion

In conclusion, while you don't need to attach any documents to your online income tax return, it is crucial to maintain a comprehensive set of documents related to your income and expenses. By keeping these documents ready, you can ensure a smooth and hassle-free experience in case of any verification or audit proceedings. So, remember to keep your documents organized and up-to-date to avoid any last-minute hassles!How do I know if my income tax return is processed successfully?

One of the most critical steps in filing your income tax return is verifying that it has been processed successfully by the income tax department. This confirmation gives you peace of mind, ensuring that your return has been received and is being reviewed by the authorities. So, how do you know if your income tax return has been processed successfully? Acknowledgement from the Income Tax Department The first indication that your return has been processed successfully is the acknowledgement you receive from the income tax department. This acknowledgement is usually sent to your registered email ID and mobile number, and it confirms that your return has been received and is under processing. The acknowledgement typically includes your Permanent Account Number (PAN), the Assessment Year, and the Date of Filing. Checking the Status of Your Return on the Income Tax Portal Another way to verify the status of your return is by logging into the income tax portal. Here's how you can do it:

- Visit the official income tax e-filing portal (https://www.incometaxindiaefiling.gov.in/) and log in to your account using your credentials.

- Click on the "View Returns/Forms" tab and select the "Income Tax Returns" option.

- Select the relevant Assessment Year and click on the "Submit" button.

- You will see the status of your return, which may be "Processing," "Verified," or "Completed," depending on the stage of processing.

- Check your email and mobile number for any notifications or updates from the income tax department.

- Verify that you have correctly uploaded all the required documents and information.

- If you have filed your return through a tax consultant or chartered accountant, contact them to resolve any issues.

- If the issue persists, you can contact the income tax department's customer support or visit your local tax office for assistance.

Promoted

Automate Your YouTube Channel Effortlessly

The #1 tool for creators to schedule and upload videos from Google Drive, 24/7. Lifetime access at just ₹999.

🔥 Get Lifetime Access Now 🔥