Background and Context

The Trump administration's tax bill, officially known as the Tax Cuts and Jobs Act (TCJA), was enacted in 2017 with the primary goal of reforming the US tax code. One of its key provisions was the introduction of a one-time transition tax on overseas profits, which aimed to encourage companies to repatriate their foreign earnings. This move had significant implications for multinational corporations like Meta, which had accumulated substantial profits overseas.

As a result of this tax bill, Meta faced a $16 billion tax charge, a substantial amount that inevitably impacted its financial reports and investor confidence. To put this into perspective, according to recent data, Meta's overseas profits were estimated to be around $200 billion, making it a prime target for this tax charge. The tax charge was calculated based on the deemed repatriation of foreign earnings, which were previously exempt from US taxation.

The implications of this tax charge are multifaceted and far-reaching. Some of the key effects include:

- Reduced cash reserves: The significant tax charge depleted Meta's cash reserves, which could have been used for investments, research, and development, or other strategic initiatives.

- Increased tax liabilities: The tax charge added to Meta's overall tax liabilities, which could impact its future tax payments and cash flows.

- Impact on investor confidence: The large tax charge may have raised concerns among investors about Meta's ability to manage its tax obligations and maintain its profitability.

Financial Impact on Meta

The recent $16 billion tax charge imposed on Meta is expected to have far-reaching implications for the company's financial performance. This substantial charge will undoubtedly affect Meta's bottom line, potentially leading to a decrease in investor confidence and stock price. As a result, investors and stakeholders are eagerly awaiting Meta's financial reports to gauge the company's financial health and future prospects.

To provide a clear picture of the company's financial situation, Meta's financial reports will need to reflect this tax charge. The reports should include detailed information on the tax charge, its impact on the company's revenue and profits, and the measures being taken to mitigate its effects. Some key areas to focus on include:

- Revenue growth: How will the tax charge affect Meta's revenue growth, and what strategies will the company employ to offset this impact?

- Profit margins: How will the tax charge influence Meta's profit margins, and what measures can be taken to maintain or improve them?

- Investment plans: Will the tax charge lead to a reassessment of Meta's investment plans, and if so, what changes can be expected?

.jpg)

Industry Implications and Comparisons

The recent tax charge imposed on Meta serves as a warning to other tech companies with substantial overseas profits. As these companies navigate complex international tax laws, they may face similar charges, which could significantly impact their financial performance. According to a report by the Institute on Taxation and Economic Policy, the top five US tech companies, including Google, Amazon, and Apple, have accumulated over $1.4 trillion in overseas profits, making them potential targets for tax charges.

To better understand the industry-wide implications, it's essential to compare Meta's situation to other companies. For instance:

- Google's overseas profits have been subject to intense scrutiny, with the company facing tax disputes in several countries, including the UK and France.

- Amazon has also been accused of tax avoidance, with the company's effective tax rate being significantly lower than the US corporate tax rate.

- Apple has been involved in a long-standing tax dispute with the European Commission, which has resulted in the company being ordered to pay billions of dollars in back taxes.

- Monitor the financial statements of tech companies, paying close attention to their overseas profits and tax provisions.

- Stay up-to-date with changes in international tax laws and regulations, which can impact the companies' tax liabilities.

- Diversify their portfolios to minimize the risk associated with potential tax charges, which can have a significant impact on a company's stock price.

Future Outlook and Strategies

As the digital landscape continues to evolve, companies like Meta must navigate complex financial challenges to remain competitive. The recent tax charge imposed on the company will undoubtedly have a significant impact on its financial strategy, requiring swift adaptation to maintain investor confidence. According to recent reports, Meta's revenue has grown by 22% in the past year, reaching $118 billion in 2022. However, the company must now focus on mitigating the effects of the tax charge to ensure sustained growth.

To achieve this, Meta may employ various strategies to offset the financial burden. Some potential approaches include:

- Increasing revenue through innovative advertising solutions and expanded e-commerce offerings

- Reducing costs by streamlining operations and optimizing resource allocation

- Exploring new markets and opportunities, such as emerging technologies and untapped geographic regions

Frequently Asked Questions (FAQ)

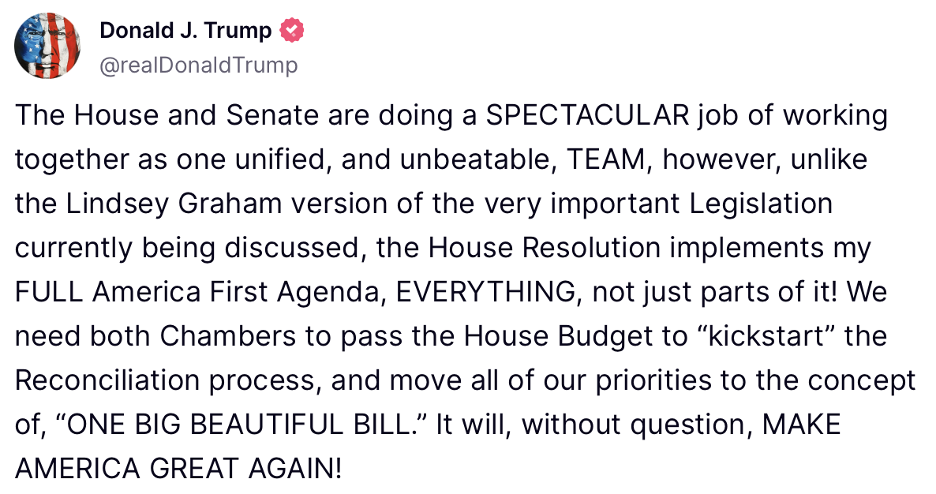

What is the Trump bill's tax charge, and how does it affect Meta?

The recent tax charge imposed on Meta has significant implications for the company's financial stability and investor confidence. As of the latest financial reports, Meta is required to pay a one-time payment of $16 billion, which will notably impact its bottom line. This substantial tax charge is expected to affect the company's profitability and cash flow, potentially influencing its future investments and strategic decisions. To understand the scope of this impact, consider the following key aspects:

- Financial reports: The $16 billion tax charge will be reflected in Meta's upcoming financial reports, potentially leading to a decrease in net income and earnings per share.

- Investor confidence: The significant tax charge may influence investor sentiment, potentially affecting the company's stock price and overall market valuation.

- Strategic adaptations: Meta will need to reassess its business strategy to mitigate the effects of the tax charge, potentially exploring cost-saving measures or alternative revenue streams.

- Monitor financial reports: Keep a close eye on Meta's upcoming financial reports to understand the exact impact of the tax charge on the company's profitability and cash flow.

- Track industry trends: Stay up-to-date with the latest developments in the tech industry, including emerging trends and innovations that may affect Meta's business strategy.

- Analyze competitor performance: Compare Meta's performance with that of its competitors, such as Alphabet and Amazon, to gain a deeper understanding of the company's relative position in the market.