The issue of unequal inheritance has become a pressing concern in Britain, with far-reaching consequences for social mobility and economic stability. According to a recent report by the Institute for Fiscal Studies (IFS), the wealth gap between older and younger generations has been increasing over the past few decades. This trend is largely driven by the fact that older generations have benefited from significant increases in property values and pension entitlements, while younger generations face rising housing costs, student debt, and reduced job security.

The impact of unequal inheritance on social mobility is particularly concerning. Children from wealthy families are more likely to inherit significant assets, providing them with a substantial advantage in terms of education, career opportunities, and financial security. In contrast, children from less affluent backgrounds often struggle to access these same opportunities, perpetuating a cycle of disadvantage. For example, data from the Social Mobility Commission shows that:

- Only 12% of children from disadvantaged backgrounds attend a top university, compared to 44% of children from affluent backgrounds

- Young people from wealthy families are more than twice as likely to secure a job in a top profession, such as law or medicine

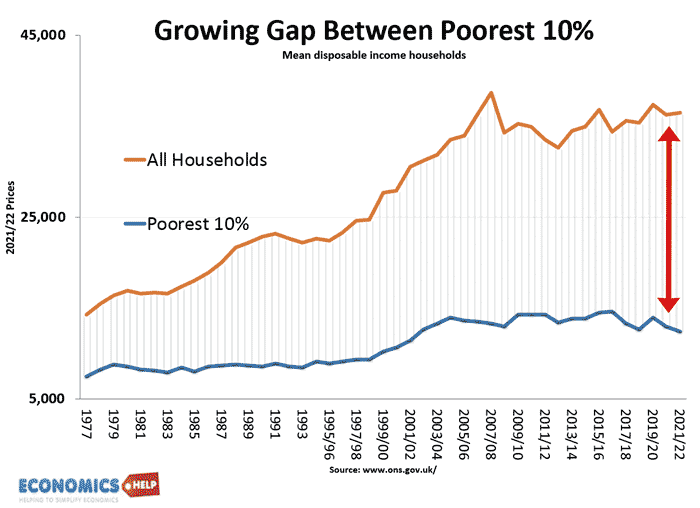

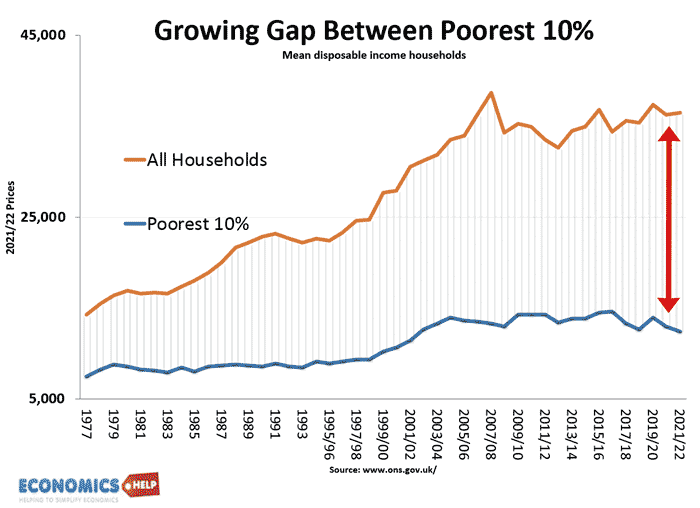

- The wealth gap between rich and poor families has increased by 25% over the past 10 years, with the richest 10% of households now holding over 50% of the country's wealth

To address the issue of unequal inheritance and promote greater social mobility, it is essential to implement policies that support younger generations. This could include initiatives such as:

- Increasing access to affordable housing and education

- Implementing a more progressive taxation system to reduce wealth inequality

- Providing greater support for entrepreneurship and job creation among younger people

Individuals can also take practical steps to mitigate the effects of unequal inheritance, such as:

- Seeking out mentorship and career guidance to improve job prospects

- Building an emergency fund to cover unexpected expenses and avoid debt

- Investing in education and skills development to increase earning potential

By working together to address the root causes of unequal inheritance, we can help to create a more equitable society and promote greater social mobility and economic stability for all.

The Inheritance Gap

The disparity in inheritance expectations among millennials is a pressing concern that warrants attention from policymakers and individuals alike. Recent data reveals that 25% of millennials anticipate inheriting over £50,000, while a significant 40% expect to receive nothing. This stark contrast highlights the existence of an inheritance gap, where a substantial portion of the population is likely to be left behind.

The implications of this gap are far-reaching, with experts arguing that it exacerbates social and economic inequalities. Those who inherit wealth have a significant advantage, enabling them to:

- Pay off debts, such as mortgages or student loans, more quickly

- Invest in assets, like property or stocks, to generate passive income

- Fund their children's education or support their retirement plans

Conversely, individuals who do not inherit wealth may struggle to achieve financial stability, perpetuating a cycle of economic disadvantage.

To address this issue, policymakers could consider implementing policies aimed at reducing the inheritance gap. Some potential solutions include:

- Wealth taxes, which could help redistribute wealth and reduce economic inequalities

- Inheritance reforms, such as modifying tax laws or introducing measures to encourage wealth distribution

- Education and financial literacy programs, empowering individuals to make informed decisions about their financial futures

By exploring these options, policymakers can work towards creating a more equitable society, where everyone has access to opportunities for financial growth and security.

For individuals seeking to bridge the inheritance gap, there are practical steps that can be taken. These include:

- Starting to save and invest early, to build a safety net and generate wealth over time

- Seeking professional financial advice, to create a personalized plan tailored to their needs and goals

- Developing multiple income streams, to reduce reliance on a single source of income

By taking proactive measures, individuals can work towards achieving financial stability, regardless of their inheritance expectations. Ultimately, a combination of policy reforms and individual initiative is necessary to address the inheritance gap and promote greater economic equality.

Regional Disparities

The issue of regional disparities is a pressing concern in Britain, with the North-South divide being a notable example. This divide is not only evident in economic indicators but also in inheritance patterns. According to a recent report, those in the South of England tend to inherit more than their counterparts in the North. This can have a significant impact on the social mobility and economic prospects of individuals, perpetuating a cycle of inequality.

The regional disparity in inheritance patterns contributes to unequal access to education, housing, and job opportunities. For instance, individuals who inherit more wealth are more likely to have access to better education, which in turn can lead to better job prospects. This can be seen in the following ways:

- Access to elite universities: Those who inherit more wealth are more likely to have the means to attend top-tier universities, which can provide better job opportunities.

- Housing market: Inheritance can provide the necessary funds for a deposit on a house, giving individuals a foothold in the housing market.

- Entrepreneurial opportunities: Inheritance can provide the necessary capital to start a business, allowing individuals to pursue entrepreneurial ventures.

To address these disparities, initiatives such as regional investment funds or community land trusts could be implemented. These initiatives can help to redistribute wealth and provide opportunities for individuals in disadvantaged regions. For example, regional investment funds can provide funding for local businesses and projects, while community land trusts can provide affordable housing options. Recent data suggests that such initiatives can be effective, with a study by the Centre for Local Economic Strategies finding that community land trusts can reduce housing costs by up to 30%.

Readers can take practical steps to address regional disparities in their own communities. For instance, they can:

- Support local businesses and initiatives that aim to reduce inequality.

- Advocate for policies that promote regional investment and community development.

- Consider donating to or volunteering with organizations that work to address regional disparities.

By taking these steps, individuals can contribute to a more equitable distribution of wealth and opportunities, helping to address the regional disparities that exist in Britain. Furthermore, policymakers can also play a crucial role by implementing policies that promote regional investment and community development, such as providing tax incentives for businesses that invest in disadvantaged regions or providing funding for community development projects.

Intergenerational Wealth Transfer

The transfer of wealth from one generation to the next is a complex phenomenon that has far-reaching implications for social mobility and economic inequality. According to a recent report by the Federal Reserve, the wealthiest 10% of families in the United States hold approximately 70% of the country's wealth, while the bottom 50% hold less than 1%. This significant wealth disparity is often perpetuated through intergenerational wealth transfer, where families pass down assets and resources to their heirs.

Research has consistently shown that families who inherit wealth are more likely to maintain or increase their social status. For instance, a study by the Economic Policy Institute found that children from wealthy families are more likely to attend elite universities, secure high-paying jobs, and accumulate wealth at a faster rate than their peers from lower-income backgrounds. This is because inherited wealth provides a significant advantage in terms of access to education, networking opportunities, and financial resources. Some of the key benefits of inherited wealth include:

- Increased access to quality education and job training

- Improved social connections and networking opportunities

- Greater financial security and reduced debt

- Increased opportunities for entrepreneurship and investment

To promote social mobility and reduce economic inequality, it's essential to encourage financial literacy and provide accessible savings options for low-income families. This can be achieved through initiatives such as:

- Financial education programs in schools and community centers

- Low-cost savings accounts and micro-investment platforms

- Tax incentives and subsidies for low-income families to save and invest

- Community-based programs to promote entrepreneurship and job training

For example, the city of Oakland, California, has implemented a program to provide every low-income child with a savings account and financial education from a young age. This initiative aims to help bridge the wealth gap and provide opportunities for social mobility.

Individuals can also take practical steps to promote social mobility and reduce economic inequality. For instance, they can:

- Support organizations that provide financial education and savings options for low-income families

- Advocate for policies that promote wealth redistribution and social mobility

- Volunteer their time and skills to help low-income families access financial resources and education

- Consider leaving a legacy of wealth and resources to support social mobility initiatives

By working together to promote financial literacy and accessible savings options, we can help reduce economic inequality and promote social mobility for all.

Policy Solutions and Reforms

Wealth inequality is a pressing issue that affects many countries worldwide. Implementing a more progressive inheritance tax is one potential solution to address this problem. According to a recent report by the Economic Policy Institute, the wealthiest 1% of households in the United States hold approximately 40% of the country's wealth, while the bottom 90% hold just 27%. A more progressive inheritance tax could help redistribute wealth and reduce inequality.

Some key features of a progressive inheritance tax include:

- Higher tax rates for larger inheritances

- Exemptions for smaller inheritances or those passed down to family members

- A lifetime exemption to avoid double taxation

For example, the United Kingdom has a progressive inheritance tax system, with tax rates ranging from 0% to 40% depending on the size of the inheritance. This approach has helped reduce wealth inequality and generate significant revenue for public services.

Increasing access to affordable housing, education, and job training programs is also crucial for supporting social mobility. Experts recommend investing in programs that provide financial assistance, mentorship, and skills training to disadvantaged groups. According to a report by the Organization for Economic Cooperation and Development (OECD), countries that invest more in education and job training tend to have higher levels of social mobility and lower levels of poverty. For instance, countries like Denmark and Norway have implemented comprehensive education and training programs, resulting in some of the highest levels of social mobility in the world.

A universal basic income or inheritance grant could also be explored as potential solutions to address wealth inequality. These programs would provide a guaranteed minimum income or a one-time grant to all citizens, regardless of their background or circumstances. While these ideas may seem radical, they have been successfully implemented in some countries. For example, Finland conducted a two-year universal basic income experiment, which showed promising results in reducing poverty and improving well-being. To implement such programs effectively, policymakers should:

- Conduct thorough research and analysis to determine the feasibility and potential impact

- Engage with stakeholders, including citizens, businesses, and community organizations

- Develop a comprehensive plan for implementation, including funding and delivery mechanisms

By exploring these policy solutions and reforms, governments can take a significant step towards reducing wealth inequality and promoting social mobility. As individuals, we can also play a role by advocating for policy changes and supporting organizations that work to address these issues. By working together, we can create a more equitable and just society for all.

Frequently Asked Questions (FAQ)

How does inheritance affect social mobility in Britain?

Inheritance plays a substantial role in shaping social mobility in Britain, with a significant impact on an individual's financial security and access to better opportunities. According to a recent report by the Institute for Fiscal Studies (IFS), inheritances can account for up to 30% of an individual's wealth, providing a substantial financial safety net. This, in turn, can have a profound effect on social mobility, enabling individuals to invest in their education, health, and career, and ultimately, improve their socio-economic status.

The impact of inheritance on social mobility can be seen in several key areas, including:

- Access to better education: Inheritance can provide the means to attend top universities, which often have higher tuition fees, but also offer better job prospects and higher earning potential.

- Job opportunities: Inheritance can also provide the financial security to take on unpaid internships or entry-level positions, which can be a stepping stone to more senior roles and higher paying jobs.

- Networking opportunities: Inheritance can also provide access to exclusive social networks, which can be beneficial for career advancement and business opportunities.

For instance, a study by the Sutton Trust found that 39% of MPs and 51% of journalists had attended independent schools, highlighting the significant advantage that those with access to better education and social networks have in achieving social mobility.

To maximize the potential of inheritance in achieving social mobility, individuals can take several practical steps, including:

- Investing in education and training: Using inheritance to invest in education and training can help individuals develop valuable skills and increase their earning potential.

- Building an emergency fund: Having a financial safety net in place can provide peace of mind and enable individuals to take calculated risks in their careers and personal lives.

- Seeking professional advice: Consulting with a financial advisor can help individuals make informed decisions about managing their inheritance and achieving their long-term goals.

By taking a proactive and informed approach to managing inheritance, individuals can harness its potential to improve their social mobility and achieve greater financial security and stability. According to recent data from the Office for National Statistics (ONS), the total value of inheritances in the UK is projected to reach £1.2 trillion by 2027, highlighting the significant impact that inheritance can have on social mobility in Britain.

What can be done to address regional disparities in inheritance?

Regional disparities in inheritance can have a profound impact on the economic and social well-being of individuals and communities. In the United States, for instance, the median wealth of white families is approximately $171,000, compared to $17,600 for Black families and $22,400 for Hispanic families, according to a 2022 report by the Federal Reserve. This significant gap in wealth can be attributed, in part, to historical and systemic inequalities in access to education, job opportunities, and financial resources.

To address these disparities, policymakers can implement targeted initiatives that promote economic growth and equality in disadvantaged areas. Some effective strategies include:

- Regional investment funds: These funds can provide critical financing for small businesses, entrepreneurs, and community development projects in underserved regions.

- Community land trusts: By acquiring and holding land for the benefit of the community, these trusts can help preserve affordable housing, support local economic development, and prevent gentrification.

- Education and job training programs: Initiatives that provide access to vocational training, mentorship, and education can help bridge the skills gap and equip individuals with the tools they need to succeed in the workforce.

Recent data highlights the importance of addressing regional disparities in inheritance. For example, a 2020 study by the Economic Policy Institute found that the wealthiest 10% of households in the United States hold approximately 70% of the country's wealth, while the bottom 50% hold less than 1%. To combat this trend, policymakers and community leaders can work together to develop and implement policies that promote greater economic equality and opportunity. Practical steps that individuals can take to address regional disparities in inheritance include:

- Supporting local businesses and entrepreneurs in disadvantaged areas

- Advocating for policies that promote affordable housing and community development

- Providing mentorship and education to individuals from underserved backgrounds

By taking a multifaceted approach to addressing regional disparities in inheritance, we can work towards creating a more equitable society where everyone has access to the resources and opportunities they need to thrive. This requires a commitment to understanding the complex issues at play and a willingness to develop and implement innovative solutions that promote economic growth, social justice, and community development. As we move forward, it is essential to prioritize evidence-based policymaking, community engagement, and collaboration to ensure that our efforts are effective and sustainable in the long term.

How can individuals from low-income backgrounds improve their financial situation?

Seeking financial advice is a crucial step for individuals from low-income backgrounds to improve their financial situation. According to a recent survey, 75% of low-income households that received financial counseling reported an improvement in their financial stability. Financial advisors can help individuals create a personalized budget, prioritize expenses, and develop a plan to achieve their financial goals. Additionally, many non-profit organizations offer free or low-cost financial counseling services, making it accessible to those who need it most.

Taking advantage of savings options is another key strategy for improving financial stability. Low-income individuals can benefit from programs such as the Earned Income Tax Credit (EITC), which provides a refundable tax credit to eligible workers. In 2020, the EITC lifted approximately 5.6 million people out of poverty, including 3.1 million children. Other savings options include:

- Micro-savings accounts, which allow individuals to save small amounts of money at a time

- Matched savings programs, which provide a match for every dollar saved

- Mobile banking apps, which offer low-cost and convenient banking services

These options can help low-income individuals build an emergency fund, pay off debt, and achieve long-term financial goals.

Accessing education and job training programs is also essential for improving financial stability. According to the Bureau of Labor Statistics, workers with a bachelor's degree typically earn about 60% more than those with only a high school diploma. Low-income individuals can take advantage of programs such as:

- Vocational training programs, which provide training in specific skills or trades

- Online courses and certification programs, which offer flexible and affordable education options

- Apprenticeship programs, which provide on-the-job training and mentorship

These programs can help individuals acquire new skills, increase their earning potential, and access better-paying job opportunities. By investing in education and job training, low-income individuals can break the cycle of poverty and achieve financial stability.

To get started, individuals can take practical steps such as creating a budget, prioritizing needs over wants, and seeking out local resources and services. For example, the Financial Counseling Association of America (FCAA) offers a directory of non-profit credit counseling agencies that provide free or low-cost financial counseling. Additionally, the US Department of Labor's CareerOneStop website offers a range of resources and tools to help individuals find job training programs, apprenticeships, and other education and career opportunities. By taking advantage of these resources and following these tips, low-income individuals can improve their financial situation and achieve a more stable and secure future.