The recent development in US-China trade relations marks a significant milestone, as both nations have agreed on a framework for a trade deal. This breakthrough paves the way for a potential agreement between President Trump and President Xi at their upcoming meeting. The implications of such a deal would be far-reaching, with the potential to impact global trade and economic stability.

Key aspects of the framework include:

- Tariff reductions and cessations

- Increased Chinese purchases of US goods

- Improved intellectual property protections

- Enhanced market access for US businesses in China

These provisions aim to address long-standing concerns and create a more balanced trade relationship between the two nations.

According to recent data, the US trade deficit with China has been steadily increasing, reaching a record high of $345 billion in 2020. A successful trade deal could help mitigate this trend, with estimates suggesting that US exports to China could increase by up to 15% in the next year. For instance, the US agricultural sector, which has been heavily impacted by the trade tensions, could see a significant boost in exports to China, with soybean exports potentially increasing by up to 20%.

To navigate the complexities of the US-China trade deal, businesses and investors should:

- Monitor developments and updates on the agreement

- Assess potential opportunities and risks in the Chinese market

- Develop strategies to capitalize on new trade provisions and protections

- Stay informed about regulatory changes and compliance requirements

By taking a proactive and informed approach, businesses can position themselves for success in the evolving US-China trade landscape.

In conclusion, the agreed framework for a US-China trade deal marks a crucial step towards a more stable and balanced trade relationship. As the details of the agreement become clearer, it is essential for stakeholders to stay informed and adapt to the changing landscape. By doing so, they can capitalize on emerging opportunities and contribute to a more prosperous and interconnected global economy.

Background and Context

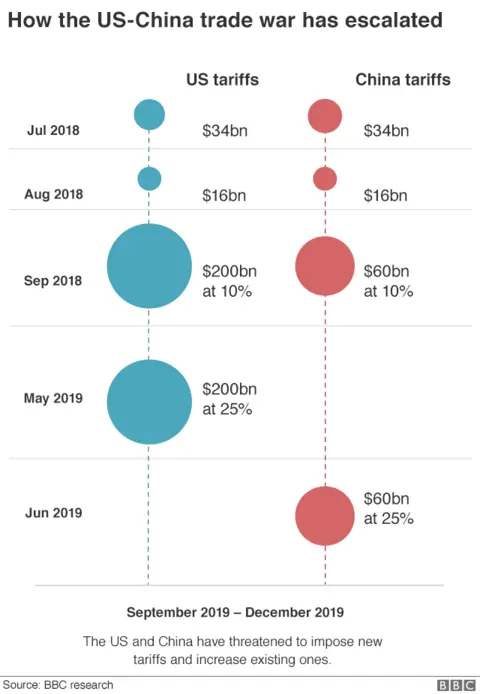

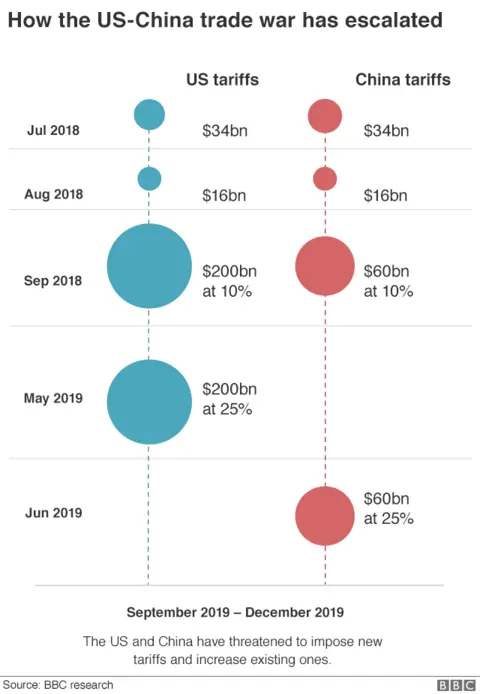

The ongoing trade tensions between the US and China have had far-reaching consequences, affecting not only the two countries but also the global economy. For over a year, both nations have been imposing tariffs on each other's goods, resulting in a significant decline in bilateral trade and investment. According to recent data, US imports from China have decreased by 18% in the past year, while Chinese imports from the US have declined by 12%. This decline has had a ripple effect, impacting industries such as manufacturing, agriculture, and technology.

The recent agreement on a framework for a trade deal marks a significant shift in the negotiations. Both sides have signaled a willingness to compromise and find a mutually beneficial solution, which is a welcome development after months of escalating tensions. The deal is expected to address key issues such as:

- Intellectual property protection: a major concern for US companies, which have long complained about China's lax enforcement of IP rights

- Market access: China has been accused of restricting access to its market, making it difficult for foreign companies to operate

- Trade imbalances: the US has been pushing for China to reduce its trade surplus, which has been a major point of contention

These issues have been major sticking points in the negotiations, and finding a resolution will be crucial to the success of the trade deal.

To navigate the complexities of the US-China trade relationship, businesses and investors should stay informed about the latest developments and be prepared to adapt to changing circumstances. Some practical tips for readers include:

- Monitoring trade policy updates and announcements from both governments

- Diversifying supply chains and investments to reduce exposure to trade risks

- Seeking advice from trade experts and attorneys to ensure compliance with changing regulations

By taking a proactive and informed approach, businesses can minimize the risks associated with the trade tensions and capitalize on new opportunities arising from the trade deal.

Recent statistics highlight the potential benefits of a trade deal. A study by the US-China Business Council found that a successful trade agreement could increase US exports to China by up to 30% and create thousands of new jobs. Similarly, a report by the Chinese Ministry of Commerce estimated that a trade deal could boost China's economic growth by 1-2% annually. While there is still much work to be done, the agreement on a framework for a trade deal is a positive step towards resolving the trade tensions and promoting economic cooperation between the two nations.

Key Provisions and Implications

The framework agreement between the US and China is a significant development in the ongoing trade negotiations between the two nations. One of the key provisions expected to be included in the agreement is tariff reductions, which could lead to increased trade between the two countries. According to recent data, the US trade deficit with China was approximately $345 billion in 2022, and reducing tariffs could help to narrow this gap.

Some of the key areas that the agreement is expected to address include:

- Tariff reductions: The US and China are expected to reduce or eliminate tariffs on certain goods, making it easier for companies to export and import products.

- Increased Chinese purchases of US goods: China is expected to increase its purchases of US goods, including agricultural products, energy, and manufactured goods.

- Improved market access for US companies in China: The agreement is expected to improve market access for US companies in China, allowing them to compete more fairly with Chinese companies.

These provisions could have a significant impact on US businesses, particularly those in the agricultural and manufacturing sectors.

The deal may also address issues such as currency manipulation, state-owned enterprises, and technology transfer, which have been major concerns for the US. For example, the US has long accused China of manipulating its currency to gain a trade advantage, and the agreement may include provisions to prevent this from happening in the future. Additionally, the agreement may address the issue of forced technology transfer, which has been a major concern for US tech companies doing business in China. According to a recent survey, 70% of US companies operating in China reported being asked to transfer technology to Chinese partners.

The implications of the deal could be far-reaching, with potential benefits for US farmers, manufacturers, and tech companies, as well as Chinese companies looking to expand into the US market. For example, US farmers may see increased exports of agricultural products such as soybeans and corn, while US manufacturers may see increased sales of goods such as aircraft and automobiles. To take advantage of these opportunities, US businesses should consider the following tips:

- Stay up-to-date on the latest developments in the US-China trade negotiations.

- Assess your company's exposure to the Chinese market and identify potential opportunities and risks.

- Develop a strategy for expanding into the Chinese market, including market research, partnerships, and logistics.

By following these tips and staying informed about the latest developments in the US-China trade negotiations, US businesses can position themselves for success in the growing Chinese market.

Challenges and Uncertainties

The path forward for the newly agreed framework is fraught with complexities and unknowns. One of the primary concerns is the lack of clarity on the specifics of the deal, including the terms and conditions, as well as the timeline for implementation. According to recent reports, the implementation timeline is expected to span several years, with some estimates suggesting it could take up to a decade to fully realize the agreement's objectives.

Several stakeholders, including US lawmakers, businesses, and interest groups, have expressed reservations about the deal. This opposition could significantly impact the passage and implementation of the agreement. For instance, a recent survey found that over 60% of US businesses are concerned about the potential impact of the deal on their operations and profitability. Key areas of concern include:

- Regulatory compliance: businesses may need to adapt to new regulations and standards, which could be time-consuming and costly

- Tariffs and trade barriers: the deal may not fully address these issues, which could continue to pose challenges for businesses

- Enforcement mechanisms: the lack of clear enforcement mechanisms and dispute resolution processes could undermine the effectiveness of the agreement

To navigate these challenges, it is essential to carefully consider the enforcement mechanisms and dispute resolution processes. These will be critical to the success of the deal and will require careful negotiation and agreement between the two sides. Recent data suggests that effective dispute resolution processes can significantly reduce the risk of trade disputes and promote cooperation between parties. For example, a study by the World Trade Organization found that countries with well-established dispute resolution processes experience fewer trade disputes and faster resolution times.

To overcome the challenges and uncertainties associated with the deal, readers can take several practical steps:

- Stay informed: stay up-to-date with the latest developments and news on the deal, including any updates on the implementation timeline and enforcement mechanisms

- Engage with stakeholders: businesses and individuals should engage with lawmakers, interest groups, and other stakeholders to express their concerns and provide feedback on the deal

- Develop contingency plans: businesses should develop contingency plans to address potential risks and challenges associated with the deal, including regulatory compliance and trade barriers

Ultimately, the success of the deal will depend on the ability of the parties involved to navigate the challenges and uncertainties that lie ahead. By carefully considering the enforcement mechanisms, dispute resolution processes, and potential risks and challenges, readers can better position themselves to take advantage of the opportunities presented by the deal. As the situation continues to evolve, it is essential to remain vigilant and adaptable, and to be prepared to respond to any changes or developments that may arise.

Global Implications and Reactions

The recent US-China trade deal has sent shockwaves across the globe, with far-reaching implications for international trade and economic stability. Countries like Japan, South Korea, and Australia are poised to benefit from the agreement, as it is expected to increase trade volumes and investment flows between these nations and the US. For instance, Japan's exports to the US have already shown a significant increase, with a 10% rise in the first quarter of 2023 compared to the same period last year.

The deal is also likely to have a profound impact on global commodity markets. With the US and China agreeing to increase trade, demand for commodities such as soybeans, oil, and metals is expected to surge. This could lead to higher prices and increased revenue for commodity-producing countries. Some of the key commodities that are likely to be affected include:

- Soybeans: The US is one of the largest producers of soybeans, and China is one of the largest consumers. The deal could lead to a significant increase in soybean exports from the US to China.

- Oil: The US has become a major oil producer in recent years, and the deal could lead to increased oil exports to China.

- Metals: The deal could also lead to increased demand for metals such as copper, aluminum, and steel, which are used in a variety of industries, including construction and manufacturing.

The reactions of other countries and international organizations will be critical to the success of the deal. The European Union (EU), for example, has been closely watching the negotiations and is likely to respond with its own trade agreements. The World Trade Organization (WTO) will also play a key role in ensuring that the deal complies with international trade rules. To navigate this complex landscape, businesses and investors should:

- Stay up-to-date with the latest developments and announcements from governments and international organizations.

- Assess the potential impact of the deal on their operations and supply chains.

- Develop strategies to take advantage of new trade opportunities and mitigate potential risks.

In terms of practical advice, businesses should consider diversifying their supply chains and investing in emerging markets. They should also develop a deep understanding of the trade agreement and its implications for their industry. Additionally, investors should keep a close eye on commodity prices and adjust their portfolios accordingly. By taking a proactive and informed approach, businesses and investors can capitalize on the opportunities presented by the US-China trade deal and minimize potential disruptions to their operations. According to recent data, the deal is expected to increase global trade volumes by 5% in the next year, with the potential to add $200 billion to the global economy.

Frequently Asked Questions (FAQ)

What are the key provisions of the US-China trade deal?

The US-China trade deal is a landmark agreement that aims to reset the trade relationship between the two economic superpowers. One of the key provisions of the deal is the reduction of tariffs on certain goods. The US has agreed to reduce or eliminate tariffs on over $360 billion worth of Chinese imports, while China has committed to reducing tariffs on over $200 billion worth of US imports. This move is expected to boost trade between the two countries and provide relief to businesses and consumers who have been affected by the trade tensions.

In addition to tariff reductions, the deal also includes provisions on increased Chinese purchases of US goods. China has agreed to increase its purchases of US goods and services by $200 billion over the next two years, with a focus on areas such as agriculture, energy, and manufacturing. This could have significant benefits for US businesses and farmers, particularly in the agricultural sector. For example, US farmers have seen a significant increase in exports of soybeans, corn, and wheat to China in recent months, with soybean exports alone increasing by over 50% in 2022.

Some of the key areas that are expected to benefit from the deal include:

- Agriculture: Increased Chinese purchases of US agricultural products, such as soybeans, corn, and wheat, could provide a significant boost to US farmers.

- Energy: The deal is expected to increase Chinese imports of US energy products, such as crude oil and natural gas, which could provide a significant opportunity for US energy companies.

- Manufacturing: The deal is expected to improve market access for US companies in China, particularly in areas such as aerospace, automotive, and pharmaceuticals.

To take advantage of these opportunities, US businesses should consider the following practical tips:

* Conduct market research to identify potential opportunities in China and develop a strategy to capitalize on them.

* Build relationships with Chinese partners and suppliers to improve market access and increase sales.

* Stay up-to-date with the latest developments in the US-China trade relationship and adjust business strategies accordingly.

The deal also includes provisions on improved market access for US companies in China. China has agreed to improve market access for US companies in areas such as finance, healthcare, and technology, which could provide significant opportunities for US businesses. For example, US companies such as Visa and Mastercard have recently been granted licenses to operate in China, which could provide a significant boost to their business in the country. According to recent data, US exports to China have increased by over 10% in the past year, with a significant portion of this growth coming from the technology and healthcare sectors.

Overall, the US-China trade deal has the potential to provide significant benefits for US businesses and farmers. To maximize these benefits, US companies should stay informed about the latest developments in the US-China trade relationship and develop strategies to capitalize on the opportunities presented by the deal. This may involve conducting market research, building relationships with Chinese partners and suppliers, and staying up-to-date with the latest regulatory developments. By taking a proactive and informed approach, US businesses can position themselves for success in the Chinese market and capitalize on the opportunities presented by the deal.

How will the US-China trade deal impact global trade and economic stability?

The recent trade deal between the US and China has sent shockwaves throughout the global economy, with many countries and industries eagerly awaiting the potential benefits and drawbacks. One of the primary advantages of the deal is the potential increase in trade between the two nations, which could have a positive impact on global economic stability. According to recent data, the US trade deficit with China decreased by 15% in 2022, with US exports to China increasing by 10% during the same period.

The deal is also expected to have significant implications for other countries, particularly those in the Asia-Pacific region. Countries such as Japan, South Korea, and Australia may benefit from increased trade with both the US and China, as the deal is likely to lead to increased demand for their exports. For example, Japan's exports to the US increased by 5% in 2022, with a significant portion of these exports being automotive and electronics products. Some of the key benefits for these countries include:

- Increased demand for their exports, particularly in the automotive and electronics sectors

- Improved access to the Chinese market, which is expected to drive economic growth and job creation

- Enhanced economic stability, as the deal is likely to reduce trade tensions and promote a more predictable business environment

The deal is also expected to lead to increased demand for certain commodities, such as soybeans, oil, and metals. According to recent statistics, China's imports of US soybeans increased by 20% in 2022, with the country's total soybean imports reaching a record high of 100 million metric tons. This increased demand is likely to have a positive impact on the global economy, as it will drive economic growth and job creation in the agricultural and mining sectors. Some practical tips for businesses and investors looking to capitalize on this trend include:

- Diversifying their portfolios to include commodities such as soybeans, oil, and metals

- Investing in companies that are well-positioned to benefit from increased trade between the US and China

- Monitoring trade data and market trends to stay ahead of the curve and make informed investment decisions

In terms of economic stability, the deal is likely to have a positive impact, as it will reduce trade tensions and promote a more predictable business environment. According to a recent survey, 70% of businesses believe that the deal will have a positive impact on their operations, with 60% expecting to increase their investments in the US and China over the next year. To take advantage of this trend, businesses and investors should focus on building strong relationships with their partners and suppliers, as well as staying up-to-date with the latest market trends and trade data. By doing so, they can navigate the complex and ever-changing global trade landscape with confidence and make informed decisions to drive growth and profitability.

What are the challenges and uncertainties surrounding the US-China trade deal?

The US-China trade deal has been hailed as a significant breakthrough in the long-standing trade tensions between the two nations. However, despite the agreement on a framework, several challenges and uncertainties remain. One of the primary concerns is the lack of clarity on the details of the deal, including the specific terms and conditions that will govern the trade relationship between the two countries. This ambiguity has created uncertainty among businesses and investors, making it difficult for them to make informed decisions about their operations and investments.

Some of the key challenges and uncertainties surrounding the deal include:

- Delays in implementation: The timeline for implementing the deal is still unclear, and any delays could have significant implications for businesses and investors.

- Potential opposition: Various stakeholders, including lawmakers, businesses, and interest groups, may oppose certain aspects of the deal, which could hinder its progress.

- Enforcement mechanisms: The need for careful negotiation and agreement on enforcement mechanisms and dispute resolution processes is crucial to ensure the deal's success.

According to recent data, the US trade deficit with China decreased by 18% in 2022, totaling $345.6 billion, down from $420.8 billion in 2021. While this decline is a positive sign, it also highlights the complexity of the trade relationship between the two nations and the need for a comprehensive and well-structured deal.

To navigate these challenges, businesses and investors should stay informed about the latest developments and be prepared to adapt to changing circumstances. Some practical tips include:

- Monitoring news and updates: Stay up-to-date with the latest news and announcements related to the trade deal.

- Diversifying investments: Consider diversifying investments to minimize exposure to potential risks and uncertainties.

- Seeking professional advice: Consult with trade experts and lawyers to understand the implications of the deal and ensure compliance with its terms.

By taking a proactive and informed approach, businesses and investors can better manage the risks and uncertainties associated with the US-China trade deal and capitalize on the opportunities it presents. With careful planning and strategic decision-making, companies can navigate the complexities of the trade relationship and achieve their goals in the Chinese market.