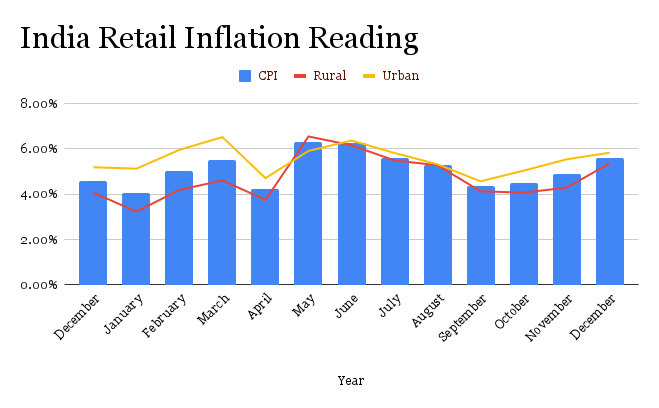

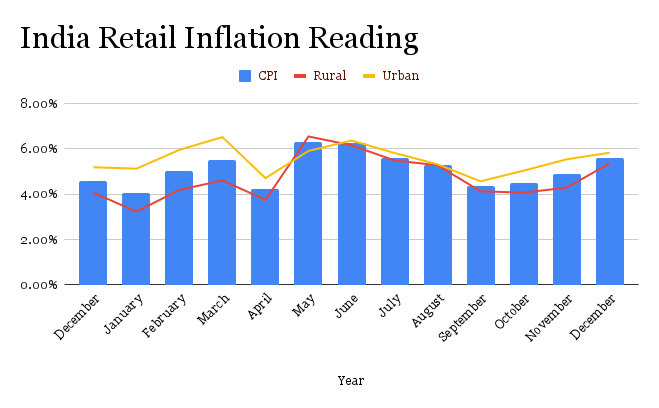

The recent retail inflation rate of 2.1% in August has been a significant topic of discussion among economists and financial experts. This rate is a measure of the change in prices of goods and services consumed by households. The inflation rate is an important indicator of the overall health of the economy, as it can have far-reaching implications on various aspects of economic activity.

One of the key implications of the 2.1% retail inflation rate is its impact on consumer spending. When inflation is low, consumers are more likely to spend money, which can boost economic growth. On the other hand, high inflation can lead to decreased consumer spending, as people may choose to save their money or postpone purchases. The current inflation rate suggests that consumer spending is likely to remain stable, which can have a positive impact on the economy.

The implications of the retail inflation rate on the economy can be summarized as follows:

- Impact on consumer spending and economic growth

- Effect on interest rates and monetary policy

- Influence on business investment and production decisions

- Consequences for employment and income levels

These factors are interconnected and can have a ripple effect on the overall economy. For instance, low inflation can lead to lower interest rates, which can stimulate business investment and create jobs.

The 2.1% retail inflation rate in August is also significant because it is within the target range set by many central banks. This suggests that the economy is stable and that inflation is under control. However, it is essential to monitor inflation closely, as it can fluctuate rapidly in response to changes in global events, economic conditions, and government policies. By understanding the implications of the retail inflation rate, policymakers and businesses can make informed decisions to promote economic growth and stability.

What is Retail Inflation?

Retail inflation refers to the rate of increase in prices of goods and services consumed by households. It is a key indicator of the overall health of an economy, as it affects the purchasing power of consumers and the profitability of businesses.

Inflation is important in the economy because it can have both positive and negative effects. On the one hand, a moderate level of inflation can stimulate economic growth by encouraging spending and investment. On the other hand, high inflation can erode the purchasing power of consumers and reduce the value of savings.

The measurement and calculation of retail inflation are crucial to understanding its impact on the economy. It is typically measured using a price index, which tracks changes in the prices of a basket of goods and services. The most common price index used to measure retail inflation is the Consumer Price Index (CPI).

The CPI is calculated based on the following components:

- Food and beverages

- Housing and utilities

- Apparel and footwear

- Transportation

- Healthcare

- Recreation and culture

- Education

- Miscellaneous goods and services

These components are weighted according to their importance in the average household budget, and the prices of the items in each component are collected from a sample of retailers and service providers.

The calculation of retail inflation involves comparing the current period's CPI with the previous period's CPI. The result is expressed as a percentage change, which represents the rate of inflation. For example, if the current period's CPI is 105 and the previous period's CPI is 100, the rate of inflation would be 5%. This means that prices have increased by 5% over the past period.

Causes of the Inflation Rate Increase

The increase in inflation rate is a complex phenomenon that can be attributed to various factors. One of the primary causes is the rise in food prices, which has a significant impact on the overall inflation rate. This is because food items constitute a substantial portion of the average household's expenses. As a result, even a slight increase in food prices can lead to a considerable rise in the inflation rate.

Another factor that contributes to the increase in inflation rate is the rise in fuel costs. Fuel prices have a ripple effect on the economy, as they influence the costs of production, transportation, and distribution of goods. As fuel prices increase, companies may pass on the additional costs to consumers, leading to higher prices for goods and services. This, in turn, contributes to the rise in inflation rate.

Some of the key factors that contribute to the increase in inflation rate include:

- Monetary policy: An increase in money supply can lead to higher demand for goods and services, resulting in inflation.

- Economic growth: A rapidly growing economy can lead to higher demand for goods and services, resulting in inflation.

- Supply and demand imbalance: A shortage of essential goods and services can lead to higher prices and inflation.

- Global events: Global events such as wars, natural disasters, and trade wars can disrupt supply chains and lead to higher prices and inflation.

Global events have a significant impact on domestic inflation rates. For instance, a trade war between two major economies can lead to higher tariffs, resulting in increased costs for imported goods. This, in turn, can lead to higher prices for consumers and a rise in inflation rate. Similarly, a global shortage of essential commodities can lead to higher prices and inflation.

The impact of global events on domestic inflation rates can be significant, and it is essential for policymakers to consider these factors when making decisions about monetary policy and economic growth. By understanding the causes of inflation rate increase, policymakers can take steps to mitigate its effects and maintain a stable economy. This can include implementing policies to control food prices, reducing fuel costs, and promoting economic growth while maintaining low inflation.

Impact on Consumers and Businesses

The increased inflation rate has a significant impact on consumer spending and purchasing power. As prices rise, the value of money decreases, leading to a decline in the purchasing power of consumers. This means that consumers can buy fewer goods and services with the same amount of money, affecting their overall standard of living.

Inflation affects consumer spending in various ways. Consumers may reduce their spending on non-essential items, such as dining out or entertainment, and focus on essential items like food and housing. This change in spending habits can have a ripple effect on the economy, influencing the demand for certain products and services.

Consumers may also adjust their budgets to account for higher prices, leading to a decrease in savings rates and an increase in debt.

The consequences of inflation for businesses are multifaceted. Some of the key effects include:

- Changes in pricing strategies: Businesses may need to adjust their prices to keep up with inflation, which can be a challenging task, especially for small businesses or those with thin profit margins.

- Impact on profit margins: Inflation can erode profit margins if businesses are unable to pass on the increased costs to consumers, leading to reduced profitability and potentially even losses.

- Shifts in demand: As consumers adjust their spending habits, businesses may need to adapt to changes in demand, which can be difficult to predict and respond to.

Businesses may respond to inflation by implementing various pricing strategies, such as price increases, discounts, or promotions. However, these strategies can be complex and may not always be effective. For example, if businesses raise their prices too high, they may lose customers to competitors who are able to maintain lower prices.

In addition to pricing strategies, businesses may also need to consider the impact of inflation on their supply chains and production costs. As the cost of raw materials and labor increases, businesses may need to find ways to reduce their costs or pass them on to consumers. This can be a challenging task, especially for businesses with complex global supply chains.

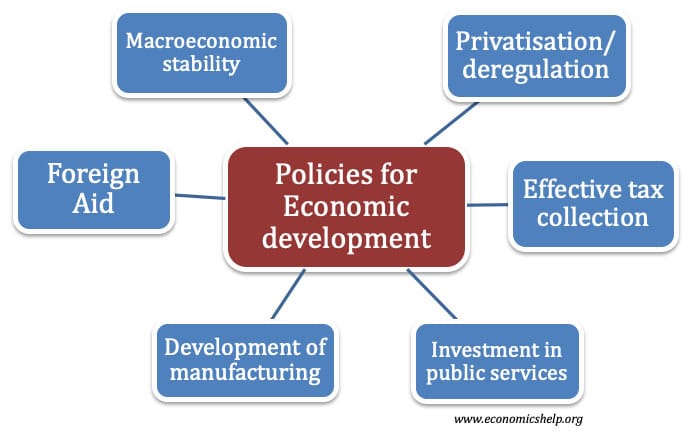

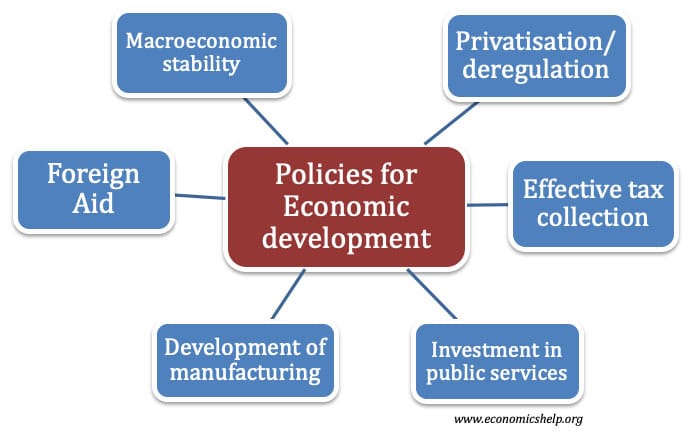

Government Response and Future Outlook

The government plays a crucial role in managing inflation, and its response to rising inflation rates can have significant effects on the economy. One potential response is to adjust monetary policy, which involves using tools such as interest rates and money supply to control inflation. The government may increase interest rates to reduce borrowing and spending, thereby decreasing demand for goods and services and bringing inflation under control.

Monetary policy adjustments can be implemented through various measures, including:

- Increasing interest rates to reduce borrowing and spending

- Reducing money supply to decrease demand for goods and services

- Implementing quantitative easing to inject liquidity into the economy

These measures can help to stabilize prices and prevent inflation from getting out of control.

In terms of future outlook, retail inflation is expected to continue to rise in the short term, driven by factors such as supply chain disruptions and increased demand for goods and services. However, the government's response to inflation, including monetary policy adjustments, can help to mitigate its effects and bring prices under control. The future outlook for retail inflation will depend on various factors, including:

- Global economic trends and trade policies

- Domestic demand and supply conditions

- Government policies and interventions

These factors will shape the trajectory of retail inflation and its impact on the economy.

The potential effects of retail inflation on the economy are far-reaching and can have significant consequences for businesses and individuals. High inflation can erode purchasing power, reduce savings, and decrease investment, ultimately affecting economic growth and stability. On the other hand, low inflation can stimulate economic growth by increasing demand for goods and services and encouraging investment. The government's response to inflation will be critical in determining the future outlook for the economy and the impact of retail inflation on businesses and individuals.

Speculating on the future outlook, it is likely that the government will continue to monitor inflation closely and adjust monetary policy as needed to keep prices under control. The future of retail inflation will depend on the government's ability to balance the need to control inflation with the need to support economic growth and stability. As the economy continues to evolve, it is essential to keep a close eye on inflation and its potential effects on the economy, and to be prepared for any changes that may arise.

Frequently Asked Questions (FAQ)

What does the increase in retail inflation mean for my savings?

The increase in retail inflation can have a significant impact on personal finances, particularly when it comes to savings. As prices rise, the value of money decreases, which means that the purchasing power of savings may also decrease over time. This can be a concern for individuals who have been saving for long-term goals, such as retirement or a big purchase.

One of the main effects of inflation on savings is the erosion of purchasing power. As inflation rises, the same amount of money can buy fewer goods and services than it could before. This means that even if savings remain constant, their value in terms of what they can buy decreases. For example, if someone has $1,000 in savings and inflation rises by 2%, the purchasing power of that $1,000 may decrease by $20, leaving them with the equivalent of $980 in purchasing power.

There are several ways that inflation can affect savings, including:

- Reduced purchasing power: As mentioned earlier, inflation can reduce the purchasing power of savings over time.

- Lower interest rates: In some cases, high inflation can lead to lower interest rates on savings accounts, which means that savings may not grow as quickly as they would in a low-inflation environment.

- Increased costs: Inflation can also lead to increased costs for goods and services, which can eat into savings and make it harder to achieve long-term goals.

To mitigate the effects of inflation on savings, individuals can consider a few strategies. These include investing in assets that historically perform well in inflationary environments, such as stocks or real estate, and seeking out savings accounts or other investments that offer higher interest rates to keep pace with inflation. By taking a proactive approach to managing savings, individuals can help to protect their purchasing power and achieve their long-term financial goals.

How will the increased inflation rate affect interest rates?

The recent surge in inflation rates has sparked concerns among economists and consumers alike. As the cost of living continues to rise, the central bank is under pressure to take measures to curb inflation. One of the primary tools at the central bank's disposal is adjusting interest rates.

The increase in retail inflation may lead to higher interest rates as the central bank attempts to control inflation. This is because higher interest rates can help reduce borrowing and spending, thereby slowing down the economy and bringing inflation under control. When interest rates rise, it becomes more expensive for people and businesses to borrow money, which can lead to a decrease in consumption and investment.

Some of the key ways in which higher interest rates can impact the economy include:

- Reduced borrowing and spending: Higher interest rates make borrowing more expensive, which can lead to a decrease in consumption and investment.

- Increased savings: Higher interest rates can encourage people to save more, as they can earn higher returns on their deposits.

- Reduced demand for goods and services: As borrowing and spending decrease, the demand for goods and services also decreases, which can help bring inflation under control.

The central bank's decision to raise interest rates will depend on various factors, including the rate of inflation, economic growth, and employment rates. If the central bank decides to raise interest rates, it can have a significant impact on the economy, including the housing market, stock market, and overall economic growth. As such, the central bank must carefully weigh the potential benefits and drawbacks of raising interest rates before making a decision.

In conclusion, the increase in inflation rates is likely to lead to higher interest rates, as the central bank attempts to control inflation and maintain economic stability. The impact of higher interest rates will be far-reaching, affecting various aspects of the economy, including borrowing, spending, and savings. As the economy continues to evolve, it is essential to monitor the situation closely and adjust policies accordingly to ensure sustainable economic growth.

What can consumers do to protect themselves from the effects of inflation?

To mitigate the effects of inflation, consumers can take proactive steps to safeguard their financial well-being. One approach is to reassess and adjust their spending habits. This involves prioritizing essential expenses, such as housing, food, and healthcare, while reducing discretionary spending on non-essential items.

Consumers can also consider investing in assets that historically perform well during periods of inflation. These investments can help their wealth keep pace with rising prices. Some examples of such assets include:

- Commodities, such as gold or oil, which often increase in value during inflationary periods

- Real estate, which can appreciate in value over time and provide a hedge against inflation

- Dividend-paying stocks, which can provide a steady income stream and help offset the effects of inflation

In addition to adjusting their spending habits and investing in inflation-resistant assets, consumers can explore ways to increase their income. This can involve:

- Pursuing additional education or training to enhance their career prospects and earning potential

- Starting a side business or freelance work to supplement their primary income

- Negotiating a pay raise with their employer, if possible, to keep pace with inflation

By taking these steps, consumers can reduce their exposure to the negative effects of inflation and maintain their purchasing power over time. It is essential for consumers to be proactive and adaptable in their financial planning, as inflation can have a significant impact on their long-term financial well-being.