The current geopolitical landscape is complex, with multiple countries playing significant roles in shaping global events. India, the US, Iran, and Russia are four nations that have been at the forefront of recent developments, particularly in the realm of energy trade. The relationships between these countries are multifaceted, with cooperation and competition existing simultaneously.

At the heart of this intricate web is the global oil trade, which is crucial for the economic well-being of nations around the world. The import and export of oil have significant implications for a country's economy, influencing factors such as inflation, employment, and industrial production. The geopolitical dynamics involving India, the US, Iran, and Russia have a direct impact on the global oil market, leading to fluctuations in prices and affecting the stability of the market.

Some key factors influencing the global oil trade include:

- Sanctions imposed by the US on Iran, which have limited Iran's ability to export oil, thereby reducing global supply and driving up prices.

- Russia's role as a major oil producer and its efforts to expand its influence in the global energy market.

- India's position as a significant oil importer, making it vulnerable to price fluctuations in the global market.

- The US's status as a major oil producer, with its policies and actions having a substantial impact on the global oil trade.

The interplay between these nations has far-reaching consequences, affecting not just the oil trade but also the broader geopolitical landscape. Understanding the complex relationships and interests at play is essential for navigating the challenges and opportunities that arise from this dynamic scenario. As the global oil market continues to evolve, it is crucial to monitor the actions and policies of India, the US, Iran, and Russia, as they will undoubtedly shape the future of the energy trade and have significant implications for the global economy.

Introduction to India's Oil Imports

India is one of the largest oil importers in the world, accounting for a significant portion of the global oil trade. The country's vast and growing economy, combined with its limited domestic oil production, has led to a substantial reliance on foreign oil. This dependency has far-reaching implications for the country's economy, trade balance, and energy security.

The country's oil imports are driven by its rapid industrialization, urbanization, and growing transportation sector. As the economy continues to expand, the demand for oil is expected to rise, further increasing the country's dependence on foreign oil. This trend is likely to continue in the foreseeable future, making India one of the largest oil-importing nations in the world.

The impact of India's oil imports on its economy is multifaceted. Some of the key effects include:

- Trade deficit: The large oil import bill contributes significantly to the country's trade deficit, putting pressure on the rupee and affecting the overall balance of payments.

- Foreign exchange reserves: The oil imports also affect the country's foreign exchange reserves, as a significant portion of the reserves is spent on importing oil.

- Inflation: The volatility in global oil prices can lead to inflationary pressures in the economy, affecting the overall cost of living and economic growth.

- Energy security: The dependence on foreign oil also raises concerns about energy security, as any disruption in oil supplies can have a significant impact on the economy.

The Indian government has been taking steps to reduce the country's dependence on foreign oil, such as investing in renewable energy sources, improving energy efficiency, and promoting the use of alternative fuels. However, these efforts are still in the early stages, and the country's oil imports are likely to remain a significant factor in its economy for the foreseeable future. As the global energy landscape continues to evolve, India's oil imports will play a crucial role in shaping the country's economic and energy policies.

US Sanctions on Iran Oil

The imposition of sanctions on Iran's oil exports by the US in 2018 marked a significant escalation in the tensions between the two nations. These sanctions were aimed at curbing Iran's nuclear program and its alleged support for terrorism. The US government reintroduced the sanctions after withdrawing from the Joint Comprehensive Plan of Action (JCPOA), also known as the Iran nuclear deal.

The sanctions have had a profound impact on Iran's economy, which is heavily reliant on oil exports. The country's oil exports have declined significantly, resulting in a substantial loss of revenue. This has led to a sharp decline in the value of the Iranian rial, making imports more expensive and contributing to higher inflation. The sanctions have also made it difficult for Iran to access the international financial system, further exacerbating the country's economic woes.

Some of the key effects of the sanctions on Iran's economy include:

- Decline in oil exports, resulting in significant revenue losses

- Sharp decline in the value of the Iranian rial

- Higher inflation due to increased import costs

- Difficulty in accessing the international financial system

- Reduced economic growth and increased unemployment

The sanctions have also had an impact on global oil prices. The reduction in Iran's oil exports has led to a decrease in the global oil supply, resulting in higher prices. This has been particularly beneficial for other oil-producing countries, which have been able to increase their market share and revenues. However, the higher oil prices have also had a negative impact on oil-importing countries, which have had to pay more for their oil imports.

The effects of the sanctions on global oil prices have been significant, with prices increasing by over 10% in the aftermath of the sanctions. The Organization of the Petroleum Exporting Countries (OPEC) has also played a role in mitigating the impact of the sanctions on global oil prices. OPEC has increased oil production to offset the decline in Iran's oil exports, helping to stabilize the global oil market. Overall, the sanctions on Iran's oil exports have had far-reaching consequences for both Iran's economy and the global oil market.

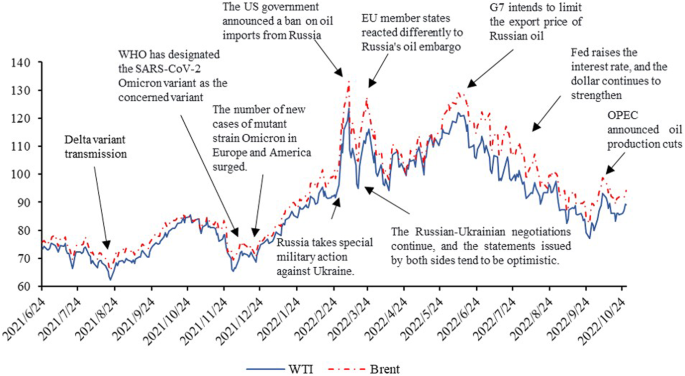

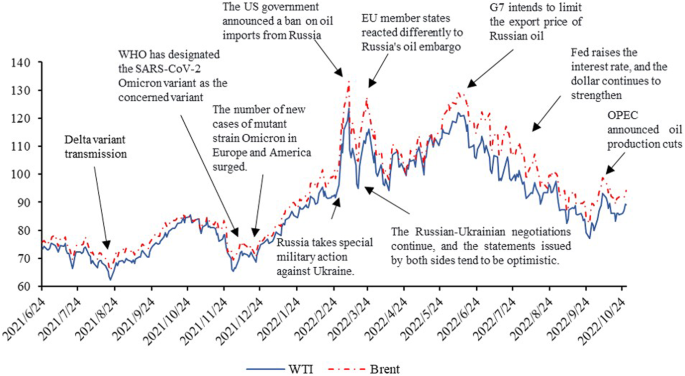

Impact of Russia-Ukraine Conflict

The ongoing conflict between Russia and Ukraine has sent shockwaves across the globe, impacting various aspects of the international economy. One of the significant effects of this conflict is the disruption of global oil supplies. Russia is one of the world's largest oil producers, and the conflict has led to a significant reduction in oil production and exports.

As a result of the disrupted oil supplies, the global oil market has witnessed a significant surge in oil prices. This increase in oil prices has far-reaching implications for countries that rely heavily on oil imports. India, being one of the largest oil-importing countries, is particularly concerned about the rising oil prices. The country's economy is heavily dependent on oil imports, and the increasing prices are likely to have a significant impact on its trade deficit and inflation.

Some of the key concerns for India due to the rising oil prices include:

- Increased cost of imports, which could lead to a higher trade deficit

- Rising inflation, which could impact the country's economic growth

- Higher transportation costs, which could affect various industries such as aviation and logistics

- Potential reduction in government revenue due to lower economic growth

The Indian government is closely monitoring the situation and is exploring alternative sources of oil to reduce its dependence on Russian oil. However, finding alternative sources may not be easy, and the country may have to rely on more expensive oil from other producers. The government is also considering measures to reduce the impact of rising oil prices on the economy, such as reducing taxes on petroleum products or increasing subsidies for certain industries.

The conflict between Russia and Ukraine is a complex issue with far-reaching implications for the global economy. The disruption of oil supplies and the resulting increase in oil prices are just a few of the many challenges that countries like India are facing. As the situation continues to evolve, it is essential for governments and industries to work together to find solutions to mitigate the impact of the conflict on the global economy.

India's Request to the US

India has recently made a request to the US to allow imports of Iranian oil. This move is seen as an attempt to curb the country's reliance on Russian oil, which has become a significant concern in the wake of the ongoing conflict in Ukraine. The request is part of a broader effort by India to diversify its energy sources and reduce its dependence on any one country.

The implications of this request are far-reaching, with potential consequences for US-Iran relations and global oil trade. If the US were to grant India's request, it could lead to a significant shift in the dynamics of the global oil market. This, in turn, could have a major impact on the prices of oil and other energy sources.

Some of the key implications of India's request include:

- Potential easing of tensions between the US and Iran, as the US would be allowing a significant importer of oil to purchase from Iran

- A reduction in India's reliance on Russian oil, which could lead to a decline in Russia's influence in the global energy market

- A potential increase in global oil supplies, which could help to stabilize prices and reduce the risk of shortages

- A shift in the balance of power in the global oil market, with Iran potentially emerging as a more significant player

The US has been cautious in its response to India's request, with officials weighing the potential benefits against the potential risks. One of the main concerns is the impact that allowing Indian imports of Iranian oil could have on the US's own sanctions against Iran. The US has imposed significant sanctions on Iran in recent years, and allowing Indian imports could be seen as a weakening of those sanctions.

Despite these concerns, there are also potential benefits to granting India's request. For example, it could help to reduce India's reliance on Russian oil, which is seen as a key strategic goal for the US. It could also help to stabilize the global oil market, by increasing supplies and reducing the risk of shortages. Ultimately, the decision will depend on a careful consideration of the potential implications, and a weighing of the potential benefits against the potential risks.

Frequently Asked Questions (FAQ)

Why is India seeking to import Iranian oil?

India's decision to import Iranian oil is a strategic move to diversify its energy sources and reduce its reliance on Russian oil. The Russia-Ukraine conflict has had a significant impact on the global energy market, and India is seeking to mitigate its effects on its economy. By importing Iranian oil, India aims to reduce its dependence on Russian oil and promote energy security.

The main reasons behind India's decision to import Iranian oil are:

- Geopolitical tensions between Russia and Ukraine have led to sanctions on Russian oil, making it challenging for India to maintain its oil imports from Russia.

- India is seeking to reduce its dependence on Russian oil and promote energy security by diversifying its energy sources.

- Iranian oil is seen as a viable alternative to Russian oil, given its proximity to India and the existing infrastructure for oil transportation.

The benefits of importing Iranian oil are numerous. It will help India to reduce its trade deficit with Russia and promote economic growth. Additionally, it will provide India with a stable source of oil, which is essential for its growing economy. The import of Iranian oil will also help to reduce the impact of the Russia-Ukraine conflict on India's economy, as it will provide a buffer against price fluctuations in the global energy market.

In terms of logistics, India is planning to use the existing infrastructure, including ports and pipelines, to transport Iranian oil. This will help to reduce the cost and time required for oil transportation, making it a viable option for India. The import of Iranian oil is expected to start soon, and it is likely to have a significant impact on India's energy sector and economy. Overall, India's decision to import Iranian oil is a strategic move to promote energy security and reduce its dependence on Russian oil.

How will the US respond to India's request?

The US response to India's request is a complex issue that involves multiple factors and stakeholders. The current state of US-Iran relations is a crucial aspect that will influence the US decision. Tensions between the US and Iran have been escalating, and any decision made by the US will have to take into account the potential implications on this relationship.

The global oil market dynamics also play a significant role in determining the US response. As a major oil-producing country, the US has a vested interest in maintaining stability in the global oil market. The US will have to consider the potential impact of its decision on the global oil prices and the potential consequences for the world economy.

Some of the key factors that will influence the US response include:

- the current level of oil imports from Iran to India

- the potential impact on the global oil market if the US were to grant a waiver to India

- the diplomatic relationship between the US and India

- the potential consequences for US-Iran relations if the US were to deny India's request

These factors will be carefully weighed by the US administration before making a decision on India's request.

The US administration will also have to consider the potential long-term implications of its decision. Granting a waiver to India could set a precedent for other countries, potentially undermining the effectiveness of US sanctions on Iran. On the other hand, denying India's request could strain the diplomatic relationship between the two countries and potentially drive India closer to other oil-producing countries.

Ultimately, the US response to India's request will depend on a delicate balance of geopolitical, economic, and diplomatic considerations. The US will have to navigate these complex factors carefully to make a decision that serves its national interests while also maintaining stability in the global oil market.

What are the potential implications of India importing Iranian oil?

India's decision to import Iranian oil can have far-reaching consequences on the global energy landscape. One of the primary implications of this move is a reduction in India's dependence on Russian oil. This shift can lead to a diversification of India's energy sources, making it less vulnerable to geopolitical tensions and price volatility.

A potential shift in global oil trade dynamics is also a likely outcome of India importing Iranian oil. This development can lead to a rebalancing of power in the global energy market, with Iran emerging as a significant player. The implications of this shift can be multifaceted, influencing not only the energy sector but also international relations and global politics.

Some of the key implications of India importing Iranian oil include:

- A reduction in India's dependence on Russian oil, allowing the country to negotiate better prices and terms

- A potential shift in global oil trade dynamics, with Iran emerging as a major oil exporter

- A possible improvement in US-Iran relations, as the US may be more inclined to engage with Iran on energy issues

The potential improvement in US-Iran relations is a significant aspect of India importing Iranian oil. As the US and Iran engage on energy issues, it can lead to a thaw in their relations, potentially paving the way for cooperation on other fronts. This development can have a positive impact on regional stability and global security.

In conclusion, India's decision to import Iranian oil can have significant implications for the global energy landscape, international relations, and regional stability. As the dynamics of the global oil trade continue to evolve, it will be essential to monitor the developments and adjust strategies accordingly to navigate the changing landscape.