The upcoming discussion is centered around the Goods and Services Tax (GST) rate cuts and their subsequent impact on various aspects of insurance. This topic is of significant interest to policyholders as it directly affects their financial planning and budgeting.

The primary focus of the discussion will be on understanding how GST rate cuts influence insurance premiums. GST is a crucial component in determining the overall cost of insurance policies, and any changes to its rate can have a ripple effect on the premiums paid by policyholders.

To provide a comprehensive understanding, the following key points will be explored:

- Implications of GST rate cuts on insurance premiums, including the potential for reduced costs and the subsequent benefits to policyholders.

- The impact of GST rate cuts on insurance renewals, considering how changes in GST rates might affect the renewal process and costs for existing policies.

- The effects of GST rate cuts on returns for policyholders, examining how these changes might influence the overall value and benefits that policyholders receive from their insurance investments.

The aim is to break down complex concepts into easily understandable information, making it simpler for readers to grasp the nuances of GST rate cuts and their implications for insurance policyholders. By exploring these aspects in detail, readers will gain a clearer understanding of how GST rate adjustments can affect their insurance premiums, renewals, and returns.

Ultimately, the goal is to empower policyholders with the knowledge needed to make informed decisions regarding their insurance policies and to navigate the implications of GST rate cuts effectively. This knowledge will enable them to optimize their financial planning and maximize the benefits from their insurance investments.

Understanding GST on Insurance

The Goods and Services Tax (GST) is a comprehensive tax system that has replaced multiple indirect taxes in India, including the service tax that was applicable on insurance premiums. GST is a consumption-based tax, where the tax is levied on the value added at each stage of production and distribution. In the context of insurance, GST is applicable on the premiums paid by policyholders for various insurance products.

Pre-GST, the tax structure on insurance premiums was complex and involved multiple taxes, including service tax, education cess, and secondary and higher education cess. The service tax rate on insurance premiums was 15%, which included 14% service tax, 0.5% Swachh Bharat Cess, and 0.5% Krishi Kalyan Cess. This tax structure has been replaced by GST, which has simplified the tax system and reduced the complexity associated with multiple taxes.

The key aspects of GST on insurance products are as follows:

- GST is applicable on all types of insurance products, including life insurance, health insurance, motor insurance, and other general insurance products.

- The GST rate on insurance premiums is 18%, which is higher than the pre-GST service tax rate of 15%.

- GST is levied on the gross premium, which includes the premium amount and any additional charges, such as administrative fees and late payment fees.

- Insurance companies are required to collect GST from policyholders and deposit it with the government.

In terms of the impact of GST on insurance premiums, the increased tax rate of 18% has resulted in higher premiums for policyholders. However, the GST system has also simplified the tax structure and reduced compliance costs for insurance companies, which may lead to more efficient and cost-effective operations. Overall, the application of GST on insurance products has introduced a new tax regime that is expected to have a significant impact on the insurance industry and policyholders.

Impact of GST Cut on Premiums

The reduction in Goods and Services Tax (GST) rates on insurance premiums has been a welcome move for policyholders. This cut has resulted in a decrease in the premium amounts that policyholders have to pay for their insurance policies. As a result, policyholders can now enjoy the same coverage at a lower cost, which can help to increase the overall affordability of insurance products.

One of the key benefits of the GST cut is the reduction in premium amounts for policyholders. This reduction can be significant, especially for policies with high premium amounts. For instance, a policyholder who was previously paying a premium of Rs 10,000 per annum may now have to pay only Rs 9,500 per annum, resulting in a saving of Rs 500. This reduction can be a big relief for policyholders, especially those who are on a tight budget.

The comparison of old and new GST rates on insurance premiums is as follows:

- The old GST rate on insurance premiums was 18%, which was one of the highest tax rates on any financial product.

- The new GST rate on insurance premiums is 5% for certain types of insurance policies, such as health insurance and term life insurance.

- The reduced GST rate applies to premiums paid for both new and existing policies, making it a universal benefit for all policyholders.

- The GST cut is expected to increase the demand for insurance products, as they become more affordable and attractive to consumers.

The impact of the GST cut on premiums is expected to be significant, especially in the long term. With the reduction in premium amounts, policyholders can now opt for higher coverage or add more riders to their policies, which can provide them with better protection against unforeseen events. Additionally, the GST cut is also expected to increase the penetration of insurance products in the country, as more people are likely to opt for insurance coverage due to its increased affordability.

Renewal and Returns Under New GST Regime

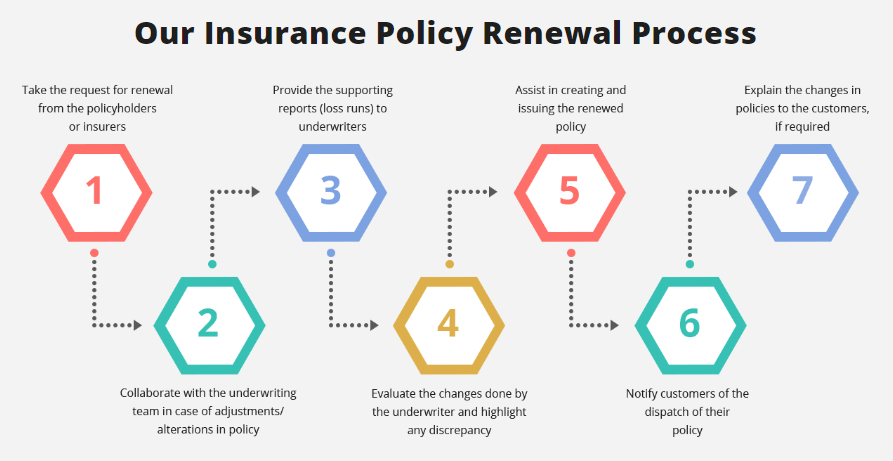

The introduction of the new GST regime has brought about significant changes in the way businesses and individuals manage their taxes. One of the key areas affected by this change is the insurance sector, where policyholders can now enjoy reduced GST rates on their premiums. To take advantage of these reduced rates, policyholders need to renew their insurance policies under the new GST regime.

The process of renewing insurance policies with reduced GST rates involves several steps. Policyholders need to first check if their existing policy is eligible for renewal under the new GST regime. They can then proceed to renew their policy by paying the reduced GST amount on their premium. It is essential to note that the reduced GST rates apply only to new and renewed policies, and not to existing policies that are still in force.

To claim returns or refunds on previously paid GST amounts, policyholders need to follow a specific procedure. The key steps involved in this process are:

- Identify the GST amount paid in excess, which can be calculated by comparing the old GST rate with the new reduced rate

- Submit a claim for refund or return with the insurance provider, along with supporting documents such as policy documents and proof of payment

- Wait for the insurance provider to process the claim and refund the excess GST amount

- Verify the refund amount to ensure it is correct and complete

It is crucial to note that the process of claiming returns or refunds may vary depending on the insurance provider and the specific policy terms.

In addition to renewing insurance policies and claiming returns, policyholders also need to be aware of the deadlines for submitting their claims. The GST council has specified a timeframe within which policyholders can claim refunds on previously paid GST amounts. Policyholders who miss this deadline may not be eligible for a refund, so it is essential to submit claims promptly.

Overall, the new GST regime offers policyholders an opportunity to reduce their tax burden by renewing their insurance policies at reduced GST rates and claiming returns on previously paid GST amounts. By following the correct procedure and meeting the deadlines, policyholders can ensure a smooth transition to the new GST regime and enjoy the benefits of reduced taxation.

Sector-Wise Impact of GST Cut

The reduction in Goods and Services Tax (GST) has far-reaching implications for various sectors, particularly the insurance industry. In the health insurance sector, the GST cut is expected to make health insurance policies more affordable for consumers. This could lead to an increase in the number of people opting for health insurance, ultimately reducing the financial burden on individuals and families in the event of medical emergencies.

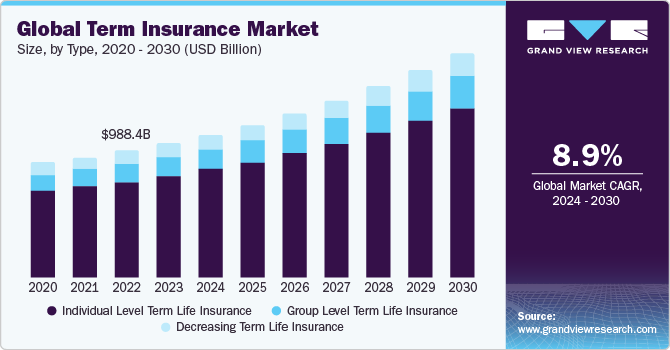

In the life insurance sector, the GST reduction is likely to have a positive impact on the sales of life insurance policies. With lower GST rates, life insurance policies may become more attractive to consumers, leading to increased demand. This, in turn, could lead to higher revenue for life insurance companies and more competitive pricing for policyholders.

The motor insurance sector is also expected to benefit from the GST cut. With lower GST rates, motor insurance policies may become more affordable for vehicle owners, leading to increased compliance with motor insurance regulations. This could result in a reduction in the number of uninsured vehicles on the road, ultimately leading to a safer and more responsible driving culture.

Some of the key benefits of the GST reduction across different insurance types include:

- Increased affordability of insurance policies for consumers

- Higher demand for insurance policies, leading to increased revenue for insurance companies

- More competitive pricing for policyholders

- Increased compliance with insurance regulations

- A safer and more responsible driving culture in the case of motor insurance

A comparison of the benefits across different insurance types reveals that health insurance policies are likely to benefit the most from the GST reduction. This is because health insurance policies are often considered essential expenses, and the GST cut could make them more affordable for a larger section of the population. Life insurance policies are also expected to benefit, although the impact may be less pronounced compared to health insurance policies. Motor insurance policies, on the other hand, may see a moderate impact from the GST reduction, with increased affordability and compliance being the primary benefits.

Frequently Asked Questions (FAQ)

How will the GST cut affect my existing insurance policy?

The introduction of GST cuts is expected to have a significant impact on various sectors, including the insurance industry. Policyholders can expect a reduction in their premium payments, depending on the type of insurance and GST rate applicable. This change is likely to bring relief to many individuals and businesses that have been bearing the brunt of high premium costs.

The reduction in GST rates will be applicable to various types of insurance policies, including health, motor, and life insurance. Policyholders can expect a decrease in their premium payments, which will be a welcome respite for those who have been struggling to keep up with the high costs. The extent of the reduction will depend on the type of insurance policy and the GST rate applicable to it.

Some of the key benefits of the GST cut on insurance policies include:

- Reduced premium payments for policyholders

- Increased affordability of insurance policies for individuals and businesses

- Potential increase in the demand for insurance policies due to reduced costs

- Greater competitiveness in the insurance industry, leading to better services and products for policyholders

The GST cut is also expected to have a positive impact on the insurance industry as a whole. With reduced premium costs, insurance companies may see an increase in the number of policyholders, leading to increased revenue and growth. Additionally, the reduced costs may also lead to increased competition among insurance companies, resulting in better services and products for policyholders.

It is essential for policyholders to review their existing insurance policies and understand how the GST cut will affect their premium payments. They should also be aware of any changes to their policy terms and conditions, as well as any potential benefits or drawbacks of the GST cut. By doing so, policyholders can make informed decisions about their insurance policies and take advantage of the benefits offered by the GST cut.

Can I claim a refund for the excess GST paid on my insurance premiums?

To determine if you are eligible for a refund on excess GST paid on your insurance premiums, it is essential to review your policy terms and conditions. The process of claiming refunds on previously paid GST amounts will depend on the insurance provider and the specific policy terms. Insurance providers have different procedures and requirements for handling GST refund claims, so it is crucial to understand the specific guidelines set by your provider.

The first step in claiming a refund is to contact your insurance provider and inquire about their process for handling GST refund claims. They will be able to provide you with the necessary information and guidance on how to proceed. You may need to provide documentation, such as proof of payment and policy details, to support your claim.

Some common requirements for claiming a GST refund include:

- A written request to the insurance provider, stating the reason for the refund claim

- Proof of payment of the excess GST amount

- A copy of the insurance policy document, highlighting the relevant terms and conditions

- Any other supporting documentation, as required by the insurance provider

It is essential to ensure that you have all the necessary documentation and information before submitting your claim, as incomplete or inaccurate information may lead to delays or rejection of your refund claim.

The timeframe for processing GST refund claims can vary depending on the insurance provider and the complexity of the claim. Some providers may process claims within a few weeks, while others may take several months. It is essential to follow up with your provider to ensure that your claim is being processed and to inquire about the expected timeframe for the refund to be issued.

Will the GST cut lead to an increase in insurance policy sales?

The reduction in GST rates is expected to make insurance products more attractive to consumers, potentially leading to an increase in policy sales. This move is likely to boost the insurance industry, as lower premiums will make policies more affordable for customers. As a result, insurance companies may witness a surge in demand for their products.

The main reason behind this anticipated increase in sales is the reduced cost of insurance policies. With lower GST rates, policyholders will have to pay less for their premiums, making insurance more accessible to a wider range of people. This, in turn, may encourage more individuals to purchase insurance policies, thereby driving up sales.

Some of the key benefits of the GST cut on insurance policy sales include:

- Increased affordability: Lower premiums will make insurance policies more affordable for customers, leading to higher demand.

- Improved penetration: The reduced cost of insurance policies may lead to increased penetration of insurance products in the market.

- Enhanced attractiveness: Insurance products will become more attractive to consumers, potentially leading to an increase in policy sales.

The insurance industry is likely to experience a significant impact from the GST cut. Insurance companies will need to adapt to the new tax structure and adjust their pricing strategies accordingly. This may involve revising their premium rates, reworking their product offerings, and modifying their marketing strategies to take advantage of the new tax regime.

Overall, the GST cut is expected to have a positive impact on the insurance industry, leading to an increase in policy sales and improved penetration of insurance products. As the industry continues to evolve, it will be interesting to see how insurance companies respond to the new tax structure and capitalize on the opportunities it presents.