In today's digital age, online banking has become an indispensable part of our daily lives. With the convenience of managing our finances at our fingertips, it's easy to overlook the potential risks involved. However, the importance of online banking security cannot be overstated. Cyber threats are on the rise, and a single misstep can result in devastating consequences, including identity theft, financial loss, and damage to your credit score. The increasing sophistication of cybercriminals has made it imperative for individuals to take proactive measures to safeguard their online banking activities. According to a recent report, the global cost of cybercrime is projected to reach $6 trillion by 2025. This staggering figure highlights the urgent need for online banking users to prioritize security and adopt best practices to prevent cyber threats. In this article, we will delve into the essential tips to prevent cyber threats and ensure the security of your online banking activities. From password management and two-factor authentication to browser security and avoiding phishing scams, we will cover the most critical aspects of online banking security.

Why Online Banking Security Matters

Online banking security is not just a concern for individuals; it's also a top priority for financial institutions. A security breach can result in significant financial losses, damage to reputation, and erosion of customer trust. In addition, online banking security is crucial for protecting sensitive personal and financial information, including:- Account numbers and passwords

- Personal identification numbers (PINs)

- Credit card information

- Social Security numbers

- Driver's license numbers

Use Strong and Unique Passwords

Password Security: The First Line of Defense

In today's digital landscape, passwords are the keys to unlocking our online identities. With the rise of cyber attacks and data breaches, it's more crucial than ever to prioritize password security. A single weak password can compromise your entire online presence, leaving you vulnerable to identity theft, financial loss, and reputational damage.So, what makes a strong and unique password? It's a combination of complexity, length, and randomness. Aim for passwords that are at least 12 characters long, featuring a mix of uppercase and lowercase letters, numbers, and special characters. The more complex, the better. However, it's challenging to create and remember these complex passwords for each account, which is where a password manager comes in.

Password Managers: The Ultimate Solution

A password manager is a secure program that generates and stores complex passwords for you. With a password manager, you only need to remember one master password, and it will autofill login credentials for all your accounts. This eliminates the risk of using weak or duplicate passwords, and you'll no longer have to worry about remembering multiple passwords. Some popular password manager options include:- LastPass

- 1Password

- Dashlane

- KeePass

Two-Factor Authentication: An Additional Layer of Security

While strong passwords are essential, they can still be compromised. This is where two-factor authentication (2FA) comes in. 2FA adds an extra layer of security to your accounts by requiring you to provide a second form of verification, in addition to your password, to access your account. Common 2FA methods include:- Authenticator apps like Google Authenticator or Authy

- SMS or email-based one-time passwords

- Biometric verification, such as fingerprint or facial recognition

- Physical tokens or smart cards

The Dangers of Password Reuse

Using the same password across multiple accounts is a significant security risk. If a hacker gains access to one account, they can use the same password to breach other accounts. This is known as a credential stuffing attack. To avoid this, use a unique password for each account, and store them securely in your password manager. In conclusion, using strong and unique passwords is crucial in today's online landscape. By leveraging a password manager to generate and store complex passwords, enabling two-factor authentication for added security, and avoiding password reuse, you'll significantly reduce the risk of cyber attacks and protect your online identity.

Keep Your Banking App and Device Up-to-Date

Staying Safe in the Digital Banking Era

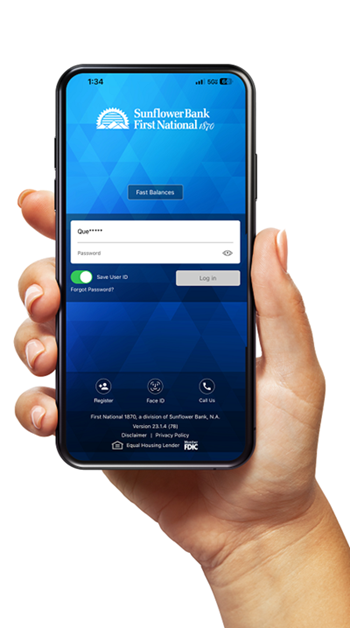

In today's digital age, online banking has become an essential part of our lives. With just a few taps on our devices, we can manage our finances, pay bills, and transfer funds. However, this convenience comes with a responsibility to ensure our online banking experience is secure. One of the most critical aspects of online banking security is keeping your banking app and device up-to-date. Regular App Updates: The First Line of Defense Regularly updating your banking app is crucial to ensuring you have the latest security patches. These updates often include fixes for vulnerabilities that could be exploited by cybercriminals. Outdated apps can leave your sensitive information exposed, making it easier for hackers to gain unauthorized access to your account. To avoid this, make it a habit to:- Enable automatic updates for your banking app

- Regularly check for updates and install them as soon as they become available

- Review the app's changelog to stay informed about the latest security enhancements

- Keep your device's OS and browser updated with the latest security patches

- Use a reputable antivirus software to protect your device from malware

- Avoid using outdated browsers, such as Internet Explorer, and opt for modern browsers like Google Chrome or Mozilla Firefox

Be Cautious of Phishing Scams and Fraudulent Activities

Staying Safe in the Digital Age

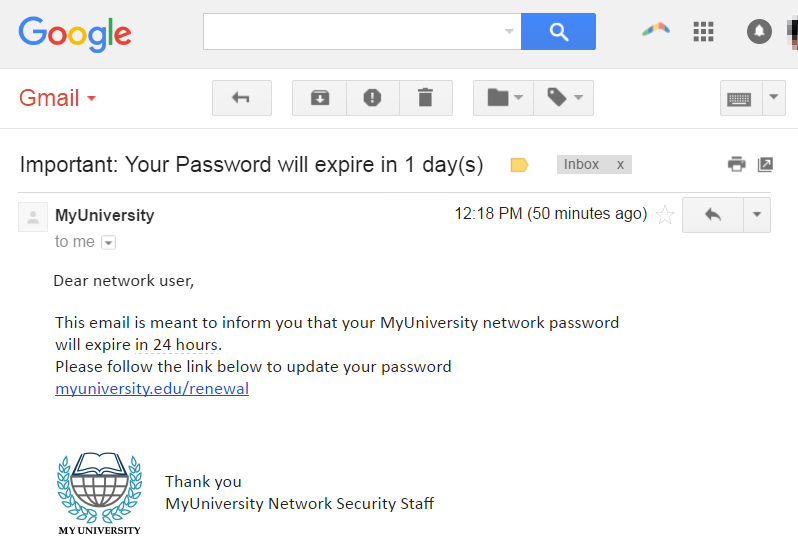

In today's digital landscape, it's more important than ever to be vigilant when it comes to protecting yourself from phishing scams and fraudulent activities. With cybercriminals becoming increasingly sophisticated in their tactics, it's crucial to stay one step ahead of them to avoid falling victim to their nefarious schemes.One of the most common ways that scammers attempt to trick people is through suspicious emails, texts, or calls claiming to be from your bank or a reputable institution. These messages often create a sense of urgency, stating that your account has been compromised or that you need to take immediate action to prevent a problem. However, it's essential to remember that your bank will never contact you out of the blue asking for sensitive information such as passwords or account numbers.

Verifying Authenticity is Key- When you receive an email or message claiming to be from your bank, never click on any links or download any attachments. Instead, go directly to your bank's website by typing the URL into your browser or using a bookmark you've saved previously.

- Be cautious of URLs that are similar to your bank's website but have slight variations. Scammers often use fake URLs that are designed to look legitimate but are actually phishing sites.

- Avoid using public computers or public Wi-Fi networks to access your bank's website or conduct financial transactions. These networks may be compromised, allowing hackers to intercept your sensitive information.

Monitoring Your Account Activity

Regularly monitoring your account activity is a crucial step in detecting any suspicious transactions. By keeping a close eye on your accounts, you can quickly identify and report any fraudulent activity to your bank.

- Set up account alerts to notify you of any large or unusual transactions.

- Check your account statements regularly, either online or by mail.

- If you notice any suspicious activity, report it to your bank immediately. They can help you resolve the issue and prevent further fraud.

By being cautious of suspicious emails, texts, or calls, verifying the authenticity of URLs, and regularly monitoring your account activity, you can significantly reduce your risk of falling victim to phishing scams and fraudulent activities. Remember, it's always better to err on the side of caution when it comes to your financial safety and security.

Use Additional Security Measures

Stay Ahead of Cyber Threats with These Essential Security Measures

In today's digital landscape, protecting your online identity and sensitive information is crucial. While having strong passwords and keeping your software up-to-date is a great start, it's essential to take your security measures to the next level. By implementing additional security measures, you can significantly reduce the risk of falling victim to cyber attacks and data breaches. Enable Account Alerts for Large or Unusual Transactions One of the most effective ways to detect and prevent fraudulent activity is to set up account alerts for large or unusual transactions. This way, you'll receive instant notifications whenever a suspicious transaction is made, allowing you to take swift action to prevent further damage. Most banks and financial institutions offer this feature, so be sure to take advantage of it. To enable account alerts, simply log in to your online banking platform, navigate to the settings or security section, and follow the prompts to set up alerts for transactions that exceed a certain amount or appear unusual. You can also customize the alert settings to fit your specific needs, such as receiving alerts for international transactions or transactions made outside of your region.Protect Your Internet Connection with a Virtual Private Network (VPN)

Public Wi-Fi networks and unsecured internet connections are a hacker's paradise. Without proper protection, your sensitive information can be intercepted and exploited. That's where a Virtual Private Network (VPN) comes in. A VPN creates a secure, encrypted tunnel between your device and the internet, ensuring that your data remains private and protected. When choosing a VPN, look for one that offers robust encryption, a no-logs policy, and a user-friendly interface. With a VPN, you can browse the internet with confidence, knowing that your data is safe from prying eyes.Block Malicious Scripts with a Browser Extension

Malicious scripts can compromise your online security in an instant. These scripts can be embedded in seemingly harmless websites, injecting malware into your device or stealing your sensitive information. To combat this threat, consider using a browser extension that blocks malicious scripts. Browser extensions like uBlock Origin, NoScript, and Malwarebytes offer advanced protection against malicious scripts, ads, and trackers. These extensions scan websites for potential threats and block them before they can cause harm. By installing a reputable browser extension, you can significantly reduce the risk of falling victim to malware and other online threats. By implementing these additional security measures, you can enjoy a safer and more secure online experience. Remember, staying ahead of cyber threats requires proactive measures and a commitment to protecting your digital identity.

Frequently Asked Questions (FAQ)

How do I know if my online banking session is secure?

When it comes to online banking, security is of utmost importance. You want to ensure that your sensitive financial information is protected from prying eyes and malicious attacks. One of the most critical steps in securing your online banking session is verifying the connection. But how do you do that?

Look for the "S" in HTTPS

The first thing to check is the URL of your online banking website. Make sure it starts with "https" and not just "http". The "s" in https stands for "secure", indicating that the connection between your browser and the website is encrypted. This encryption ensures that any data exchanged between your device and the website remains confidential and cannot be intercepted by hackers.The Lock Icon: A Symbol of Security

In addition to checking the URL, you should also look for a lock icon in the address bar of your browser. This lock icon indicates that the website has a valid Secure Sockets Layer (SSL) certificate, which is a digital certificate that verifies the website's identity and enables encryption. The lock icon is usually displayed in the address bar, often accompanied by the word "Secure" or a green padlock.- If you see a lock icon with a red slash or a warning symbol, it may indicate that the SSL certificate is not valid or has expired. Avoid proceeding with the session in such cases.

- Some browsers may display a green padlock or a green address bar to indicate a secure connection.

- Contact your bank's customer support to verify the authenticity of the website and report the issue.

- Update your browser and operating system to ensure you have the latest security patches.

- Avoid using public computers or public Wi-Fi networks to access online banking.

What should I do if I suspect fraudulent activity on my account?

If you suspect fraudulent activity on your account, it's essential to act quickly to minimize potential damage and protect your financial well-being. Here's a step-by-step guide to help you navigate the situation:

Initial Response

The first and most crucial step is to contact your bank's customer support immediately. Don't delay, even if you're not entirely sure if the activity is fraudulent. The sooner you report the issue, the faster your bank can take action to secure your account.- Call the bank's customer support phone number listed on the back of your card or on their website.

- Be prepared to provide detailed information about the suspicious activity, including the date, time, and amount of the transaction.

- Have your account information and identification ready to verify your identity.

Securing Your Account

Once you've reported the fraudulent activity, your bank will guide you through the necessary steps to secure your account. This may include:- Placing a hold on your account to prevent further transactions

- Issuing a new card or account number to replace the compromised one

- Setting up additional security measures, such as two-factor authentication or fraud alerts

Monitoring Your Account

It's essential to closely monitor your account activity in the days and weeks following the suspected fraud. Keep a close eye on your account statements, and report any additional suspicious transactions to your bank.- Regularly check your account online or through the bank's mobile app

- Set up account alerts for large or unusual transactions

- Review your account statements carefully to ensure all transactions are legitimate

Protecting Your Identity

If your personal information, such as your Social Security number or driver's license number, was compromised during the fraudulent activity, you may need to take additional steps to protect your identity.- Place a fraud alert on your credit report with the three major credit bureaus (Equifax, Experian, and TransUnion)

- Consider placing a credit freeze to restrict access to your credit report

- Monitor your credit report regularly for signs of identity theft

Is it safe to use public Wi-Fi for online banking?

The convenience of public Wi-Fi is undeniable. Whether you're sipping coffee at a café, waiting at the airport, or relaxing in a hotel lobby, public Wi-Fi can be a lifesaver. However, when it comes to online banking, it's essential to exercise extreme caution.

Risks Associated with Public Wi-Fi

Using public Wi-Fi for online banking can be a significant security risk. Here are a few reasons why:- Unsecured Networks: Public Wi-Fi networks are often unsecured, making it easy for hackers to intercept your data. This is particularly problematic for online banking, as sensitive information such as passwords, account numbers, and financial data can be compromised.

- Man-in-the-Middle (MITM) Attacks: Hackers can position themselves between you and the connection point, allowing them to eavesdrop on your online activity. This can lead to unauthorized access to your accounts and financial information.

- Malware and Viruses: Public Wi-Fi networks can be infected with malware and viruses, which can be transferred to your device. These malicious programs can steal your login credentials, track your online activity, and even take control of your device.

The Consequences of Using Public Wi-Fi for Online Banking

The risks associated with using public Wi-Fi for online banking can have serious consequences, including:- Financial Loss: Hackers can use your stolen credentials to drain your accounts, make fraudulent transactions, or even steal your identity.

- Identity Theft: Compromised personal and financial information can be used to commit identity theft, leading to a range of problems, from credit score damage to legal issues.

- Reputation Damage: If your personal or financial information is compromised, it can lead to reputational damage, making it difficult to recover from the aftermath.

Safer Alternatives for Online Banking

So, what's the solution? Instead of using public Wi-Fi for online banking, consider the following alternatives:- Secure Internet Connection: Use a secure internet connection, such as your home network or a trusted mobile hotspot, to access online banking services.

- Virtual Private Network (VPN): A VPN creates a secure, encrypted connection between your device and the internet, making it much harder for hackers to intercept your data.