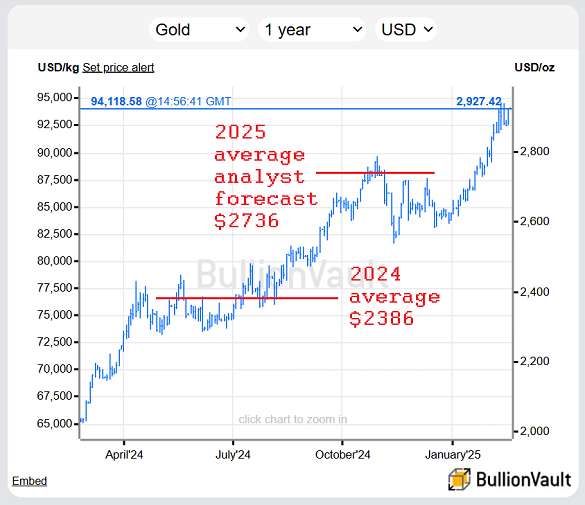

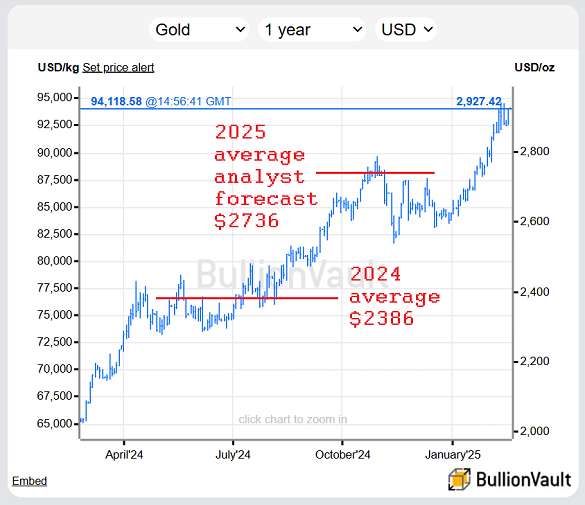

As we navigate the complexities of the global economy, one asset class that continues to capture the attention of investors and market analysts alike is gold. The allure of this precious metal lies in its perceived safe-haven status, with many turning to it as a hedge against inflation, geopolitical uncertainty, and market volatility. In this blog post, we embark on an in-depth examination of gold price trends, delving into the historical context, current market dynamics, and expert insights to predict the potential price range for late 2025.

Understanding the Significance of Gold Price Trends

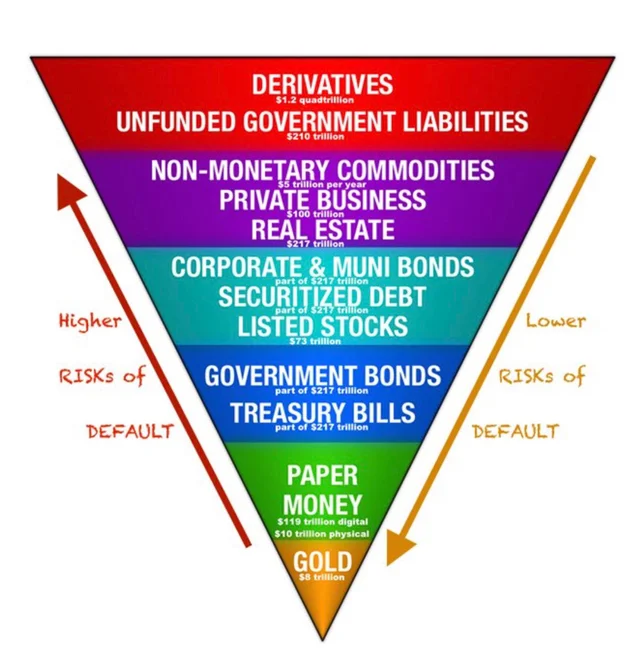

Gold's value is deeply intertwined with the health of the global economy. During times of economic prosperity, gold prices often decline as investors seek higher returns in riskier assets. Conversely, during periods of uncertainty or turmoil, gold becomes a coveted asset, driving up its value. As a result, gold price trends serve as a bellwether for the overall economic climate.- Inflationary Pressures: Gold is often seen as a natural hedge against inflation, as its value tends to increase when inflation rises.

- Geopolitical Tensions: Political instability, trade wars, and conflicts can drive up gold prices as investors seek safe-haven assets.

- Currency Fluctuations: A weaker US dollar, for instance, can boost gold prices, as a stronger dollar can lead to a decline in gold's value.

Setting the Stage for Late 2025

As we look ahead to late 2025, several factors will likely influence gold price trends. These include:- Central Banks' Monetary Policies: The pace of interest rate hikes, quantitative easing, and other monetary decisions will impact gold's value.

- Global Economic Growth: A slowdown or rebound in economic growth will affect gold demand and, subsequently, its price.

- Supply and Demand Dynamics: Changes in gold production, recycling, and jewelry demand will influence the global supply chain.

Historical Gold Price Trends and Patterns

Uncovering the Past: A Decade of Gold Price Trends

As we delve into the historical data of gold prices from 2010 to 2025, several patterns and trends emerge, shedding light on the complex dynamics that influence this coveted metal. Over the past decade, gold prices have experienced a rollercoaster ride, with significant fluctuations in response to various global events, economic shifts, and central bank actions.Global Events and Gold Prices: A Cause-and-Effect Relationship

The impact of global events on gold prices is undeniable. During times of economic uncertainty, geopolitical tensions, and financial instability, investors often flock to gold as a safe-haven asset, driving up its price. Some notable examples include:- The European sovereign debt crisis (2010-2012), which saw gold prices surge to an all-time high of $1,923.70 per ounce in September 2011.

- The COVID-19 pandemic (2020), which triggered a massive influx of investors into the gold market, pushing prices up by over 25% in a single year.

- The Russia-Ukraine conflict (2022), which led to a 10% increase in gold prices within a span of just three months.

Central Banks: The Invisible Hand Behind Gold Prices

Central banks play a crucial role in shaping gold prices through their gold reserves and interest rate policies. By adjusting their gold holdings, central banks can influence the supply and demand dynamics of the gold market. For instance:- The Swiss National Bank's (SNB) decision to abandon its currency peg in 2015 led to a significant increase in gold prices, as investors sought safe-haven assets amidst the ensuing market volatility.

- The People's Bank of China's (PBOC) steady accumulation of gold reserves since 2015 has contributed to a gradual upward trend in gold prices, as the country seeks to diversify its foreign exchange holdings.

Trends and Patterns: A Glimpse into the Future

As we analyze the historical data, several trends and patterns emerge:- Gold prices tend to rise during periods of economic uncertainty and decline during times of economic stability.

- Central banks' gold reserves and interest rate policies have a significant impact on gold prices.

- Geopolitical tensions and global events can trigger sudden spikes in gold prices.

Key Factors Influencing Gold Prices in 2025

Supply and Demand: The Fundamental Forces

The age-old principle of supply and demand is a crucial determinant of gold prices. On the supply side, mining production plays a significant role. When mining output increases, the supply of gold in the market surges, putting downward pressure on prices. Conversely, a decrease in mining production can lead to a shortage, driving prices up.- Mining production: The world's largest gold-producing countries, such as China, Australia, and Russia, have a significant impact on global supply. Any disruptions to their mining operations, such as strikes or natural disasters, can affect gold prices.

- Jewelry demand: Gold jewelry is a significant component of global demand, particularly in countries like India and China. Festive seasons, cultural events, and economic conditions can influence jewelry demand, which, in turn, affects gold prices.

Macroeconomic Factors: Inflation, Currency Fluctuations, and Interest Rates

Macroeconomic factors, including inflation, currency fluctuations, and interest rates, also exert a significant influence on gold prices.- Inflation: As inflation rises, the purchasing power of currencies decreases, making gold a more attractive hedge against inflation. Central banks may increase interest rates to combat inflation, which can drive gold prices up.

- Currency fluctuations: A strong US dollar can lead to lower gold prices, as a stronger dollar makes gold more expensive for holders of other currencies. Conversely, a weaker dollar can boost gold prices.

- Interest rates: Higher interest rates can increase the opportunity cost of holding gold, as investors may opt for higher-yielding assets. Lower interest rates, on the other hand, can make gold more attractive.

Geopolitical Tensions, Trade Wars, and Global Economic Uncertainty

Geopolitical tensions, trade wars, and global economic uncertainty can create a safe-haven demand for gold, driving prices up.- Geopolitical tensions: Political instability, conflicts, and tensions between nations can lead to a flight to safety, boosting gold prices.

- Trade wars: Trade wars and tariffs can disrupt global supply chains, leading to economic uncertainty and increased demand for gold.

- Global economic uncertainty: Downturns in major economies, such as the US, China, or Europe, can lead to a surge in gold prices as investors seek safe-haven assets.

Gold Price Prediction for Late 2025: Expert Analysis

- Physical Gold: Buying physical gold in the form of coins, bars, or jewelry is a popular way to invest in gold. This option provides direct ownership and control over the asset.

- Gold ETFs (Exchange-Traded Funds): Gold ETFs track the price of gold, offering investors a convenient and liquid way to invest in gold without physically holding the asset.

- Mining Stocks: Investing in mining stocks allows investors to benefit from the performance of gold mining companies. This option provides exposure to gold prices, as well as the potential for dividends and capital appreciation.

Investment Strategies for Gold in 2025

Why Diversify with Gold?

As investors, we're constantly seeking ways to maximize returns while minimizing risk. One often-overlooked yet highly effective strategy is diversifying a portfolio with gold. This precious metal has long been a safe-haven asset, providing a hedge against inflation, currency fluctuations, and market volatility. By incorporating gold into your investment mix, you can:- Risk Management: Gold tends to perform inversely to stocks and bonds, making it an excellent addition to a diversified portfolio. This means that when other assets decline in value, gold is likely to increase, providing a stabilizing effect.

- Inflation Protection: Gold is known for its ability to maintain purchasing power over time, even in the face of rising inflation. As prices increase, the value of gold tends to rise, preserving your wealth.

Gold Investment Options

Now that we've established the benefits of investing in gold, let's explore the various ways to do so:- Physical Gold: Coins, bars, and jewelry are popular ways to own physical gold. This option provides tangible ownership and the satisfaction of holding a valuable asset. However, storage and security concerns should be considered.

- Exchange-Traded Funds (ETFs): Gold ETFs allow you to invest in gold without physically holding it. These funds track the price of gold, offering flexibility and ease of trading.

- Mining Stocks: Investing in gold mining companies provides exposure to gold prices while also benefiting from the company's business operations. This option comes with additional risks, such as company performance and management decisions.

- Gold IRAs: A Gold Individual Retirement Account (IRA) allows you to hold physical gold or other precious metals within a tax-advantaged retirement account. This option provides a long-term investment strategy with potential tax benefits.

Getting Started with Gold Investment

Ready to add gold to your portfolio? Follow these tips to get started:- Set Clear Goals: Determine your investment objectives, risk tolerance, and time horizon to decide which gold investment option is best for you.

- Choose a Reputable Dealer: Research and select a trustworthy dealer or broker to ensure secure and reliable transactions.

- Start Small: Begin with a modest investment and gradually increase your allocation to gold as you become more comfortable with the market.

- Monitor and Adjust: Regularly review your portfolio and rebalance as needed to maintain an optimal asset allocation.

Selecting the Right Investment Vehicle

With multiple gold investment options available, it's essential to choose the right one for your needs. Consider the following factors:- Liquidity: If you require quick access to your funds, an ETF or mining stock might be a better option. For a longer-term approach, physical gold or a Gold IRA could be more suitable.

- Risk Tolerance: If you're risk-averse, physical gold or a Gold IRA might provide more stability. If you're willing to take on more risk, mining stocks could offer greater potential returns.

- Costs and Fees: Be aware of the costs associated with each investment option, including management fees, storage costs, and brokerage commissions.

Frequently Asked Questions (FAQ)

What are the main factors driving gold prices in 2025?

As we navigate the complexities of the global economy, understanding the factors driving gold prices has become increasingly important. In 2025, a combination of macroeconomic factors will significantly influence the value of this precious metal.

Inflation: A Key Driver of Gold Prices

Inflation, or the rate at which prices for goods and services are rising, is a critical factor in shaping gold prices. When inflation is high, the purchasing power of currencies decreases, making gold a more attractive investment option. This is because gold tends to maintain its value over time, making it a hedge against inflation. As central banks and governments around the world continue to print more money to stimulate economic growth, the risk of inflation increases. In 2025, if inflation rates rise, we can expect gold prices to follow suit.Interest Rates: A Delicate Balance

Interest rates, set by central banks, also play a crucial role in determining gold prices. When interest rates are low, borrowing money becomes cheaper, and investors tend to seek higher returns in riskier assets, such as stocks. However, when interest rates rise, investors often flock to safer assets like gold, driving up its price. In 2025, if central banks continue to raise interest rates to combat inflation, gold prices may benefit.Geopolitical Tensions: A Wild Card

Geopolitical tensions, including conflicts, sanctions, and trade wars, can significantly impact gold prices. During times of uncertainty, investors often seek safe-haven assets like gold, driving up its value. In 2025, ongoing tensions between major world powers, such as the US and China, could lead to increased demand for gold, pushing prices higher.- Other factors that may influence gold prices in 2025 include:

- Supply and demand dynamics, particularly in key markets like India and China

- The strength of the US dollar, as a weaker dollar tends to boost gold prices

- Technological advancements, such as the development of gold-backed cryptocurrencies

- Environmental and social concerns, as investors increasingly focus on sustainable investments

Is gold a good investment for 2025?

As we venture into 2025, investors are increasingly seeking ways to safeguard their wealth and ensure a stable financial future. Amidst the uncertainty, one age-old investment option stands out: gold. For centuries, gold has been a symbol of value and a trusted hedge against economic turmoil. But is gold a good investment for 2025? The answer lies in understanding its benefits and how it can fit into a diversified portfolio.

Diversification and Risk Management

One of the primary advantages of investing in gold is its ability to diversify a portfolio. Gold has a low correlation with other assets, such as stocks and bonds, meaning its performance is not directly tied to theirs. This makes it an attractive addition to a portfolio, as it can help reduce overall risk and increase stability. By allocating a portion of their portfolio to gold, investors can protect their wealth from market fluctuations and economic downturns.Hedging Against Inflation

Inflation is a persistent threat to investors, eroding the purchasing power of their hard-earned savings over time. Gold, however, has historically performed well during periods of high inflation. As inflation rises, the value of fiat currencies decreases, causing investors to seek refuge in assets that maintain their value. Gold's value tends to increase in these situations, making it an effective hedge against inflation. With many economists predicting a rise in inflation in 2025, investing in gold could provide a valuable safeguard against its erosive effects.Market Volatility and Uncertainty

The current market landscape is marked by uncertainty and volatility. Geopolitical tensions, trade wars, and monetary policy changes can all contribute to market fluctuations. Gold, with its reputation as a safe-haven asset, tends to perform well during times of uncertainty. As investors seek refuge from market turmoil, the demand for gold increases, driving up its value. By investing in gold, individuals can protect their wealth from market volatility and ensure a stable financial foundation.Ways to Invest in Gold

Investing in gold is more accessible than ever, with various options available to suit different investment goals and risk tolerance. Some popular ways to invest in gold include:- Physical gold: Investing in physical gold coins, bars, or jewelry provides a tangible asset that can be held and stored.

- Gold ETFs (Exchange-Traded Funds): Gold ETFs track the price of gold, offering a convenient and liquid way to invest in the metal.

- Gold mining stocks: Investing in gold mining companies provides exposure to the gold market, as well as the potential for capital appreciation.

- Gold IRAs (Individual Retirement Accounts): Gold IRAs allow individuals to hold physical gold within a tax-advantaged retirement account.

How can I invest in gold for 2025?

As we step into 2025, investing in gold has become an attractive option for many investors seeking to diversify their portfolios and hedge against market volatility. But with so many ways to invest in gold, it can be overwhelming to know where to start. In this article, we'll explore the various methods of investing in gold, each with its unique benefits and risks. Physical Gold: A Tangible Asset One of the most popular ways to invest in gold is by purchasing physical gold in the form of coins, bars, or jewelry. This approach offers a sense of security and control, as you can hold your gold assets in your hand. Physical gold can be stored in a safe or a vault, providing a tangible asset that can be passed down to future generations. However, physical gold also comes with its own set of challenges. For instance, you'll need to consider storage and security costs, as well as the risk of theft or damage. Additionally, buying and selling physical gold can be a complex process, and you may face higher premiums when purchasing small quantities. Exchange-Traded Funds (ETFs): A Convenient Option Another way to invest in gold is through Exchange-Traded Funds (ETFs), which track the price of gold and offer a convenient way to invest in the precious metal without physically holding it. Gold ETFs are traded on major stock exchanges, making it easy to buy and sell shares. This approach provides diversification and liquidity, as well as the potential for long-term growth. Some benefits of gold ETFs include:

- Convenience: ETFs can be bought and sold through a brokerage account, making it easy to invest in gold.

- Liquidity: ETFs offer the ability to quickly sell shares if needed.

- Diversification: Gold ETFs can be used to diversify a portfolio and reduce risk.

- Potential for high returns: If a mining company discovers a significant gold deposit, its stock price could surge.

- Diversification: Mining stocks can provide a unique opportunity to diversify a portfolio.

- Tax benefits: Gold IRAs offer tax benefits, such as deferred taxes on gains.

- Diversification: Gold IRAs can provide a unique opportunity to diversify a retirement portfolio.

Promoted

Automate Your YouTube Channel Effortlessly

The #1 tool for creators to schedule and upload videos from Google Drive, 24/7. Lifetime access at just ₹999.

🔥 Get Lifetime Access Now 🔥