The recent surge in sugar stocks has been a notable trend in the market, with several key players experiencing significant gains. This phenomenon has sparked interest among investors and industry observers, who are seeking to understand the underlying factors driving this growth.

At the heart of this trend are three major sugar companies: Dhampur Sugar Mills, Balrampur Chini Mills, and Shree Renuka Sugars. These companies have been at the forefront of the sugar industry in India, with a long history of production and distribution.

Key factors contributing to the surge in sugar stocks include:

- Government policies and regulations

- Global demand and supply dynamics

- Company-specific developments and performance

The performance of Dhampur Sugar Mills, Balrampur Chini Mills, and Shree Renuka Sugars will be examined in detail, providing insights into their current market position and future prospects. By exploring these companies and the broader sugar industry, this blog post aims to provide a comprehensive understanding of the recent surge in sugar stocks.

The analysis will delve into the financials, production capacities, and market strategies of these companies, shedding light on the factors that have contributed to their success. This information will be essential for investors, industry professionals, and anyone seeking to understand the intricacies of the sugar market.

Overview of Sugar Stocks

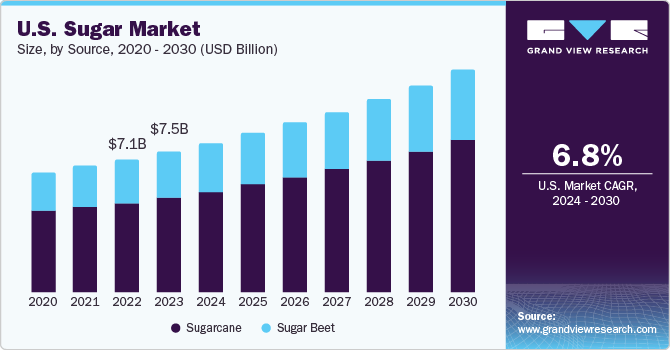

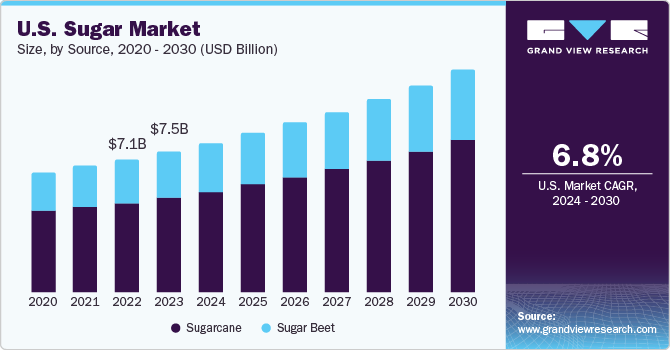

The sugar industry has witnessed a significant surge in recent times, with sugar stocks experiencing a sharp spike in their performance. This upward trend can be attributed to a combination of factors, including government policies, global demand, and other market dynamics. Currently, the market is favoring sugar stocks, with many investors looking to capitalize on the growing demand for sugar.

One of the primary factors contributing to the surge in sugar stocks is government policies. Many governments have implemented policies to support the sugar industry, such as subsidies, tax incentives, and trade agreements. These policies have helped to increase sugar production, reduce costs, and boost exports. As a result, sugar stocks have responded positively to these initiatives.

The global demand for sugar is another key factor driving the performance of sugar stocks. The demand for sugar is increasing rapidly, particularly in emerging markets such as Asia and Africa. This growing demand is driven by factors such as population growth, urbanization, and changing consumer preferences. The following are some of the key factors contributing to the sharp spike in sugar stocks:

- Government policies and subsidies to support the sugar industry

- Increasing global demand for sugar, particularly in emerging markets

- Improved sugar production and yields due to technological advancements

- Trade agreements and export opportunities for sugar-producing countries

- Investment in sugar-related infrastructure, such as storage and transportation facilities

In addition to government policies and global demand, other factors such as weather conditions, pests, and diseases can also impact sugar production and prices. As a result, sugar stocks can be volatile, and investors need to stay informed about market trends and developments. Despite these risks, many investors believe that sugar stocks have significant growth potential, driven by the increasing demand for sugar and the supportive policies of governments.

The performance of sugar stocks can also be influenced by the overall economic conditions, such as interest rates, inflation, and currency fluctuations. Investors should carefully evaluate these factors and conduct thorough research before investing in sugar stocks. By doing so, they can make informed decisions and capitalize on the opportunities presented by the sugar industry. Overall, the outlook for sugar stocks remains positive, driven by the growing demand for sugar and the supportive policies of governments.

Company Profiles: Dhampur Sugar Mills, Balrampur Chini Mills, Shree Renuka Sugars

Dhampur Sugar Mills is one of the leading sugar manufacturing companies in India. The company was established in 1933 and has a rich history spanning over eight decades. Dhampur Sugar Mills is committed to its mission of producing high-quality sugar and other allied products while ensuring sustainability and social responsibility.

The company's values are centered around integrity, transparency, and customer satisfaction. Dhampur Sugar Mills has a significant presence in the Indian sugar industry, with a production capacity of over 40,000 tons of sugar per day. The company's product portfolio includes sugar, molasses, bagasse, and ethanol, among others.

Balrampur Chini Mills is another major player in the Indian sugar industry. Founded in 1975, the company has grown significantly over the years and has become one of the largest sugar producers in the country. Balrampur Chini Mills is driven by its mission to create value for its stakeholders while adhering to the highest standards of quality and integrity.

Some of the key features of Balrampur Chini Mills include:

- Production capacity of over 1.5 million tons of sugar per annum

- Diversified product portfolio, including sugar, alcohol, and power generation

- Significant market presence, with a large customer base across India

Shree Renuka Sugars is a prominent sugar manufacturing company in India, with a history dating back to 1998. The company is committed to its mission of delivering high-quality products and services while ensuring environmental sustainability and social responsibility. Shree Renuka Sugars has a production capacity of over 20,000 tons of sugar per day and a significant presence in the global sugar market.

The company's product portfolio includes:

- Sugar, including white sugar, brown sugar, and refined sugar

- Other allied products, such as molasses, bagasse, and ethanol

- Power generation, with a capacity of over 150 MW

In terms of market presence, all three companies have a significant presence in the Indian sugar industry, with a large customer base across the country. They also export their products to various countries around the world, including the Middle East, Africa, and Southeast Asia. Overall, Dhampur Sugar Mills, Balrampur Chini Mills, and Shree Renuka Sugars are major players in the Indian sugar industry, with a strong commitment to quality, sustainability, and customer satisfaction.

Reasons Behind the Sharp Spike in Sugar Stocks

Government initiatives have played a significant role in the recent surge in sugar stocks. One such initiative is the export subsidy, which has encouraged sugar mills to export their produce, thereby increasing demand and driving up stock prices. The government has also implemented buffer stock schemes to stabilize sugar prices and ensure a steady supply. This has helped to reduce volatility in the market and attract investors to sugar stocks.

The impact of these initiatives can be seen in the significant increase in sugar exports. As a result, sugar mills have been able to clear their inventories, leading to improved cash flows and increased profitability. This, in turn, has boosted investor confidence, leading to a sharp spike in sugar stocks. Some of the key benefits of government initiatives include:

- Increased demand for sugar due to export subsidies

- Stabilization of sugar prices through buffer stock schemes

- Improved cash flows and profitability for sugar mills

- Boost in investor confidence, leading to increased investment in sugar stocks

Global demand and supply dynamics are also influencing sugar prices and stocks. The global sugar market is witnessing a deficit, driven by factors such as droughts, floods, and other weather-related events that have impacted sugar production. This has led to a surge in sugar prices, making it an attractive investment opportunity. On the other hand, some countries are increasing their sugar production, which could lead to a surplus in the market and put downward pressure on prices.

The dynamics of global demand and supply can be complex and influenced by various factors, including:

- Weather-related events that impact sugar production

- Government policies and trade agreements that influence sugar trade

- Changes in consumer preferences and dietary habits that affect sugar demand

- Technological advancements that improve sugar production efficiency

The interplay between government initiatives and global demand and supply dynamics has created a perfect storm that has led to a sharp spike in sugar stocks. As the sugar industry continues to evolve, it will be interesting to see how these factors influence the market and impact sugar stocks in the future.

Investment Opportunities and Future Outlook

The sugar industry has been experiencing significant fluctuations in recent years, driven by factors such as climate change, government policies, and shifting consumer preferences. Despite these challenges, sugar stocks offer potential investment opportunities for those looking to diversify their portfolios. One of the main growth prospects in the sugar industry is the increasing demand for ethanol, a biofuel produced from sugarcane. This trend is driven by governments' efforts to reduce greenhouse gas emissions and dependence on fossil fuels.

Investing in sugar stocks can provide a hedge against inflation, as sugar is a commodity that tends to perform well in periods of high inflation. Additionally, some sugar companies are diversifying their operations to include other products such as electricity generation, animal feed, and organic fertilizers. This diversification can reduce dependence on a single product and provide a more stable source of revenue. However, there are also risks associated with investing in sugar stocks, including price volatility, weather-related events, and changes in government policies.

Some of the key factors to consider when evaluating investment opportunities in sugar stocks include:

- Company performance and financial health

- Market trends and demand for sugar and related products

- Government policies and regulations affecting the industry

- Environmental and social factors, such as sustainability and labor practices

The future of the sugar industry is likely to be shaped by emerging trends such as the increasing demand for sustainable and organic products. Consumers are becoming more aware of the environmental and social impact of their purchasing decisions, and companies that can adapt to these changing preferences are likely to thrive. Other trends that may influence the sugar industry include the development of new technologies, such as precision agriculture and biotechnology, which can improve efficiency and reduce costs.

In terms of challenges, the sugar industry is likely to face increasing competition from alternative sweeteners, such as stevia and honey. Additionally, the industry may need to adapt to changing government policies, such as taxes on sugary drinks and subsidies for alternative energy sources. Despite these challenges, the sugar industry is expected to continue playing an important role in the global economy, particularly in regions where sugarcane is a major crop. As the industry evolves, it is likely to present new investment opportunities for those who are able to navigate its complexities and capitalize on emerging trends.

The outlook for the sugar industry is complex and multifaceted, reflecting a range of factors including market trends, government policies, and environmental considerations. As investors consider the potential of sugar stocks, they must carefully weigh the potential benefits against the potential risks and challenges. By doing so, they can make informed decisions that align with their investment goals and risk tolerance.

Frequently Asked Questions (FAQ)

What are the key factors driving the growth of sugar stocks?

Government support plays a crucial role in the growth of sugar stocks. Various initiatives and policies implemented by the government have contributed to the surge in sugar stocks. These initiatives include subsidies for farmers, tax incentives for sugar manufacturers, and trade agreements that promote the export of sugar. As a result, sugar companies have been able to increase their production and exports, leading to higher revenues and profits.

The increasing global demand for sugar is another key factor driving the growth of sugar stocks. The global demand for sugar is driven by the growing population, urbanization, and changing consumer preferences. The demand for sugar is also driven by the increasing use of sugar in various industries such as food, beverages, and pharmaceuticals. Some of the key drivers of global demand include:

- Growing demand from emerging markets

- Increasing use of sugar in food and beverages

- Rising demand from the pharmaceutical industry

Improving company fundamentals is also a key factor driving the growth of sugar stocks. Sugar companies have been focusing on improving their operational efficiency, reducing costs, and investing in new technologies. This has resulted in higher profitability and returns for investors. Some of the key company fundamentals that are driving growth include:

- Improving operational efficiency

- Reducing debt and improving financial health

- Investing in new technologies and innovations

The combination of government support, increasing global demand, and improving company fundamentals has created a favorable environment for the growth of sugar stocks. As a result, investors are becoming increasingly interested in sugar stocks, and the sector is expected to continue growing in the coming years. Overall, the growth of sugar stocks is a positive trend that is expected to benefit both investors and the sugar industry as a whole.

Is it a good time to invest in sugar stocks?

When considering investing in sugar stocks, it is essential to conduct thorough research and analysis. The sugar industry is subject to various factors that can impact stock performance, including government policies, weather conditions, and global demand. As a result, investors should carefully evaluate the company's financials, industry trends, and market conditions before making an investment decision.

Evaluating a company's financials involves reviewing its revenue growth, profit margins, and debt levels. Investors should look for companies with a stable financial position, a proven track record of profitability, and a competitive advantage in the market. Additionally, investors should consider the company's management team, its corporate governance, and its commitment to sustainability and social responsibility.

Some key factors to consider when evaluating sugar stocks include:

- Global demand and supply dynamics, including trends in consumption and production

- Government policies and regulations, such as subsidies, tariffs, and trade agreements

- Weather conditions and their impact on crop yields and sugar production

- Competition from alternative sweeteners, such as high-fructose corn syrup and artificial sweeteners

- Company-specific factors, such as production costs, marketing strategies, and research and development initiatives

Investors should also stay up-to-date with industry trends and market conditions, including changes in consumer preferences, technological advancements, and shifts in global trade patterns. By carefully evaluating these factors, investors can make informed decisions about investing in sugar stocks and potentially benefit from the growth and profitability of the sugar industry.

Ultimately, investing in sugar stocks requires a long-term perspective, a thorough understanding of the industry, and a well-diversified investment portfolio. By doing their homework and staying informed, investors can navigate the complexities of the sugar market and make smart investment decisions that align with their financial goals and risk tolerance.

How do government policies impact the sugar industry and stocks?

Government policies play a crucial role in shaping the sugar industry and its stocks. These policies can have far-reaching consequences, affecting everything from the price of sugar to the profitability of sugar producers. One of the key ways in which government policies impact the sugar industry is through export subsidies.

Export subsidies are payments made by governments to sugar producers to help them export their products more competitively. This can have a significant impact on the global sugar market, as it allows subsidized sugar to be sold at a lower price than sugar produced in other countries. As a result, countries that do not offer export subsidies may struggle to compete, leading to a decline in their sugar industries.

Some of the government policies that impact the sugar industry include:

- Export subsidies, which help sugar producers to export their products more competitively

- Buffer stock schemes, which involve the government buying and storing sugar to stabilize prices

- Import duties, which are taxes imposed on imported sugar to protect domestic producers

These policies can influence the price of sugar, with subsidies and buffer stock schemes helping to keep prices low, while import duties can drive up prices by limiting the amount of cheap imported sugar available.

The impact of government policies on the sugar industry can also be seen in the area of production. For example, policies that support domestic sugar producers can lead to an increase in production, as producers are incentivized to produce more sugar. On the other hand, policies that restrict imports or impose high taxes on imported sugar can lead to a decrease in production, as domestic producers may not be able to meet demand.

In terms of profitability, government policies can also have a significant impact on the sugar industry. Policies such as export subsidies and buffer stock schemes can help to increase profitability, as they allow sugar producers to sell their products at a higher price. However, policies such as import duties can reduce profitability, as they can limit the amount of sugar that can be sold.

Overall, government policies have a significant impact on the sugar industry and its stocks. By understanding these policies and how they affect the industry, investors and producers can make more informed decisions about their investments and production strategies.