The current economic situation in India is complex and multifaceted. India has been one of the fastest-growing major economies in the world, with a growth rate of over 7% in recent years. However, the country is also facing several challenges, including a large trade deficit and a decline in investor sentiment.

One of the major factors affecting the Indian economy is the impact of external factors, such as global trade tensions and currency fluctuations. The US tariffs on Indian goods have had a significant impact on the Indian rupee, which has been depreciating against the US dollar over the past year. This has made imports more expensive and increased the cost of living for Indian consumers.

Some of the key effects of the US tariffs on the Indian economy include:

- Decline in exports: The US tariffs have made Indian goods more expensive for American consumers, leading to a decline in exports and a widening trade deficit.

- Depreciation of the rupee: The Indian rupee has depreciated significantly against the US dollar, making imports more expensive and increasing the cost of living for Indian consumers.

- Increase in inflation: The depreciation of the rupee has led to an increase in inflation, as imported goods become more expensive.

The Indian government has been taking steps to mitigate the impact of the US tariffs and stabilize the economy. These measures include increasing tariffs on imported goods, providing support to exporters, and implementing policies to boost domestic production and reduce dependence on imports. However, the impact of these measures is still being felt, and the Indian economy remains vulnerable to external shocks.

The economic situation in India is closely tied to global economic trends and is affected by factors such as trade tensions, currency fluctuations, and changes in investor sentiment. As the global economy continues to evolve, it is likely that the Indian economy will face new challenges and opportunities, and the government will need to respond with effective policies to stabilize the economy and promote growth.

Causes of the Rupee's Decline

The decline of the rupee has been a subject of concern for the Indian economy. One of the primary causes of this decline is the impact of US tariffs on Indian exports. The US has imposed tariffs on various Indian products, including steel and aluminum, which has resulted in a significant decrease in Indian exports to the US. This has not only affected the revenue of Indian companies but also led to a decline in the value of the rupee.

The increase in oil prices has also played a crucial role in the decline of the rupee. India is a major importer of oil, and an increase in oil prices has resulted in a significant increase in the country's trade deficit. This has put pressure on the rupee, causing it to decline in value. The impact of oil prices on the rupee can be seen in the following ways:

- Increased import bill: Higher oil prices have resulted in an increased import bill for India, which has put pressure on the rupee.

- Trade deficit: The increase in oil prices has also led to a widening trade deficit, which has further weakened the rupee.

- Inflation: Higher oil prices have also led to inflation, which has reduced the purchasing power of the rupee.

Foreign investors have also played a significant role in the decline of the rupee. In recent times, foreign investors have been pulling out of Indian markets, which has resulted in a decrease in the demand for the rupee. This decrease in demand has led to a decline in the value of the rupee. The reasons for foreign investors pulling out of Indian markets include:

- Lack of economic reforms: The lack of economic reforms in India has made it less attractive for foreign investors.

- Global economic uncertainty: Global economic uncertainty has also led to foreign investors pulling out of Indian markets.

- Attractive returns in other markets: Foreign investors have been attracted to other markets that offer more attractive returns, leading to a decrease in investment in India.

The decline of the rupee has significant implications for the Indian economy. It can lead to higher import prices, inflation, and a decrease in the purchasing power of the rupee. Therefore, it is essential for the government to take measures to stabilize the rupee and promote economic growth. This can be achieved through a combination of economic reforms, monetary policy measures, and fiscal policy measures.

Effects on the Indian Economy

The Indian economy is heavily reliant on imports, and any increase in global prices can have a significant impact on the cost of doing business in the country. Higher import costs for Indian businesses can lead to a reduction in profit margins, making it challenging for them to remain competitive in the global market. This can also lead to a decrease in investment, as businesses may be less likely to invest in new projects or expand their operations.

One of the primary concerns for Indian businesses is the increased cost of raw materials and intermediate goods. This can have a ripple effect throughout the economy, leading to higher production costs and reduced demand. Some of the key areas that may be affected include:

- Textile industry, which relies heavily on imported cotton and other raw materials

- Automotive industry, which imports a significant portion of its components and spare parts

- Pharmaceutical industry, which relies on imported active pharmaceutical ingredients and other raw materials

The increased cost of living for Indian citizens is another significant concern. As businesses pass on the higher costs to consumers, the prices of everyday goods and services may rise, reducing the purchasing power of individuals. This can have a disproportionate impact on low-income households, which may struggle to afford basic necessities like food, shelter, and healthcare. The effects of higher prices can be far-reaching, leading to:

- Reduced consumer spending, as individuals may cut back on discretionary expenses

- Increased poverty and inequality, as low-income households are disproportionately affected

- Reduced savings rates, as individuals may be forced to dip into their savings to meet everyday expenses

The potential impact on Indian economic growth is a major concern for policymakers. Higher import costs and increased prices can lead to reduced investment, lower consumer spending, and decreased economic activity. This can have a negative impact on the country's GDP growth rate, making it challenging for the government to achieve its economic development goals. The effects of higher import costs and increased prices can be long-lasting, requiring policymakers to implement effective strategies to mitigate the impact and support economic growth.

Comparison with Other Currencies

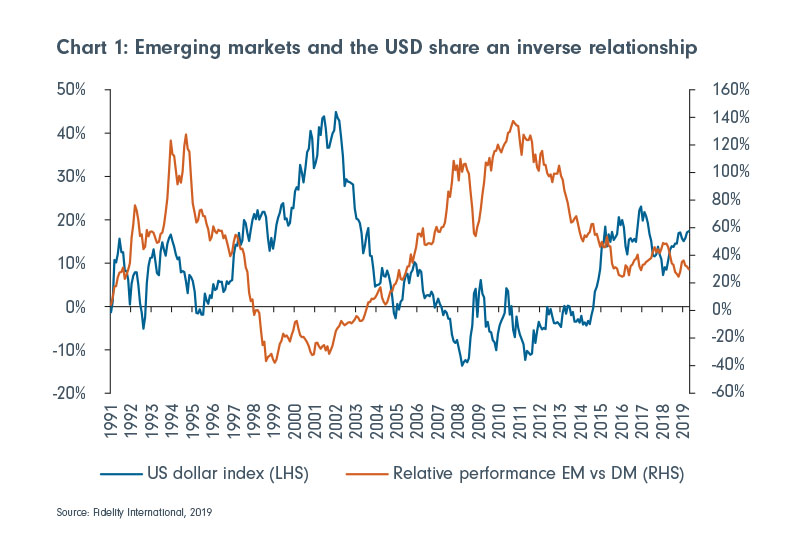

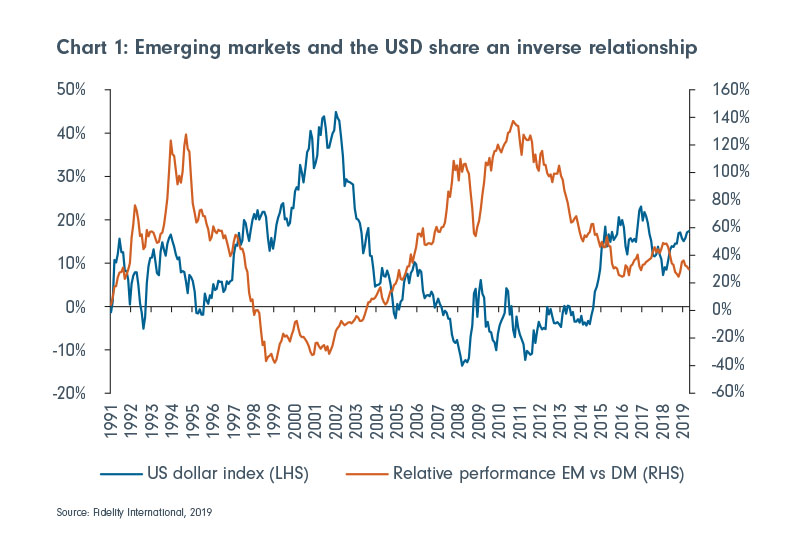

The rupee's decline has been a topic of discussion in recent times, but it is essential to compare it with other emerging market currencies to understand the broader context. Many emerging market currencies have faced similar declines due to global economic trends.

One of the primary factors contributing to the decline of these currencies is the economic policies of developed nations. For instance, the monetary policies of the US Federal Reserve have a significant impact on emerging market currencies.

Some key emerging market currencies that have faced decline include:

- South African Rand

- Brazilian Real

- Indonesian Rupiah

- Thai Baht

These currencies have been affected by various factors such as trade wars, economic sanctions, and changes in global commodity prices.

Historically, the rupee's value has been influenced by global economic trends. The rupee has faced significant declines during times of economic crisis, such as the 1991 balance of payments crisis and the 2008 global financial crisis.

The impact of global economic trends on the rupee is multifaceted. Global events such as the COVID-19 pandemic have led to a decline in the rupee's value due to a decrease in foreign investment and a decline in global trade.

In terms of historical context, the rupee's value has fluctuated significantly over the years. Prior to 1991, the rupee was pegged to the US dollar, but after the balance of payments crisis, it was allowed to float. Since then, the rupee has been subject to market forces, and its value has been influenced by a range of factors, including economic growth, inflation, and global events.

The comparison with other emerging market currencies highlights the fact that the rupee's decline is not an isolated event, but rather part of a broader trend. Understanding the historical context and the impact of global economic trends is essential to predicting the future trajectory of the rupee's value.

Government Response and Future Outlook

The Indian government has taken several measures to stabilize the rupee. These measures are aimed at reducing the country's trade deficit and increasing foreign investment. One of the key steps taken by the government is to increase the import duty on certain goods, such as gold and electronics. This move is expected to reduce the demand for foreign currency and subsequently stabilize the rupee.

In addition to increasing import duty, the government has also taken steps to boost foreign investment. This includes relaxing foreign investment norms and introducing new policies to attract foreign investors. The government has also taken measures to reduce the country's oil imports, which account for a significant portion of the country's trade deficit.

Some of the potential future actions that the government may take to address the economic situation include:

- Implementing policies to reduce the country's dependence on foreign oil

- Increasing exports to reduce the trade deficit

- Introducing new measures to attract foreign investment

- Implementing fiscal discipline to reduce the country's fiscal deficit

Expert predictions for the rupee's future value vary widely. Some experts predict that the rupee will continue to depreciate against the US dollar, while others predict that it will stabilize and even appreciate. Factors that will influence the rupee's future value include the country's trade deficit, foreign investment, and the overall state of the economy. The government's response to the economic situation will also play a crucial role in determining the rupee's future value.

The government's ability to implement effective policies and attract foreign investment will be critical in determining the future outlook for the rupee. If the government is able to successfully implement policies to reduce the trade deficit and attract foreign investment, the rupee is likely to stabilize and even appreciate. However, if the government is unable to address the economic challenges facing the country, the rupee may continue to depreciate. Overall, the future outlook for the rupee is uncertain and will depend on a variety of factors, including the government's response to the economic situation.

Frequently Asked Questions (FAQ)

What are the main reasons for the rupee's decline?

The Indian rupee has been experiencing a significant decline in recent times, and this downward trend can be attributed to a multitude of factors. The decline is not the result of a single cause, but rather a combination of external and internal factors that have cumulatively contributed to the rupee's depreciation.

One of the primary external factors responsible for the rupee's decline is the imposition of US tariffs. The ongoing trade tensions between the US and other major economies, including India, have led to a surge in protectionism, resulting in the imposition of tariffs on various goods. This has had a negative impact on India's exports, ultimately affecting the value of the rupee.

Another significant external factor is the increase in oil prices. As a major oil-importing country, India is heavily reliant on crude oil imports to meet its energy needs. The recent surge in global oil prices has increased India's oil import bill, putting pressure on the rupee. The higher oil prices have also led to a widening trade deficit, which has further contributed to the rupee's decline.

Some of the key internal factors contributing to the rupee's decline include:

- High inflation rates, which have reduced the purchasing power of the rupee

- A large fiscal deficit, which has led to an increase in borrowing and a subsequent decrease in the value of the rupee

- Weakened economic growth, which has reduced investor confidence and led to a decline in foreign investment

- Monetary policy decisions, such as interest rate changes, which can impact the attractiveness of investments in India and affect the value of the rupee

The combination of these external and internal factors has created a perfect storm that has contributed to the rupee's decline. The Indian government and monetary authorities have been taking measures to stem the decline and stabilize the currency, but the situation remains challenging. Understanding the underlying causes of the rupee's decline is crucial to developing effective strategies to mitigate its impact and promote economic growth.

How will the decline of the rupee affect Indian citizens?

The decline of the rupee has significant implications for Indian citizens, affecting various aspects of their lives. One of the primary concerns is the increase in import costs. As the value of the rupee decreases, India will have to pay more for the same amount of imports, leading to higher costs for businesses and consumers alike.

This, in turn, will lead to an increased cost of living for Indian citizens. Essential goods and services, such as food, fuel, and electronics, will become more expensive, affecting the purchasing power of individuals and families. The impact will be particularly felt by low- and middle-income households, who will have to allocate a larger portion of their income towards basic necessities.

The decline of the rupee can also have a potential impact on economic growth. A weaker currency can make exports more competitive, but it can also lead to higher costs for imported raw materials and capital goods, affecting the overall competitiveness of Indian businesses. This can result in:

- Higher production costs, which may be passed on to consumers in the form of higher prices

- Reduced profitability for businesses, which can lead to lower investment and job creation

- Decreased economic growth, which can have far-reaching consequences for the country's development and prosperity

Indian citizens will be affected in various ways, depending on their individual circumstances. For example, those who rely on imports for their business or daily needs will be directly impacted by the increase in costs. Others may be affected indirectly, through higher prices for goods and services or reduced job opportunities. Furthermore, the decline of the rupee can also affect the value of investments, such as stocks and real estate, leading to a decrease in wealth for some individuals.

Overall, the decline of the rupee is a complex issue with far-reaching consequences for Indian citizens. It is essential for policymakers to take proactive measures to mitigate the effects of a weaker currency and ensure that the economy remains stable and competitive. By doing so, they can help minimize the impact on citizens and promote sustainable economic growth.

Can the Indian government stabilize the rupee?

The Indian government has been facing challenges in stabilizing the value of the rupee against major currencies. The rupee has been experiencing high volatility, which has affected the country's trade and economy. To address this issue, the government can take various measures to stabilize the currency.

One of the measures the government can take is to intervene in the foreign exchange market. This can be done by buying or selling dollars to influence the exchange rate. When the rupee is depreciating, the government can sell dollars to reduce the supply of rupees in the market, which can help to stabilize the currency.

The government can also implement policies to attract foreign investment, which can help to increase the demand for the rupee and stabilize its value. Some of the policies that can be implemented include:

- Relaxing foreign investment norms to make it easier for foreign investors to invest in India

- Providing incentives such as tax breaks and subsidies to foreign investors

- Improving the business environment by simplifying regulatory procedures and reducing bureaucratic hurdles

In addition to these measures, the government can also take steps to reduce the country's trade deficit, which can help to reduce the pressure on the rupee. This can be done by increasing exports and reducing imports. The government can provide support to exporters by providing them with subsidies and other incentives, and by negotiating trade agreements with other countries to increase access to new markets.

The government can also use monetary policy tools to stabilize the rupee. The Reserve Bank of India, the country's central bank, can increase interest rates to make it more attractive for foreign investors to invest in India, which can help to increase the demand for the rupee. The central bank can also use other tools such as open market operations and reverse repos to manage liquidity in the market and stabilize the currency.

Overall, the government has a range of measures at its disposal to stabilize the rupee. By intervening in the foreign exchange market, implementing policies to attract foreign investment, reducing the trade deficit, and using monetary policy tools, the government can help to stabilize the value of the rupee and promote economic growth.